Sony takes $463m stake in Bandai Namco

Plus: Billboard Japan prepares publication's first top manga chart; Domestic digital manga growth slows again; Girls more active manga readers than boys; and more

This is your weekly Animenomics briefing, covering the business of anime and manga. Today is Wednesday, July 30, 2025.

In case you missed it: San Francisco-based virtual YouTuber agency VShojo, the top talent agency in the United States representing streamers who use virtual avatars, has shut down over allegations that the company mishandled hundreds of thousands of dollars of funds that were intended for a charity.

Our thought bubble: At Anime Expo earlier this month, I told the outlet VTuber NewsDrop that these agencies must improve corporate governance and clearly define their IP businesses before the world can see more publicly listed VTuber companies like Japan’s Anycolor (operator of Nijisanji) and Cover (Hololive).

Bandai Namco leans on Sony to fuel overseas IP growth

Entertainment conglomerate Sony Group will invest about ¥68 billion (US$463 million) in Bandai Namco, acquiring around 16 million shares—a 2.5 percent stake—from the toys, gaming, and anime giant’s other shareholders.

Why it matters: The agreement may give Sony—which seeks to expand its presence in entertainment but lacks its own intellectual properties—access to distribute high-value IPs like Bandai Namco’s iconic Mobile Suit Gundam.

Gundam anime sales only make up about 30 percent of the property’s overseas revenues, the Nikkei financial newspaper reports, making video distribution on a platform like Sony’s Crunchyroll a key opportunity area for growth.

Zoom out: Bandai Namco’s latest three-year business plan calls for aggressive global expansion of Gundam and its other internal IPs, Animenomics reported in February.

Management consultant Akio Fujii, himself a former Bandai Namco executive, believes closer ties with Sony could allow Bandai Namco to enable “vertical integration across content, streaming, and merchandise”.

“Bandai has grown by securing merchandising licenses for external IPs like Dragon Ball, One Piece, Kamen Rider, and Ultraman, but this dependency limits Bandai’s control over creative and international expansion decisions,” Fujii explained in a LinkedIn article in April.

By tapping into Sony’s distribution networks, Bandai Namco is facilitating future growth without the time and cost involved with funding its own global expansion.

The bigger picture: Bandai Namco and Sony also committed further investments in fan engagement efforts as they anticipate rapid growth in anime market.

In May, Sony and Bandai Namco jointly invested ¥10 billion (US$68 million) in blockchain startup Gaudiy, which recently took ownership of anime and manga community website MyAnimeList.

“We will seek to connect more broadly and deeply with IP fans around the world, analyzing their preferences and level of interest,” Bandai Namco chief executive officer Yuji Asako said of the Gaudiy investment in a newsletter to shareholders.

Between the lines: “The 2.5 percent stake is well-calibrated, as it avoids ceding excessive control, while subtly positioning Sony as a potential white knight against hostile takeovers or activist funds,” Fujii noted last week.

Under Japan’s corporate governance code, Sony’s stake would meet the 1 percent threshold to be able to propose items for Bandai Namco’s shareholders’ meeting agenda, but it doesn’t meet the 3 percent threshold to be able to inspect the company’s accounting books.

Billboard Japan to launch book, manga charts this year

Billboard, the music industry periodical best known for its iconic weekly record charts, will launch book and manga rankings for the Japanese market in September, Billboard Japan operator Hanshin Contents Link announced last month.

Driving the story: In addition to being Billboard’s first charts for the book market in any territory around the world, they will be Japan’s first book rankings to incorporate both physical sales and digital readership data.

Why it matters: Manga industry watchers in particular have long sought more data tracking of digital sales, which now account for nearly three-quarters of total manga sales in Japan and about one-third of the country’s total publishing industry revenue.

Oricon, the leading provider of music, home video, and book sales data in the country, produces its manga bestsellers chart using only physical sales data.

Some English-language online anime news outlets abroad stopped reporting on Oricon’s manga sales data in years ago due to the cost of licensing such data.

Zoom in: Indicators used in Billboard’s book charts include physical copies purchased in bookstores and online, digital downloads and subscription data, and library loans.

