Sony weighs bid for Kadokawa and its IPs

Plus: Acquisition could bring anime industry consolidation; Warner Bros. Discovery signs Japan content partner; Kinokuniya stabilizes U.S. manga sales; and more

This is your weekly Animenomics briefing, covering the business of anime and manga. Today is Wednesday, November 20, 2024.

In case you missed it: A new television ad by energy and sports drink maker Otsuka Pharmaceutical, of Pocari Sweat fame, went viral in Japan for depicting the volunteer labor that makes Tokyo’s twice-yearly Comic Market possible.

Observers say the inspiring portrayal of Comic Market subculture without added commentary, helped by Sakura Wars’s iconic theme song, is only possible thanks to anime, manga, and video games’ growing economic and cultural force.

Sony, in search of IPs, considers takeover of Kadokawa

Entertainment conglomerate Sony could end up acquiring publishing giant Kadokawa, Reuters reported this week, with Nikkei Asia also reporting that the early talks are part of a strategy to amass entertainment intellectual property (IP) for future growth.

Why it matters: Kadokawa is Japan’s third-largest book publisher by revenue and a pioneer of the media mix strategy that many Japanese entertainment companies use today to develop content across different media categories.

What’s at stake: Sony would gain from Kadokawa an immense portfolio of “early phase” IPs that chief financial officer Hiroki Totoki told the Financial Times earlier this year the company lacks.

Three out of four anime properties, in which Sony has accelerated investments, are adapted from other media like manga, light novels, video games, according to an analysis of anime broadcasting data published in 2014.

Catch up quick: Kadokawa said in its second quarter earnings presentation earlier this month that it will reach 6,000 book and magazine IPs published annually this year.

As previously reported by Animenomics, Kadokawa is the largest publisher of light novels, serial paperback novels that incorporate anime-style illustrations, capturing 50 percent of that market in 2021.

The company holds the rights to popular fantasy IPs like Delicious in Dungeon, a manga and Netflix anime property that generated ¥5.7 billion (US$36.8 million) in licensing sales over the last six fiscal quarters.

It also funded an anime production of Oshi no Ko, a manga IP licensed from rival publisher Shueisha, and generated ¥7.6 billion (US$49 million) from sublicenses, allowing the company to buy the anime studio that makes it earlier this year.

Kadokawa spent the last couple of years investing in international production and distribution capabilities in places like Taiwan, Indonesia, Thailand, and France to source new IPs from outside Japan.

The bigger picture: Japan’s Ministry of Economy, Trade, and Industry last year urged corporate boards to evaluate credible takeover offers that will boost corporate value and benefit shareholders.

“Many of the major publishers are unlisted companies, and there are many companies both in Japan and abroad that are said to be interested in the listed Kadokawa,” an anime studio executive told the Nikkei financial newspaper.

Sony earlier this year made a bid to purchase Japan’s fifth most popular manga app Mecha Comic, but the bid was instead won by global private equity fund Blackstone.

Sony could consolidate anime industry in Kadokawa bid

Sony’s bid to acquire Kadokawa would result in significant consolidation across anime planning, production, and distribution and impact adjacent industries like manga and gaming if the talks are successful.

Driving the story: Kadokawa and Sony Music subsidiary Aniplex combined invested in about one-third of 321 productions of late-night anime airing in 2022 and 2023, according to a study published at Tokyo’s Comic Market 104 in August.

Zoom in: Kadokawa and Sony’s corporate groups combined own ten anime studios, including reliable primary contractors like A-1 Pictures, CloverWorks, Kinema Citrus, and Doga Kobo.

Amid an industrywide labor shortage, a consolidated business could lock up a significant portion of anime production capacity for its own properties.

Sony already has a sprawling Crunchyroll anime streaming and e-commerce service and the PlayStation Network digital store but would gain access to Kadokawa’s global digital bookstore Book Walker.

Between the lines: Sony already has a 2.1 percent stake in Kadokawa from a 2021 capital alliance to enhance anime and video game distribution, and it also owns 14.09 percent of Kadokawa-controlled game studio FromSoftware.

