CyberAgent tackles global anime advertising

In interview with Animenomics, CyberAgent elaborates on its anime IP strategy and the challenges of global anime marketing

This is a feature story from Animenomics, covering the business of anime and manga.

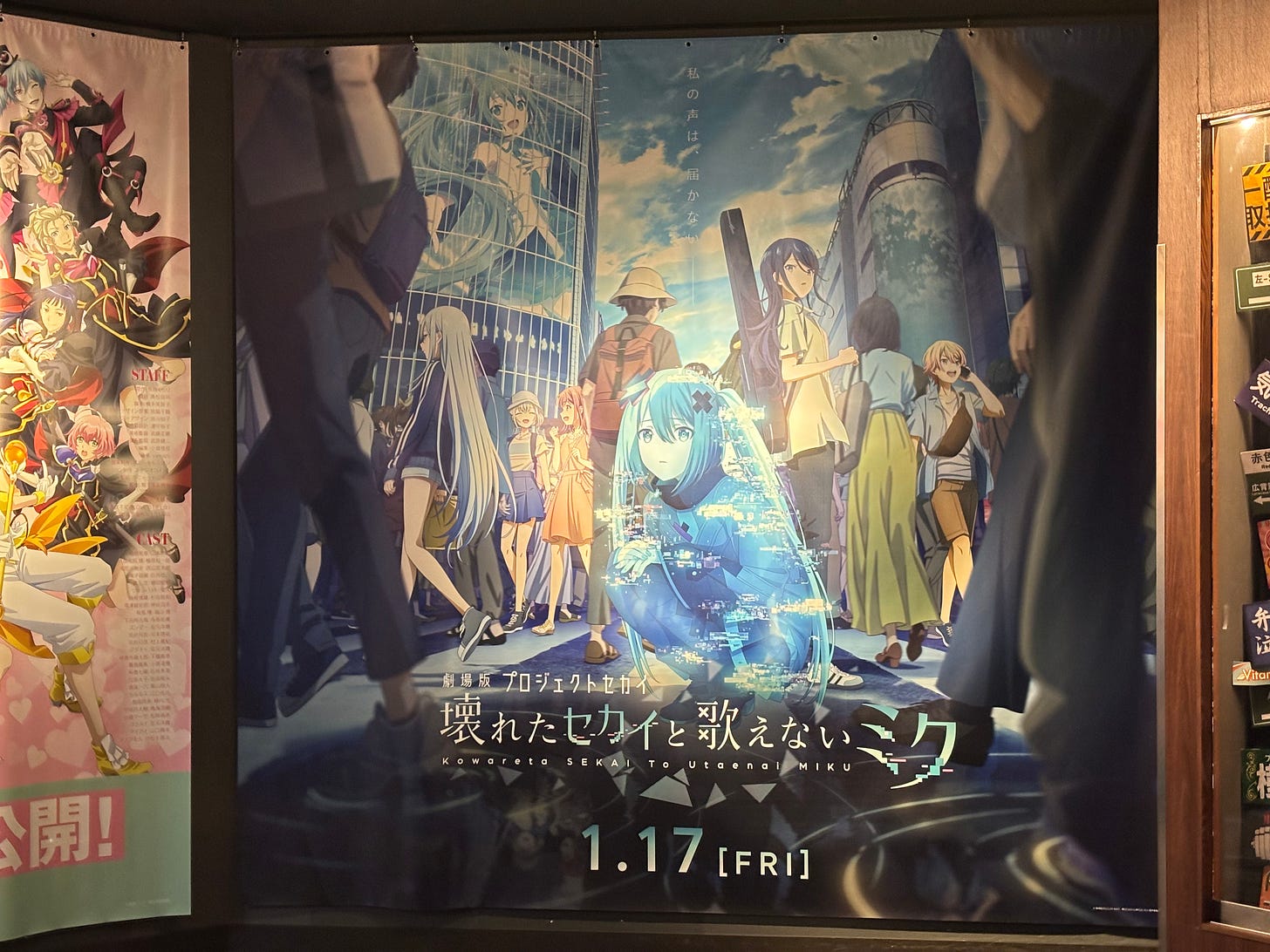

Colorful Stage! The Movie: A Miku Who Can’t Sing achieved a milestone in April when the anime film opened in theaters in the United States. It earned nearly US$1 million more on its opening weekend in the U.S. than it did in Japan three months earlier—US$2.83 million versus ¥307 million (US$1.98 million).

The film also sold as many tickets on opening weekend in the U.S. as it did in Japan, according to an estimate by anime marketing agency White Box Entertainment.

Colorful Stage! The Movie’s eponymous main character, the virtual idol Hatsune Miku, has long had broad appeal outside Japan as the mascot character of the Vocaloid singing synthesizer software, created by Sapporo-based Crypton Future Media.

Miku’s success as an anime, however, bodes well for the future of CyberAgent, one of Japan’s top digital advertising companies and the leader of the production committee that funded the film’s production.

As previously reported by Animenomics, CyberAgent last year formed an anime and IP business division in an effort to diversify away from advertising.

In the past year, the number of stories reported by this newsletter about CyberAgent demonstrates the company’s rapid progress in the anime industry, including acquiring a visual novel development studio, recruiting a veteran producer to lead a new anime studio subsidiary, and relaunching its San Francisco-based marketing subsidiary.