Eight charts are planned: a cumulative Japan Book Hot 100 chart; and four genre charts for literature, manga, politics and economy, and culture and art; and three charts grouped by period of original release—Showa and older, Heisei, and Reiwa.

Billboard Japan is asking booksellers to provide data for the top 300 titles in each category, The Bunka News reports, and in return the rankings will be provided to them free of charge.

Billboard Japan will publish the charts online for the public with articles explaining the rankings starting in October.

How it happened: Seiji Isozaki, Billboard Japan general manager at Hanshin Contents Link, came up with the idea of book charts combining physical and digital sales data while writing The Quiet Revolution of Billboard Japan, which was published last year.

Book distributors agreed on the need for comprehensive charts of top titles, but they were at first reluctant to share internal data, Isozaki said at last month’s Billboard Asia Conference 2025.

“I’ve been able to communicate to people in the publishing industry how creating hit charts was able to change the music industry,” he told conference attendees.

Clippings: Japan’s digital manga slowdown continues

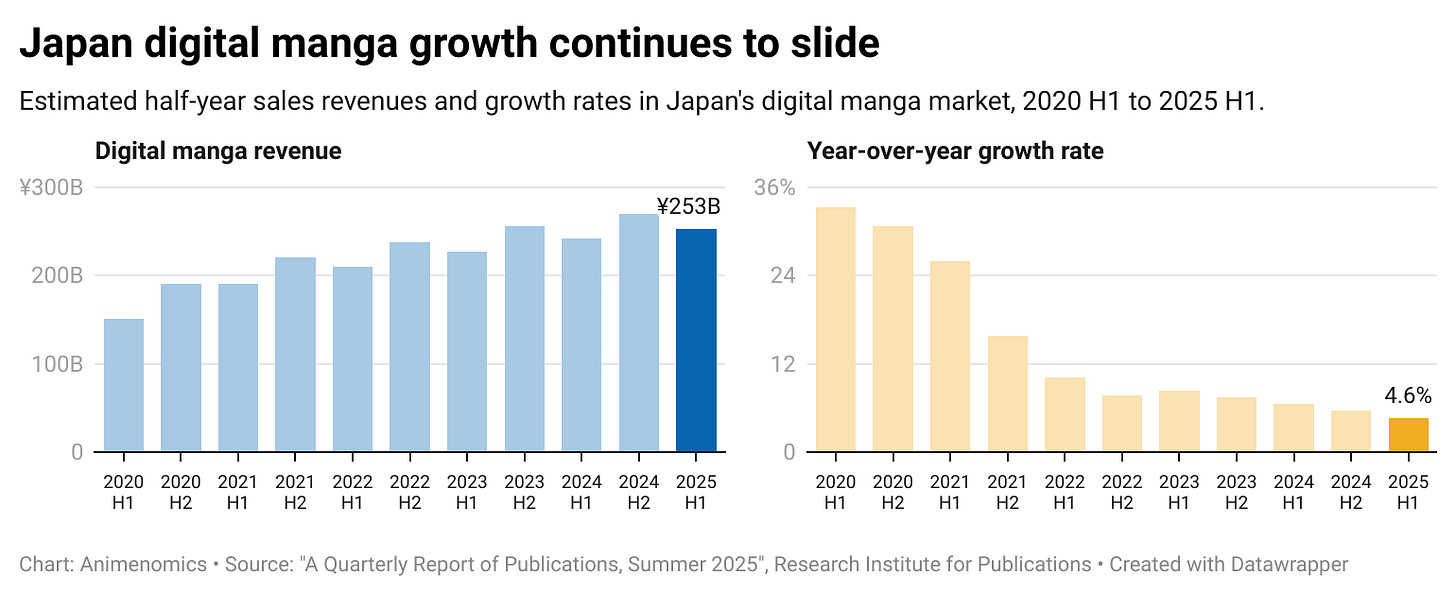

Japan’s digital manga sales for the first six months of the year rose 4.6 percent year-over-year to ¥253 billion (US$1.7 billion), the slowest growth rate for any half-year period since digital manga sales tracking in 2014. (Research Institute for Publications)

Bandai Spirits began operation of its new Gundam robot plastic model factory in Shizuoka Prefecture last week. By 2026, it’s expected to run 10 multi-color injection molding machines and 84 single-color machines. (Otaku Lab)

Earlier this year, Bandai Spirits also announced plans to open a museum at the factory site in September, allowing visitors to create their own plastic models.

