Kadokawa invests in studios to adapt its IPs

Plus: Toei Animation to expand international market footprint; Filings reveal Studio Ghibli valuation; Predicting the trending anime of 2024; and more

This is your weekly Animenomics briefing, covering the business of anime and manga. Today is Wednesday, November 8, 2023.

In case you missed it: Shogakukan and Shueisha’s U.S.-based manga subsidiary VIZ Media is now publishing a VIZ Social Media Team Substack.

Kadokawa bets on its own IPs with new anime studios

Publishing giant Kadokawa is betting on the success of its manga and light novel portfolio to fuel new investments in anime studios, including forming a “high-end” anime studio, Raging Bull, headed by Eureka Seven director Tomoki Kyoda.

Why it matters: Kadokawa’s plans reflect a desire to achieve vertical integration in its anime business, whose net sales has already grown 18 percent for the first half of the fiscal year compared to the same period last year.

What’s happening: The company told investors at its second quarter earnings presentation for the fiscal year ending March 2024 that it wants to “increase the number of seasons and episodes per [anime] title”.

Kadokawa plans to increase the number of anime titles it makes in-house from five a year currently to 20.

Yes, but: Critics say Kadokawa’s studio expansion strategy is in conflict with its goal of securing production quality of its anime titles.

By focusing on growth, Kadokawa is pushing the anime industry toward a trend of overproduction, leading to more outsourcing because studios can’t handle the workload.

Catch up quick: Kadokawa told investors in 2021 that it would target funding 40 anime productions by 2023. It’s on track to fund more than 60 productions this fiscal year.

As Animenomics previously reported, Kadokawa publishes more than 5,500 light novel releases annually and is turning successful titles into anime, film, and video game properties.

“Kadokawa’s strategy now is to not do [production] committees anymore. They're just financing [anime] flat out 100 percent,” Jarrett Martin, CEO of a subcontract anime studio Tonari Animation, told Animenomics in a recent interview.

By the numbers: Out of the top ten anime titles in Kadokawa’s portfolio with the highest net sales this fiscal year, nine came the company’s own publishing house.

The best-selling anime in the portfolio, however, is Oshi no Ko, whose original manga is published by Shueisha but whose adaptation was the result of a Kadokawa proposal.

Oshi no Ko has given Kadokawa ¥2.4 billion (US$16 million) in net sales so far this fiscal year, while the company’s top-selling in-house property is My Happy Marriage, which has earned ¥1.8 billion (US$12 million).

Zoom out: Kadokawa isn’t the first company to seek vertical integration in the anime industry. Bandai Namco Group and Sony’s Aniplex have done the same by acquiring studios.

One advantage that Kadokawa has over competitors is its publishing division, industry analyst Tadashi Sudo explains in the Animation Business Journal.

“If the company’s own group produces [anime] based on its own original work, and the all rights business gets off the ground, an all-in-one anime business will be completed,” Sudo writes.

Toei Animation looks overseas for business growth

Anime powerhouse Toei Animation announced at this year’s Tokyo International Film Festival Content Market (TIFFCOM) that it plans to open more satellite offices around the world in places like Italy, Latin America, and India.

Why it matters: Toei Animation has taken a “contrarian approach” to the global market when many Japanese companies turned inward as the Internet facilitated communication with other countries, sales and planning head Satoshi Shinohara told attendees of the company’s seminar at TIFFCOM.

As previously reported by Animenomics, Toei Animation responded to market demand in Latin America by directly licensing content to partners in those countries rather than through a distributor.