After Colorful Stage! The Movie, CyberAgent successfully aired an original anime series, Apocalypse Hotel, in April. It will also debut next week a highly-anticipated adaptation of critically-acclaimed manga The Summer Hikaru Died, licensed from publishing giant Kadokawa.

In light of these developments, Animenomics interviewed CyberAgent to learn more about its IP strategy.

CyberAgent recently reported very favorable earnings results for the Media & IP business. Sales in 2Q 2025 are up 14.4 percent year-over-year, and four of the last five quarters have reported an operating profit. What role does CyberAgent’s anime investments play in this loss-to-profit turnaround?

At CyberAgent, we are planning to build a system that will maximize the potential of the anime industry—which is projected to exceed ¥9 trillion yen (US$60 billion) in market size by 20301—and to seamlessly establish and monetize IPs from their source.

We are also working on developing a multifaceted strategy centered around anime by maximizing synergies with CyberAgent’s peripheral businesses, such as through the investment in and production of anime and through merchandise planning and sales.

Although we’ve just taken our first step into the anime industry, we expect it to become one of our company’s major future earnings. We are also hoping to contribute to the overall development of the anime industry as a whole.

In the last several years, CyberAgent has started investing in anime productions as the lead manager or co-lead manager. There are major adaptations like The Summer Hikaru Died and original IPs like Apocalypse Hotel. How does CyberAgent identify IPs that are good candidates for anime?

Since we are still in the early stages of establishing our anime division, our hope is to be involved in something that can really contribute to developing the anime industry further while working together with other industry players.

CyberAgent has an affiliate company, Cygames, that has been very successful with its Umamusume: Pretty Derby IP in both gaming and anime. What lessons have you been able to gain from that success that CyberAgent can apply in the future?

While prioritizing user satisfaction, we spare no effort or expense in making a high quality end product. When localizing anime and IP, we ensure that we maintain the property’s unique worldview, and to localize it appropriately for each respective country it’s released in. Although we haven’t been involved with many localization projects yet, we plan on continuing to accumulate knowledge and building on what we know.

CyberAgent has been building up its anime production capabilities with units like Animation AI Lab, Tokyo Anime Artifacts, and CA Soa.2 At the same time, there is concern that there isn’t enough human resources to keep producing more anime. What approaches is CyberAgent taking to address this concern?

In the anime production process, there are a number of problems such as an overreliance on overseas contractors and long working hours. At CyberAgent, we are determined to solve these problems in a way that only CyberAgent can—such as with the help of technology—and to create an environment where creators can continue to produce unique and wonderful works of art.

Earlier this year, CyberAgent America was relaunched with a focus on global anime marketing, partnering with companies like X Corp. Japan and MyAnimeList. What kind of challenges with anime marketing today are you trying to tackle?

Through international partnerships with various media and online platforms, CyberAgent intends to take on the challenge of formulating a comprehensive global marketing strategy. We also aim to promote each property in a way specific to each region without compromising the anime’s unique branding and worldview, which we believe is one of its biggest strengths.

In March, CyberAgent launched the English-language version of ANIME FREAKS, a website that reports anime news. However, around the world, many of the youngest anime fans now receive news directly from social media. Why is it important for CyberAgent to still create a direct-to-consumer website for anime news reports? What role does ANIME FREAKS play among the existing fan-operated English-language outlets that report on anime?

Our goal is to deliver anime information quickly by publishing articles simultaneously both in Japan and abroad. We will also publish original articles, such as reports on the impact of Japanese anime on overseas fans and covering anime conventions across the world. Furthermore, CA America will publish columns utilizing quantitative data from social media and anime review sites, and from qualitative data such as user comments. In addition to our website, ANIME FREAKS will post actively on social media. We hope to provide information from a variety of angles that only ANIME FREAKS can offer.

CyberAgent also plans to create other language versions of ANIME FREAKS in Korean, Simplified and Traditional Chinese, Thai, Spanish, Portuguese, and French. Do these reflect what CyberAgent believes are the emerging markets for the anime industry around the world?

The popularity of different series varies by country.

ANIME FREAKS is a news media outlet that aims to both provide the latest news in the world of anime and manga as well as opportunities for anime fans from around the world to discover new series. To this end, we plan to expand supported languages.

Animenomics is an independently run and reader-supported publication. If you enjoyed this newsletter, consider sharing it with others.

The market size of the anime industry is estimated to reach US$60,272.2 million by 2030 as stated in an industry report by Grand View Research published on January 29, 2025. Exchange rates are as of late February 2025.

Animation AI Lab is a department at CyberAgent. Tokyo Anime Artifacts is a consolidated subsidiary jointly established by Cygames, an equity-method affiliate of CyberAgent, and MAPPA. CA Soa is a consolidated subsidiary of CyberAgent.

"Listen kids! Like every other company operating in anime production in Japan we have zero interest in ensuring animators get paid fairly or are treated as human beings with dignity and respect. Don't worry though! We won't outsource to gaijin. We will probably lean heavily on genAI, but don't worry about that. It's a 100% Japanese genAI replacing human hands and emotions. Thank you for your understanding."