Publishing giant Kadokawa released guidelines allowing content creators to use clips from four anime properties in user-generated YouTube videos, sharing a cut of monetization revenue with production committees. (Press release)

The initiative significantly expands the scope of the company’s Creator Support Program that has allowed more than 600 virtual YouTubers and streamers to monetize videos that use clips from some Kadokawa anime properties.

Demon Slayer: Infinity Castle’s first anime film is now the fastest film in Japan to cross the ¥10 billion (US$67.4 million) box office earnings threshold, breaking a record initially set in 2020 by Demon Slayer: Mugen Train. (Oricon News)

France’s manga sales fell for a third straight year in 2024 and is down more than 10 percent year-over-year to an estimated €35.5 million (US$41.1 million), while volumes sold fell more than 11 percent to 9.1 million units. (French Publishers Association)

Female users dominate MangaPlaza premium readership

“Currently, over 90 percent of paying members are female.”

— Daichi Katsuki, MangaPlaza sales manager at NTT Solmare

Context: In an interview with Comic Natalie, Katsuki says that MangaPlaza’s use of a hybrid payment model has allowed NTT Solmare to capture both core manga readers and casual readers in a North American market where a physical manga volume costs three to four times the sticker price in Japan.

“A la carte purchases are the norm in Japan’s digital bookstores, but in the North American content business, subscriptions are the mainstream,” Katsuki explained.

MangaPlaza premium users pay a US$6.99 monthly subscription to access the bulk of titles and chapters in the platform’s catalog and can access the latest chapters by paying US$1 or US$2 per chapter.

