Anime retailers upbeat on Hong Kong market

Plus: CyberAgent seeks to replicate 'Umamusume' success; Piccoma retreats from French webtoon market; Japan's no. 2 streamer bets on anime; and more

This is your weekly Animenomics briefing, covering the business of anime and manga. Today is Wednesday, May 20, 2024.

In case you missed it: From Up on Poppy Hill director Goro Miyazaki accepted an honorary Palme d’Or on behalf of Studio Ghibli at the 77th Cannes Film Festival.

Anime licensees cash in on Hong Kong youth spending

Hong Kong’s Tsim Sha Tsui shopping district welcomed in April the opening of Anima Tokyo, a three-story 80,000 sq. ft. retail and exhibition space dedicated to anime, a sign that local businesses are upbeat about the anime market.

Why it matters: Outside of North America, Hong Kong and several other Asian territories make up a considerable portion of anime export revenues.

Hong Kong consistently ranks in the top ten territories with the most anime licensing contracts, according to Association of Japanese Animations data.

What’s happening: iFree Group, an Internet connectivity company, invested more than HK$200 million (US$25.6 million) to develop Anima Tokyo, the Chinese-language Ming Pao newspaper reports.

Anima Tokyo consists of an anime merchandise store, an exhibition hall that currently features art from Fullmetal Alchemist, and a Japanese food court.

Design studio Incubase Arena, which previously worked on exhibitions for One Piece and Attack on Titan, will manage the exhibition space, with more than a dozen experience projects planned for this year.

Zoom out: Earlier this year, property developer Kerry Properties also opened the 20,000 sq. ft. anime experience retail store Anichi at its MegaBox shopping mall in Kowloon Bay.

Anichi director William Wan Tsz-lung and MegaBox senior director for commercial Victor Ng told Ming Pao that young Hongkongers have a lot spending power in the local anime market.

What we’re watching: Medialink, a Hong Kong-based regional licensor of anime content has been driving demand in the market thanks to its successful Ani-One streaming service, which has about 5 million subscribers.

Medialink CEO Lovinia Chiu also told Ming Pao that her company plans to expand its merchandise licensing offerings to the United States.

CyberAgent races to reproduce ‘Umamusume’ impact

CyberAgent chief executive Susumu Fujita announced in March that he plans to step down from leading the digital advertising group he co-founded by 2026, but not before he leads the company to its new focus on anime IP creation.

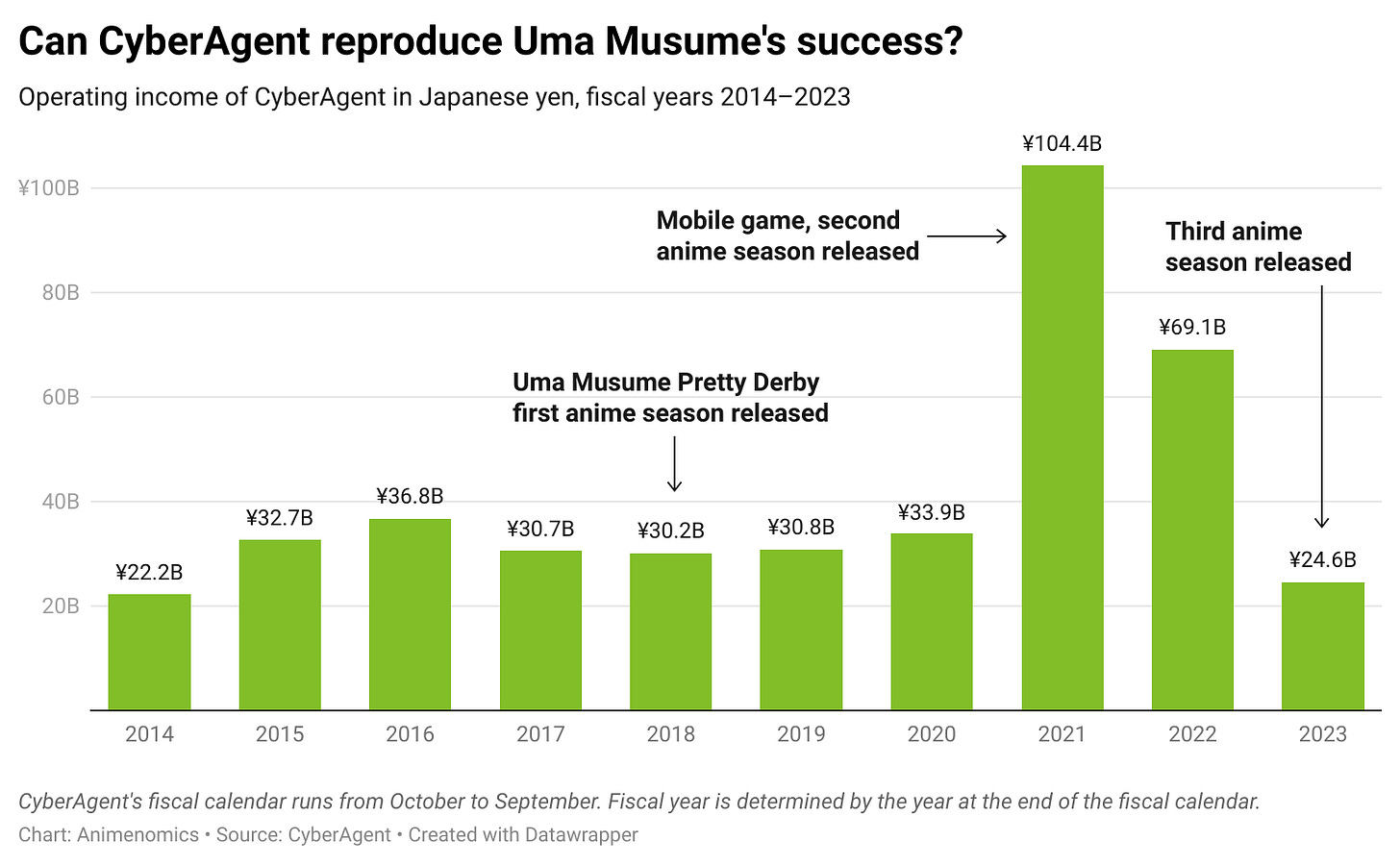

Why it matters: Fujita is betting CyberAgent’s future on the company’s ability to reproduce the runaway success of Umamusume: Pretty Derby, an original IP.

