Labor group asks gov't to rein in anime AI translations

Plus: User-generated web novel service Everystar sold again; Manga industry crosses new sales milestone; Japan's video streaming market growth slows; and more

This is your weekly Animenomics briefing, covering the business of anime and manga. Today is Wednesday, February 26, 2025.

For your information: Animenomics will be presenting two panels about the current state of the anime business at Anime Detour in Minneapolis, Minnesota, on March 28 and 29.

This is a new experiment to bring our reporting to the anime convention circuit in the United States.

Generative AI tech puts anime translation labor at risk

Japan should regulate the use of generative artificial intelligence in anime translations in order to protect intellectual property rights, anime labor advocacy group Nippon Anime & Film Culture Association said in a statement published last week.

Why it matters: Japan’s government said last year that it wants to quadruple exports of anime, manga, video games, and other entertainment content by 2033, requiring a lot more translation work to be done in the years ahead.

What they’re saying: “Careless AI translations are directly linked to a decline in the reputation of Japanese media content abroad,” NAFCA argues, responding to a public request for comment on the government’s annual plan to promote Japanese IPs.

NAFCA contends that translations don’t merely convey meaning and are an integral part of the work being translated, conveying author’s worldview, brand, and reputation.

Because AI has the potential to produce incorrect translations, those AI outputs could potentially violate the moral right of the creator to control the integrity of the work.

The bigger picture: Distributors and publishers are experimenting with AI technology to speed up translation work as consumer demand for anime and manga grows.

Crunchyroll president Rahul Purini told technology news website The Verge last year that the global streaming service is testing the use of AI for subtitling.

Earlier this year, Shogakukan launched a manga and light novel reading app in North America that publishes works translated by AI startup Mantra.

What’s at stake: By 2028, an estimated 56 percent of global revenue from translation and dubbing adaptation work in film, television, and video could be taken up by AI, a recent study from Paris-based global authors’ societies network CISAC found.

As previously reported by Animenomics, manga and light novel translators in Germany are already demanding higher pay rates as the pace of publication continues to grow with demand.

Web novel site Everystar sold to digital manga operator

Tokyo-based digital manga provider Amutus, whose parent Infocom was bought out by global private equity fund Blackstone last year, will acquire Media Do’s web novel publishing service Everystar at the end of the month.

Why it matters: Everystar was an early player in user-generated web novels in Japan, which is a market that has become an important source of new successful IPs for the anime and manga industries.

HinaProject’s Shōsetsuka ni Narō, the market leader in this space, is credited with igniting the current boom in isekai light novels and anime where the protagonist is transported to or reincarnated in a fantasy world.

Catch up quick: Everystar began in 2010 as a joint venture between mobile gaming developer DeNA and mobile telecommunications provider NTT Docomo.

The two companies sold their stakes in Everystar to Media Do in 2021 and 2022, respectively.

The details: Everystar, like Amutus’s own Mecha Comic digital manga platform, is popular with young women, so the company plans to adapt works that are popular in Everystar into manga for distribution on Mecha Comic.

Amutus and Media Do will also form an alliance as part of the Everystar deal to grow the offerings of Mecha Comic with works from Media Do’s catalog as an e-book distributor.

The bottom line: “It is important to be able to read a variety of manga, including popular manga from major publishers, but creating manga that can only be read here [on Mecha Comic] also differentiates us,” Blackstone Group Japan principal Yuya Yamaguchi told M&A Research Report Online in November.

Clippings: Japan manga industry crosses ¥700b in sales

Japan’s manga industry grew an estimated 1.5 percent last year, according to data compiled by the Research Institute for Publications. Revenue crossed the ¥700 billion (US$4.7 billion) threshold for the first time. (The Mainichi)

As previously reported by Animenomics, the digital manga market is now double the magnitude of its size before the COVID-19 pandemic.

