Int'l contracts rise at anime production firms

Plus: Anime studio revenue and profit disparities widen; Universal Studios Japan draws visitors with anime characters; Comiket attendance highest since 2019; and more

This is your weekly Animenomics briefing, covering the business of anime and manga. Today is Wednesday, August 16, 2023.

An announcement: Animenomics is taking an end-of-summer break for the next two weeks. Our next issue will be released on Wednesday, September 6, 2023. We look forward to seeing you again then.

Anime companies double transactions with U.S. firms

A record number of Japan’s anime production companies are doing business with overseas partners, according to a new analysis of corporate data released by credit reporting agency Teikoku Databank.

Why it matters: Anime is emerging out of the COVID-19 pandemic as a global industry, with demand growing in North America and Europe and more projects hiring subcontractors in China, Taiwan, and South Korea.

The anime business market grew for the first time in three years in 2022 at a rate of 6.4 percent to ¥270 billion (US$1.85 billion).

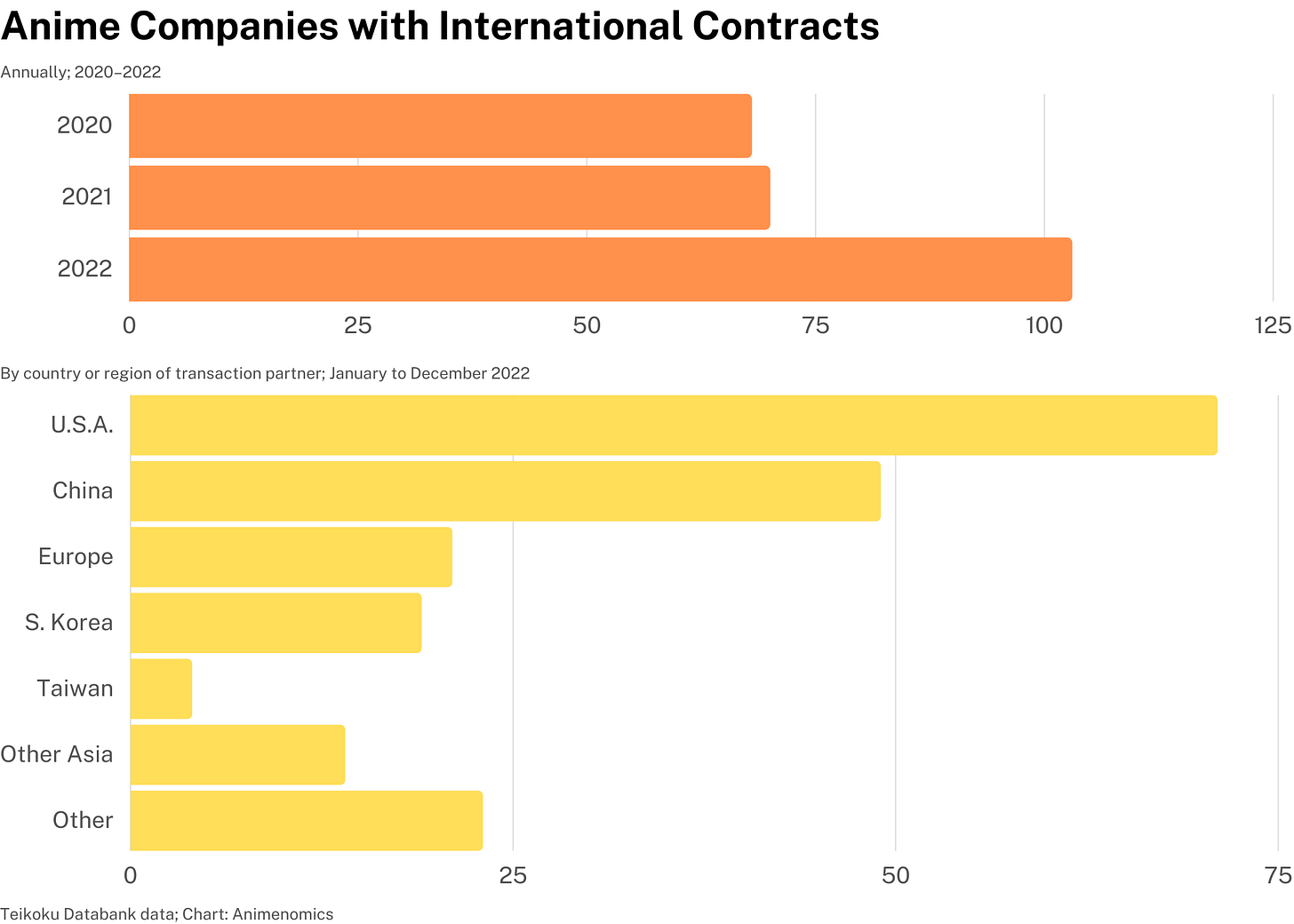

By the numbers: Teikoku Databank found that 103 out of 314 anime production companies with a credit report at the agency had at least one transaction with a foreign company in 2022.

The figure represents the highest number and the highest ratio of companies doing business internationally since the agency began collecting data in 2015.

American firms accounted for the highest number of anime deals with Japan, overtaking Chinese companies since last year’s survey.

What’s happening: Streaming video giants like Netflix and Amazon Prime Video are adding more exclusive distribution deals and direct deals with producers.

Two out of three companies that worked with a foreign partner last year had a contract with an American firm, compared to one in three in 2021.

Teikoku Databank projects the anime business market will grow another 10 percent this year if the trend in streaming growth continues.