“That studio created the influential Demon’s Souls and Dark Souls series, as well as 2022’s Elden Ring, one of the best-selling games of the decade with more than 20 million copies sold,” Stephen Totilo, editor of the Game File newsletter, told Animenomics.

Shares of Bandai Namco, which helped publish Dark Souls and Elden Ring, fell on the Tokyo Stock Exchange as investors asked whether Sony could make the studio’s future titles exclusive to PlayStation, but Totilo thinks this isn’t likely.

“More recently, we’ve seen first-party buyers like Sony and Microsoft opt to offer many of the future games from studios they acquire on their own consoles as well as competing ones. The thinking is that the overall volume of sales is more valuable than any of the advantages gained by exclusivity,” Totilo explained.

One more thing: A successful acquisition could also consolidate ownership of the two largest English-language anime news media, Crunchyroll News and Anime News Network.

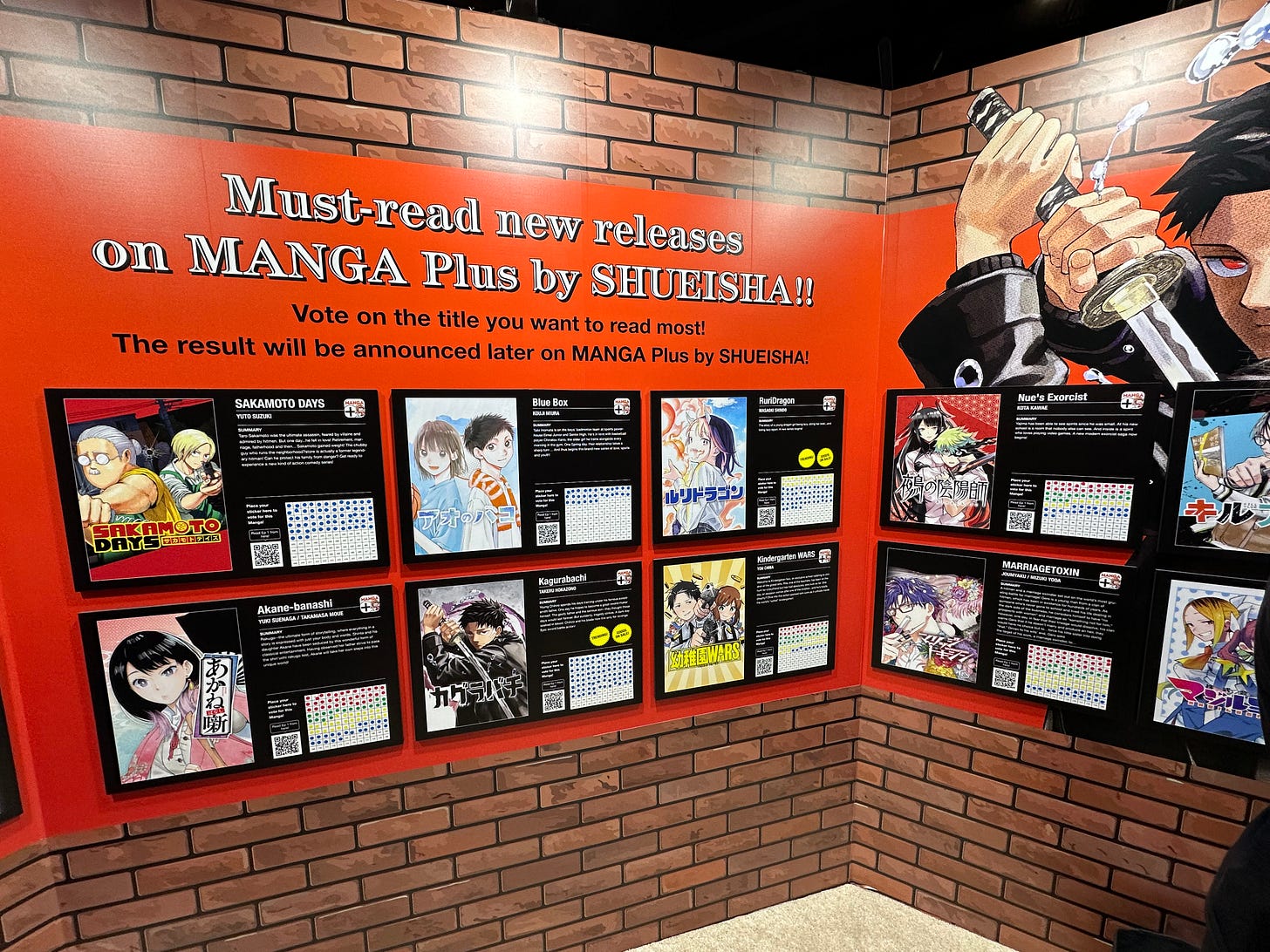

Clippings: Shueisha push simultaneous manga releases

Shueisha manga sales in Europe and the United States grew fivefold between 2019 and 2023 as anime’s popularity exploded, but the company is looking reduce reliance on anime adaptations by drawing readers with simultaneous releases. (Nikkei Asia)

The Japan Actors Union and its allies have called on the entertainment industry to not use voices generated by AI in making animation works and foreign film dubs. The groups also want rules established requiring permission to train AI. (The Mainichi)

Crunchyroll’s Google partnership will see the anime streamer launch select titles on YouTube as a Primetime Channel offering in the United States, France, the United Kingdom, Germany, and Australia by the end of the year. (Anime News Network)