Umamusume, which features anthropomorphic characters based on real-life racehorses, is an anime and mobile game property by subsidiary Cygames.

By the numbers: Sensor Tower found that Umamusume’s mobile game has earned Cygames a cumulative US$2.4 billion since its release in 2021.

An Umamusume: Pretty Derby: Road to the Top anime film released earlier this month earned ¥55 million (US$352,000) from 30 theaters on opening weekend.

A second film, Umamusume: Pretty Derby: Beginning of a New Era, opens on Friday and will have a wider release of 331 theaters.

The details: CyberAgent established this month a special task force led by Fujita and senior managing executive officer Takahiro Yamauchi to focus on IP creation efforts, the Toyo Keizai business web magazine reports.

“With the costs of TV advertising coming down, the use of anime as a way to spend marketing budget has increased,” Yamauchi told Toyo Keizai.

CyberAgent established in 2020 an anime business division, leveraging the experience gained from anime deals signed with its Abema streaming service.

It created in 2022 a webtoon production studio and last year acquired Nelke Planning, a stage play production company that adapts anime and manga.

The bigger picture: CyberAgent is feeling the urgency to diversify its business as the digital advertising industry face an uncertain future.

Apple and multiple governments have moved to restrict third-party cookies, which enable ads, and Google plans to phase them out starting this year.

Yes, but: Umamusume’s success happened under Cygames’s independent management, so CyberAgent’s task force is largely starting its work from scratch.

“It’s not that we don’t get along, so there’s no need for extra intervention,” Fujita told Toyo Keizai. “We work together with a normal sense of distance, collaborating when necessary.”

Of note: When asked about the possibility of CyberAgent acquiring an anime production studio, Fujita responded, “If one were on sale, I’d buy it, but no one is selling.”

Clippings: Streamers compete in India with anime

Over-the-top media platforms are stepping up their competition in India to draw young anime viewers in a market that is projected to grow 13 percent annually through 2030. (The Economics Times)

Private broadcaster TV Asahi announced plans to increase the number of anime programming blocks on its flagship television network after The Dangers in My Heart anime reported record overseas sales for the existing anime block. (SubCulture Press)

More than two-thirds of private broadcaster TV Tokyo’s ¥8.84 billion (US$56.5 million) operating profit for the fiscal year ending in March 2024 came from its anime and streaming businesses. (Animation Business Journal)

The First Slam Dunk recorded final box office earnings of ¥38.3 billion (US$245 million) worldwide, with nearly 60 percent coming from overseas markets. (Toei Animation, Tadashi Sudo)

Piccoma retreats from France, triggers webtoon worries

“About 10 years ago, webtoon, which was born in the Korean market, came to Japan. Webtoon then gained acceptance in Japan, where manga apps were already starting to take hold. With that, it may have seemed like the webtoon market had really developed, but I think that was simply because it coincided with the expansion of the digital manga market. Furthermore, I think that rather than webtoon being a hit, it was simply the ‘wait and it’s free’ business model that became a hit.”

— Kazuaki Ishibashi, Shogakukan’s Manga One manga app founding editor-in-chief

Context: Ishibashi took to X last week to share his thoughts on Piccoma’s sudden withdrawal from the French webtoon and manga market after its local manga app ended service after just two years.

Catch up quick: Investors have been watching Piccoma, a subsidiary of South Korea’s Kakao and Japan’s highest-earning smartphone app service operator, as a barometer of the webtoon business.

What they’re saying: Ishibashi and other manga industry observers now fear an impending bursting of the bubble in the webtoon market, which had been forecast to reach US$60 billion globally in the next decade.

Piccoma earned more than ¥100 billion (US$665 million) last year. In 2022, it delayed a plan to list on the Tokyo Stock Exchange.

Japan’s no. 2 streamer bets on anime to add market share

Streaming platform U-NEXT is seeing a high demand for anime content as the company seeks to grow market share in the Japanese streaming market.

Why it matters: U-NEXT has grown its share of Japan’s streaming video on demand (SVOD) market for five consecutive years and is now ranked second only to Netflix, according to data compiled by GEM Partners.

Driving the story: U-NEXT president Tenshin Tsutsumi told the Branc business news website that market share is important to the company.

“There is a sense of crisis that if we don’t rank at least first or second among users, we won’t be selected by them, so we have prioritized investment in areas where we can achieve that position,” Tsutsumi said.

How it happened: U-NEXT built its burgeoning subscription base by focusing on films instead of the focus on television drama serials by many competitors.

In 2022, the company formed a partnership with movie theater chain TOHO Cinemas to allow subscribers to watch new films on the platform.

“Next is anime,” Tsutsumi told Branc. “Although there is a high demand for new anime, older works can still sell well, so our goal has been to be number one in terms of product selection, regardless of new or old, when it comes to movies and anime.”

Animenomics is an independently-run and reader-supported publication. If you enjoyed this newsletter, consider sharing it with others.