Yes, but: The report’s authors warn that an increase in the number of works produced for streaming platforms risks exacerbating labor shortages and the strain of overwork at anime studios.

What we’re watching: The Association of Japanese Animations’ annual industry report, which unlike Teikoku Databank’s includes consumer market data, will be released in November.

Last year, the AJA said that the global streaming market may have reached its peak and that the anime industry might be losing the momentum of the 2010s.

Growth, profitability remain uneven in anime studios

Teikoku Databank’s anime industry report found that specialty anime production companies are still struggling with growth even as the average revenue of anime businesses recovered in 2022 to pre-pandemic levels.

Driving the story: The average revenue of a specialty anime studios has fallen 14 percent since 2019, while the average flagship studio saw a 6.6 percent growth over the same period.

What’s happening: Specialty studios, which provide subcontracted services like screenwriting, background art, photography, special effects, and editing, are at the front line of the anime industry’s labor shortage.

Unable to hire specialized talent to meet their workload, specialty studios in Japan end up competing with cheaper and fully-staffed studios overseas and occasionally even outsource work to them, further eroding profits.

What’s changing: Some studios are investing in digital production methods, scanning and restoring old works, and starting to work with CG animation to increase the market value of their work.

Between the lines: The situation may be improving, with the number of specialty studios reporting a revenue decrease falling to its lowest level in 20 years.

Specialty studios are shifting to a profit structure that is less dependent on major anime studios, and as a result 73 percent of them are now profitable, improving from 59 percent in 2020.

On the other side: Outsourcing costs are offsetting record profits made by flagship studios on intellectual property licenses, with the share of those studios that are profitable hovering around 66 percent.

Reality check: The Nikkei financial newspaper reminds us in an editorial published last week that having one in three anime studios operating in the red is still a major risk for the anime industry.

The newspaper is calling for the industry to raise wages and train licensing executives to enable them to negotiate more favorable terms with foreign companies.

Clippings: Universal Studios Japan draws anime fans

Universal Studios Japan has risen to become the third most popular theme park in the world thanks to collaborations with popular anime and manga titles. Last year, attendance surged 125 percent to 12.3 million visitors, according to data by the Themed Entertainment Association. (Nikkei Asia)

A survey of Japanese e-book readers show that 30 percent of respondents have a favorable impression of vertical-scrolling manga, or webtoons, but getting them to pay is a challenge. More than half of paid e-book users say they have never paid to read a webtoon. (Impress Research Institute/PR Times)

Toei Animation has begun producing new anime projects aimed at the Chinese market. The studio’s local subsidiary is producing a remake of The Flower Child Lunlun, which was released by Toei in 1979 and subsequently became popular in China following airings by national broadcaster CCTV. (Animation Business Journal)

Animator corrects misconception in merch purchases

“We can’t make the next work without recovering the production costs, so it’s not wrong if you buy merchandise for the purpose of protecting animator jobs, but the merchandise revenue doesn’t go directly to us. One has nothing to do with the other.”

— Terumi Nishii, JoJo’s Bizarre Adventure: Diamond Is Unbreakable character designer and chief animation director

Context: Nishii responded to a popular refrain commonly heard among anime fans on social media about supporting the animators who create their favorite titles at an event hosted by the Nippon Anime & Film Culture Association.

Between the lines: Designers and animators aren’t paid additional money when their work is resold to licensees. Voice actors, however, receive residual payments thanks to a Japan Actors Union agreement.

Tokyo’s Comic Market returns to pre-pandemic form

Daily attendance numbers at Comic Market, the twice yearly sales event for fan art and fan comics of anime and manga characters, reached their highest levels since 2019, following Japan’s lifting of all pandemic-related restrictions in May.

Driving the story: Last weekend’s Comic Market 102 drew 260,000 visitors over a two-day period and hosted 21,000 vendors.

The last edition of the event before the COVID-19 pandemic drew a record 750,000 visitors over four days.

Why it matters: Since 1996, Comic Market, also abbreviated as Comiket, is the only event that guarantees usage of Tokyo Big Sight’s entire 115,000 square-meter convention area twice a year and over multiple days.

Yuya Hirai, a sales executive with the convention center’s operator who leads the partnership with the Comiket organizers, told The Tokyo Shimbun newspaper that planning the event is equivalent to a medical checkup for the facility.

The scale of the event requires that all corners of the facility are inspected, which could lead to the discovery of poorly installed doors and light bulbs that are about to burn out.

For Tokyo Big Sight employees, this summer’s Comiket is a rehearsal for the return of the biennial Tokyo Motor Show in October and November, an event which last drew 1.3 million visitors in 2019.

Behind the scenes: Comiket is entirely run by a committee of 3,000 volunteers, all unpaid. The Tokyo Shimbun reports it’s one of Japan's largest events run by a volunteer organization.

The committee’s operations are divided into 17 different departments, which includes 30 members of the international department that ensure the event is welcoming to attendees from overseas.

Comiket is also a boon for the printing industry as vendors seek out small, specialty printers that can print and bind their publications at low costs.

Yes, but: Despite its estimated more than ¥10 billion (US$69 million) of economic impact in 2019, Comiket operates in a gray area of copyright law since vendors are selling derivatives of copyrighted works.

Thanks for reading this week’s issue. Animenomics is an independently-run and reader-supported publication. If you enjoy this newsletter, consider sharing it with others.

This is a fascinating look into perhaps Japan’s most successful export! As someone trying to document Japan’s less known aspects, this really fits into my interests.

I’d love to see how we could potentially collaborate on future projects?