Why it matters: YouTube viewership is surging, earlier this year becoming the first streaming platform to capture a 10 percent share of total television viewing in the United States, according to Nielsen audience data.

Tokyo-based Manga International, a subsidiary of Riyadh-based Manga Arabia, has launched a digital manga platform in Japanese, English, and Arabic with a Saudi-made manga promoting the country’s bid for the 2034 FIFA World Cup. (Press release)

Pachinko machine maker Fujishoji launched a social media account on X promoting anime as Japanese gambling halls show more interest in buying anime-branded units that attract more customers. (Mynavi News)

Warner Bros. Discovery gains Japanese content pipeline

“The content today that has the most proven travel-ability is certainly Korean content, Japanese anime, as well as some of the Japanese dramas, and Chinese content. And, naturally, as we think about prioritizing what content will be relevant locally, those are certainly three that we’d start looking at and figure out a way to do something smart in one or two of those sectors”

— JB Perrette, Warner Bros. Discovery global streaming and games president and CEO

Context: Perrette, in an interview with Variety, touted Warner Bros. Discovery’s partnership with Japanese streaming provider U-NEXT in the company’s launch of the Max streaming service in the country earlier this year.

“U-NEXT has partnerships with a bunch of broadcasters in Japan who produce a lot of dramas, and we need Japanese dramas for the service globally,” Warner Bros. Discovery Asia-Pacific president James Gibbons added.

As previously reported by Animenomics, U-NEXT also boasts a robust offering of films and anime that helped it gain market share against Netflix last year.