A lawsuit alleges that Tokyo-based Studio Comet instead of entertainment company Sanrio is the rightful creator of the character Kuromi, which first appeared in the 2005 anime Onegai My Melody, animated by the studio. (Daily Shincho)

Why it matters: Kuromi is Sanrio’s third most popular character, according to a popularity poll conducted by the entertainment company last year. A new anime featuring Kuromi and her counterpart My Melody is slated for release this year.

Sanrio’s shares on the Tokyo Stock Exchange were down 3 percent on Wednesday after the company confirmed the ongoing lawsuit.

Niigata Prefecture government will allocate ¥6.57 million (US$44,000) to promote anime across the prefecture, including establishing a public–private council on anime promotion and holding a symposium with manga artists. (The Yomiuri Shimbun)

Backgrounder: Niigata is the hometown of manga artists like Rumiko Takahashi and Fujio Akatsuka. The prefecture also has nine anime studios and is home to a burgeoning animation film festival.

Shizuoka City administration told the city council last week that it plans to negotiate with Bandai Spirits to build a life-sized Gundam robot statue around Higashi-Shizuoka Station, near the site of a new Gundam plastic model factory. (The Nikkei)

Fukuoka-based West Base, which runs the Japanese NFT project Neo Tokyo Punks, will produce a vertical short anime that uses the NFT digital asset technology to sell voting rights for determining character settings and storyline. (CoinDesk Japan)

Webtoons to enter growth period in Japanese market

“I think that within three to five years, people who have made a name for themselves from published manga will enter the webtoon market.”

— Takuma Kobayashi, webtoon production studio No. 9 chief executive officer

Context: Kobayashi, speaking to South Korean reporters earlier this month following an investment by Webtoon Entertainment in his production studio, said he expects that Japanese-made webtoons will surge domestically if one is turned into an anime or video game.

About 90 percent of webtoon titles currently in circulation in Japan are works from South Korea, according to an analysis by the Korea Creative Content Agency.