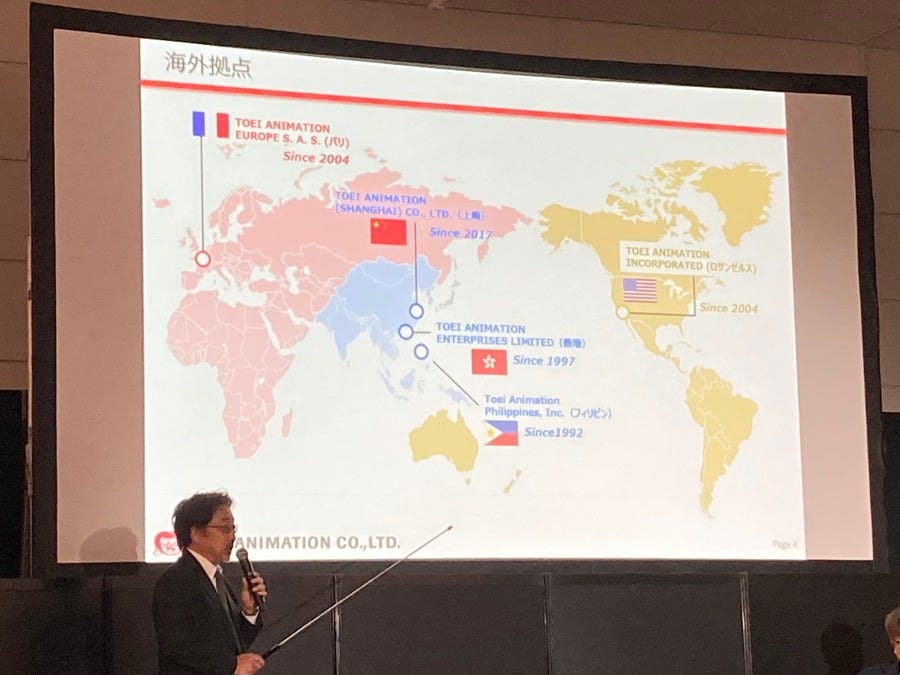

Where things stand: Toei Animation currently runs sales offices in the United States, France, and Hong Kong. It also operates production sites in Shanghai and the Philippines.

By the numbers: Overseas sales accounts for 60 percent of Toei Animation’s business today, which is changing the math of the studio’s production budgets.

Shinohara said the the company’s budget for Dragon Ball Super: Super Hero exceeded domestic box office revenues (¥2.51 billion, or US$16.7 million), but the film’s overseas box office revenues was five times that amount, ensuring a profitable production.

Reality check: Contrarian approaches to doing business don’t always pay off, as demonstrated in Toei Animation’s excessive financial commitments in the failed live-action adaptation of Saint Seiya last year.

Still, Shinohara reiterated that the company intends to continue pursuing Hollywood projects.

Clippings: Filings reveal Studio Ghibli acquisition value

Studio Ghibli was valued at ¥36.6 billion (US$243 million) at the time of its share purchase by Nippon Television in September, a transaction that made the studio a subsidiary of the private broadcaster. (Animation Business Journal)

This is believed to be highest valuation ever for a Japanese anime studio that was involved in a merger or acquisition deal.

Singapore’s flagship anime convention Anime Festival Asia is drawing criticism from local anime fans for including Japanese sex toy maker Tenga as an exhibitor, as the event’s attendance is mainly teenagers and young adults. (The Straits Times)

Music critic Ryo Miyauchi ranks this year’s top 50 anime songs. “The external factors behind some of the most popular anison releases made for a bigger story this year than any musical trends or styles,” he writes. (This Side of Japan)

Anime production house Aniplex will open a virtual reality entertainment venue in the fall of 2024 featuring content from Demon Slayer and other Sony works. It will partner with television networks and also showcase non-Sony IPs. (The Nikkei)

Mandarake founder: Gov’t preservation efforts too late

“I guess it’s the nature of the Japanese people to not really understand the value of something unless it’s praised overseas.”

— Masuzo Furukawa, founder and chairman of Mandarake

Context: Furukawa, who heads the world’s largest secondhand comics retailer, told the web news magazine Daily Shincho in an interview that while museums around the world are beginning to add anime and manga drawings to their collections, ordinary Japanese people have yet to recognize the value of manga and anime.

Rewind: Japanese news media reported in the summer that Prime Minister Fumio Kishida’s government plans to fund a multi-year effort to collect and preserve original manga and anime drawings.

“I want [the government] to do their best in collecting [the drawings], but I think it’s already too late,” Furukawa said. “A lot of good things have gone overseas, and I think we should have started working on them sooner when prices were cheaper.”

Mandarake employs a team to authenticate and appraise original drawings that the company has bought and sold. Animation cels from Studio Ghibli sold by Mandarake for tens of thousands of yen (hundreds of U.S. dollars) 20 to 30 years ago are now going for millions of yen (tens of thousands of U.S. dollars).

Magazine predicts the trending anime titles of 2024

The year-end issue of the Nikkei Trendy business magazine is predicting that Spy × Family Code: White, Mobile Suit Gundam Seed Freedom, The Apothecary Diaries, and Frieren: Beyond Journey’s End will become the Japanese entertainment sector’s biggest anime hits in terms of sales and influence over the next year.

Yes, but: It’s hard to predict trends. Some of Japan’s biggest anime and manga trends this year, like Oshi no Ko, Bocchi the Rock!, and Blue Lock, weren’t even on Nikkei Trendy’s radar last year.

Go deeper: Patrick St. Michel of the Make Believe Mailer newsletter takes a further look at what else the magazine predicts will be trending in 2024.

Animenomics is an independently-run and reader-supported publication. If you enjoy this newsletter, consider sharing it with others.