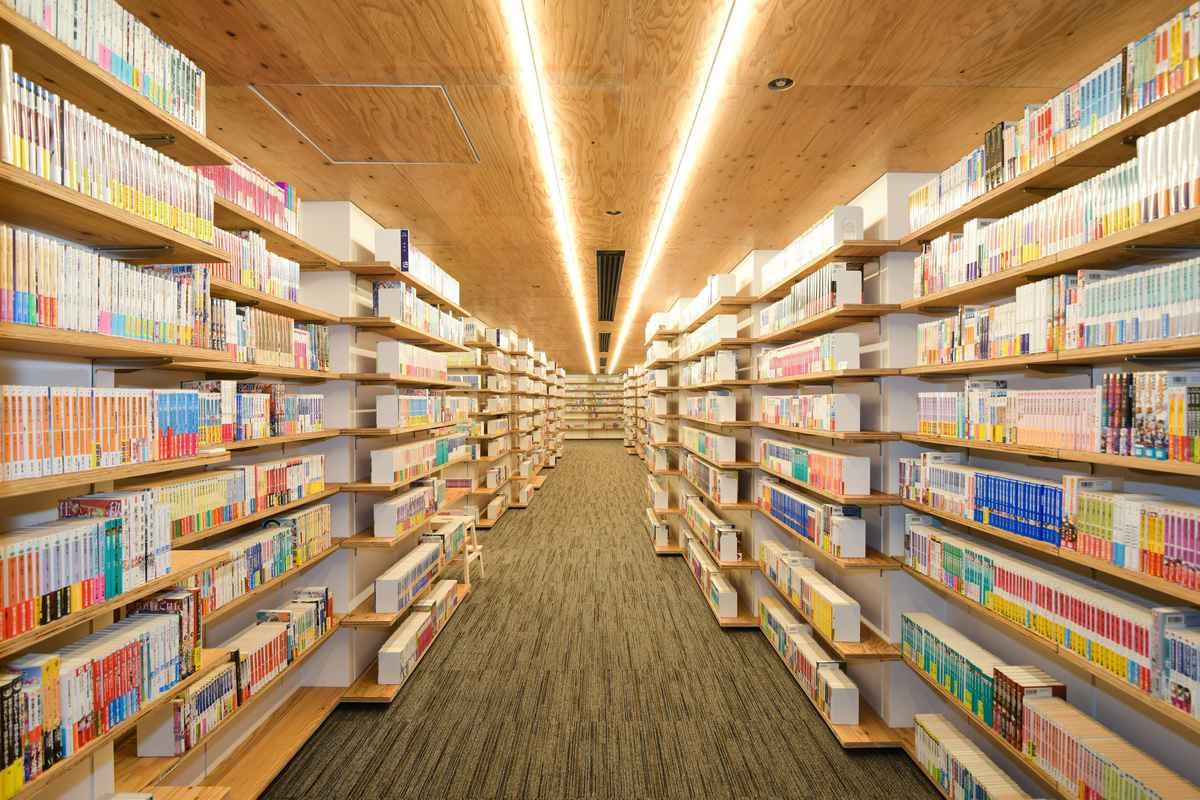

Kinokuniya stores see stabilizing U.S. print manga sales

Kinokuniya Book Stores of America, the United States subsidiary of Japan’s Kinokuniya chain of bookstores, projects that retail sales of English-translated manga this year are on pace to match last year’s numbers.

Why it matters: Kinokuniya’s reported numbers show the retailer has stabilized print manga sales in the U.S. after last year’s declines following back-to-back record years in the manga market.

By the numbers: Kinokuniya recorded US$12.5 million in sales of English-translated print manga in the U.S. through the end of October, Shigekazu Watanabe, east coast area general manager, said during a presentation at last week’s International Manga Anime Festival Reiwa Toshima.

Sales of English-translated manga last year hit US$15 million, a 12 percent decline from the 2022 peak during the COVID-19 pandemic.

Sales of manga in their original Japanese language are approximately one-quarter that of English-translated manga.

Yes, but: Across the entire U.S. comics market, manga sales were down 21 percent in the first half of 2024, according to a white paper by the ICv2 trade publication.

This means Kinokuniya’s success may have more to do with strategies like selling exclusive editions of this year’s top two bestsellers, Initial D’s omnibus release and The Guy She Was Interested in Wasn't a Guy at All.

Zoom out: Kinokuniya’s U.S. manga sales across 17 stores nationwide are significantly higher today—more than triple—compared to pre-pandemic levels.

Kinokuniya’s overseas revenues have more than doubled in the last four years, to more than ¥32 billion (US$200 million) in the fiscal year that ended in June.

Animenomics is an independently-run and reader-supported publication. If you enjoyed this newsletter, consider sharing it with others.

You need to link this out on LinkedIn. Your take on the Sony/Kadokawa talks is by far the most comprehensive and accurate for many different reasons.

Kadokawa's 6,000 IPs annually!? That's a content powerhouse.