U-NEXT outruns SVOD competition in market share race

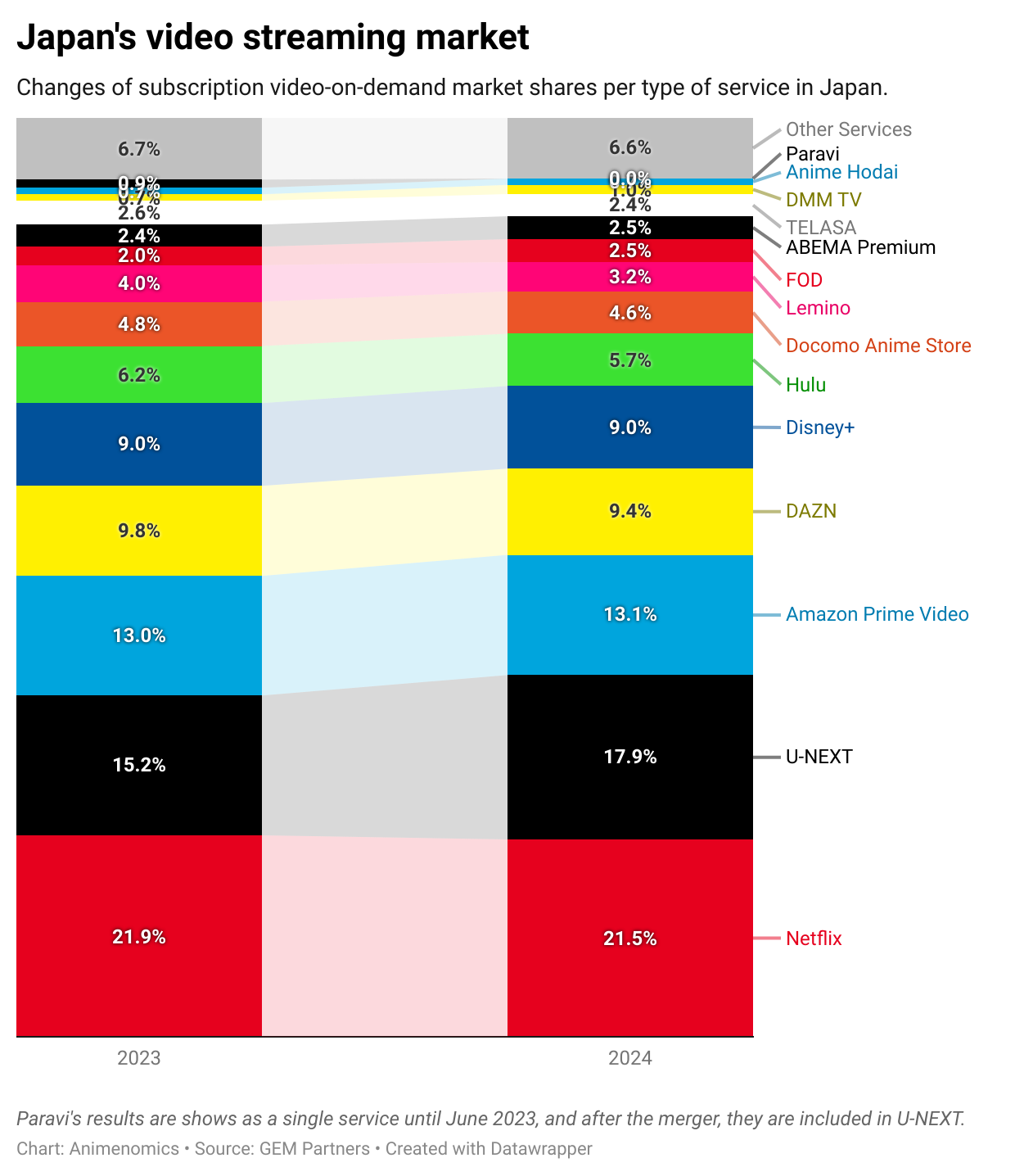

Japan’s market for subscription video-on-demand services grew 4.1 percent last year to an estimated ¥526 billion (US$3.5 billion), according to newly published data by entertainment analytics firm GEM Partners.

Why it matters: The numbers represent a significant slowdown from the double-digit growth seen by streaming platforms in the country during the COVID-19 pandemic.

Zoom in: Domestic streaming service U-NEXT continues to stage a serious challenge to market leader Netflix, growing market share by 2.7 percentage points compared to the previous year, the most of any service.

U-NEXT’s growth goes beyond subscriptions that the service gained when it merged with live-action drama streamer Paravi in June 2023.

As previously reported by Animenomics, U-NEXT has seen increased demand for anime content and also launched a partnership with Warner Bros. Discovery’s Max service last year.

The other side: Market share figures also show that Japanese viewers aren’t drawn to platforms that specialize in anime, says Tadashi Sudo, an anime industry journalist.

Docomo Anime Store, jointly operated by mobile telecommunications company NTT Docomo and publishing giant Kadokawa, saw market share fall 0.2 points.

U-NEXT’s own Anime Hodai platform also didn’t grow its 0.7 percent market share.

Animenomics is an independently-run and reader-supported publication. If you enjoyed this newsletter, consider sharing it with others.

Re AI Translation and NAFCA’s claim that poorly produced machine translation harms the reputation and popularity of those affected works is bang on the money. TenCent and Bilibili often wonder aloud why their donghua doesn’t connect with international audiences outside of a couple of breakout shows like Link Click and Heaven Official’s Blessing. The reason is because their English subtitles are very low quality. Even worse they do not serve the story well at all and often make them incomprehensible. Having someone who doesn’t speak English fluently in charge of an AI translation tool and final check and QC will result in a fucking terrible end product.

If this doesn't happen, it will be looked back upon in a few years and people will wonder why steps weren't taken to stop this mindless application of low quality AI. This goes for pretty much all aspects of creative content worldwide currently suffering from the AI assault.