Go deeper: NTT Solmare’s role in supporting manga publishers

Teenage girls read digital manga more often than boys

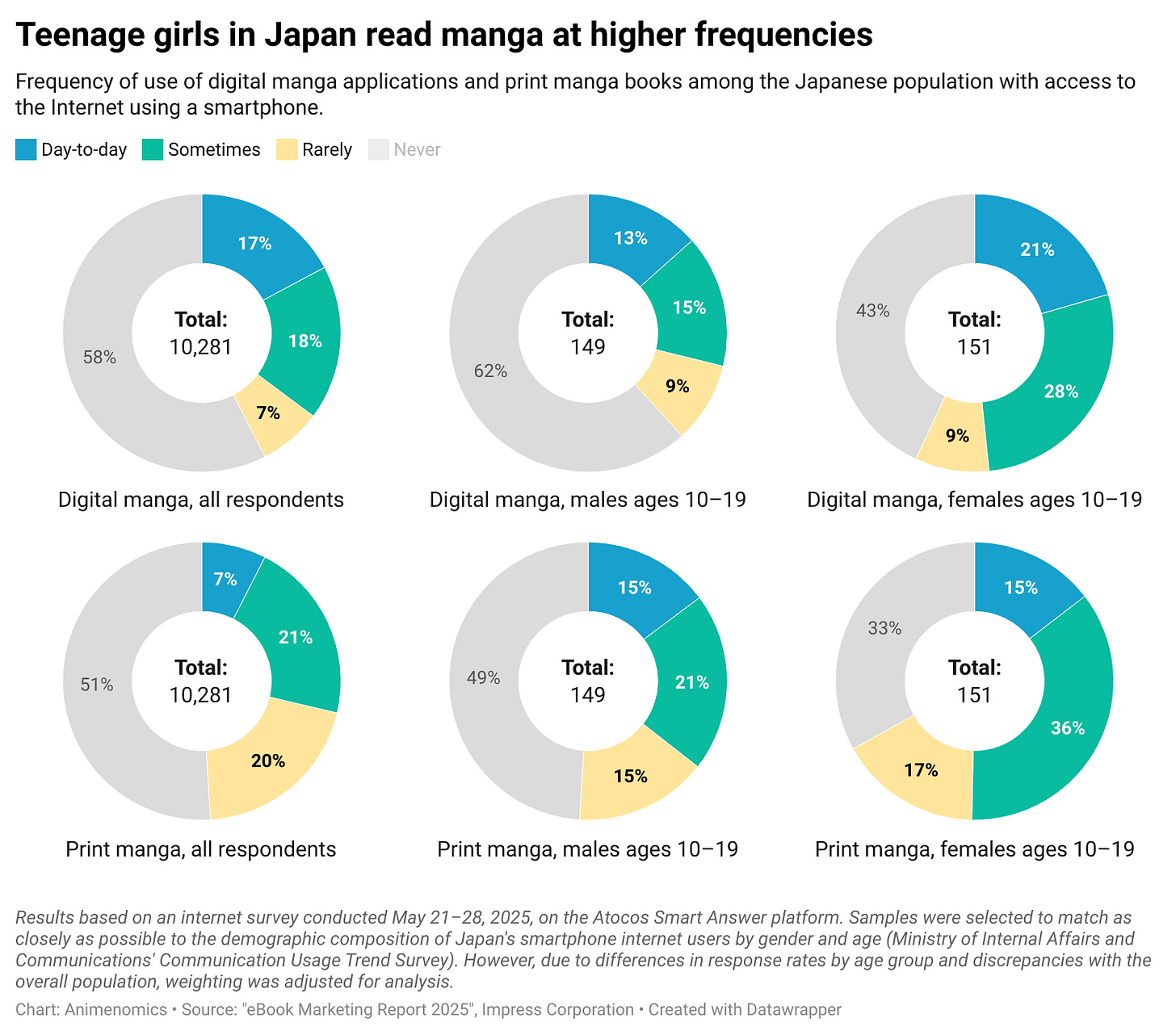

Japanese teenage girls are more active readers of manga—in both digital and physical formats—than teenage boys, according to the findings of a recent survey published in a report on the country’s e-book business that went on sale last week.

Why it matters: The survey’s results provide insight into the driving force behind the abundance of digital manga platforms and digital-first manga titles aimed at women in Japan.

By the numbers: Female readers ages 10–19 are more likely to use digital manga apps than the average Japanese smartphone user, and they are nearly twice as likely to use them than their male counterparts.

Girls ages 10–19 are also more likely to self-report using digital manga apps on a day-to-day basis than reading print manga.

The survey also found that three out of four girls ages 10–19 who have read an e-book in the past read them without for free, indicative of low disposable income.

The intrigue: About 40 percent of girls ages 10–19 report having read user-generated web novels, more than twice the ratio of boys in the same age group and nearly three times the ratio in the general population.

“I think this is probably the first survey on the use of web novels published by a third party in Japan,” report co-author Ichishi Iida writes in his summary of the survey’s findings.

Animenomics is an independently run and reader-supported publication. If you enjoyed this newsletter, consider sharing it with others.

Do you know anyone who would label themself as an “IP fan”? WTF does that even mean?

““We will seek to connect more broadly and deeply with IP fans around the world, analyzing their preferences and level of interest,” Bandai Namco chief executive officer Yuji Asako said of the Gaudiy investment in a newsletter to shareholders.”

I really wish these companies would engage with people like me to help them create their outward-facing communications because this is not how anybody in the industry or wider consumer-facing press speaks.

Also! If this deal was in the works for a while why did Filmworks license Qwuuuuuarks (! I can’t be arsed spell checking this stupid title to a great show) to Amazon globally and not Crunchyroll where it would have generated a much better engagement level for the Gundam brand?

As long as Bandai Namco’s different divisions dance to their own tune, chasing revenue rather than building long-term engagement and monetisation funnels, with no joined-up global “IP fan” development strategy to speak of they’re more or less gonna keep pushing shit up hill in a broken wheelbarrow while serving the same middle aged Gunpla otaku they did this time over a decade ago.