Profitability gap widens for anime studios

Plus: Studios still employ freelancers at a high rate; Print books dominate Tokyo Comic Market; What 'Look Back' says about the future of anime films; and more

This is your weekly Animenomics briefing, covering the business of anime and manga. Today is Wednesday, August 28, 2024.

An announcement: Animenomics is taking an end-of-summer break next week. Our next issue will be on Wednesday, September 11, 2024. We look forward to seeing you again then.

Profits diverge between large and small anime studios

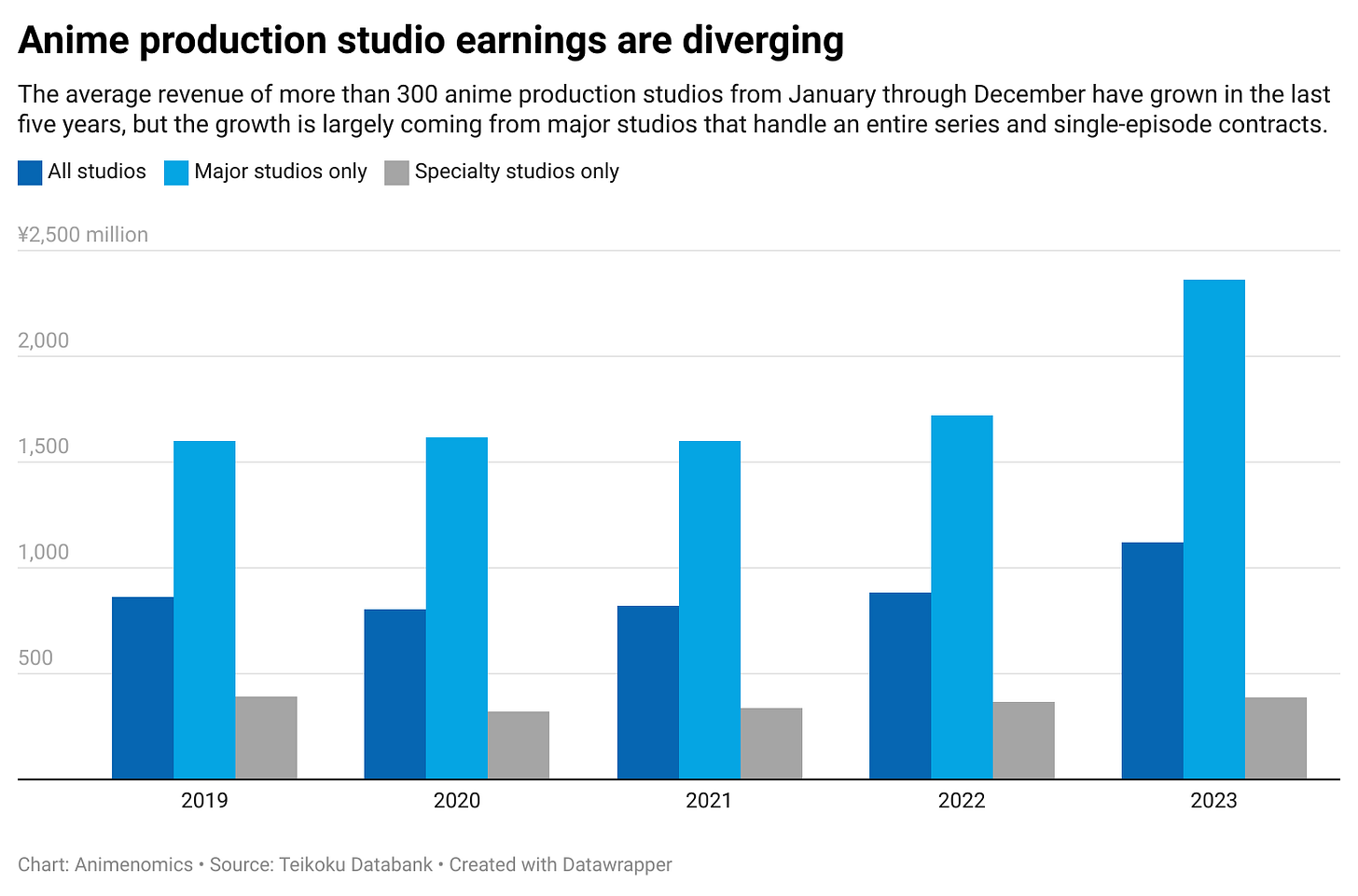

There is a growing profitability gap in the production finances of Japanese anime studios, an annual analysis of corporate data by credit reporting agency Teikoku Databank found.

Why it matters: Small- and medium-sized anime studios are being left out from receiving the benefits of a roaring global anime market as larger studios surge ahead in revenues and profits.

What’s happening: Ownership over an anime production’s intellectual property rights through membership in a production committee is quickly becoming the determining factor in a studio’s profitability.

Among primary contractor studios, which are more likely to have a stake in anime productions and to earn royalty from them, about 78 percent earned a profit last year.

Meanwhile, only 57 percent of subcontractor studios are profitable, and the proportion of loss-making studios in this group is the highest since 2020, when work largely stopped in the early days of the COVID-19 pandemic.

Zoom in: Overall, anime studio revenues grew 23 percent last year to ¥339 billion (US$2.34 billion), the highest ever recorded by Teikoku Databank.

Yes, but: Out of the 301 studios where revenue figures for consecutive years were available, only about 37 percent saw their revenues rise last year.

This marks an 8-point decline from 2022, meaning growth is becoming more concentrated within a smaller pool of primary contractor studios.

On the other end of the spectrum, about 1 out of 4 anime studios actually saw revenues fall last year.

Reality check: IG Port, which operates three anime studios, told investors in its year-end earnings presentation last month that losses are deeper when there are more production orders from overseas streaming platforms despite high budgets.

Production delays are common in high-value orders. When this happens, monthly fixed costs pile up and result in losses because the budget was fixed when the order was made.

IG Port studios Production I.G and WIT STUDIO have worked with Netflix and Crunchyroll on several productions for their platforms.

The bigger picture: Specialty subcontractor and smaller primary studios have been especially susceptible to the labor cost fluctuations that come from foreign outsourcing and the depreciation of the yen.

Unlike major studios, these smaller companies are less likely to be invited to join production committees and don’t earn royalty from their anime titles, resulting in smaller profit margins.

Freelance employment at anime studios remains stable

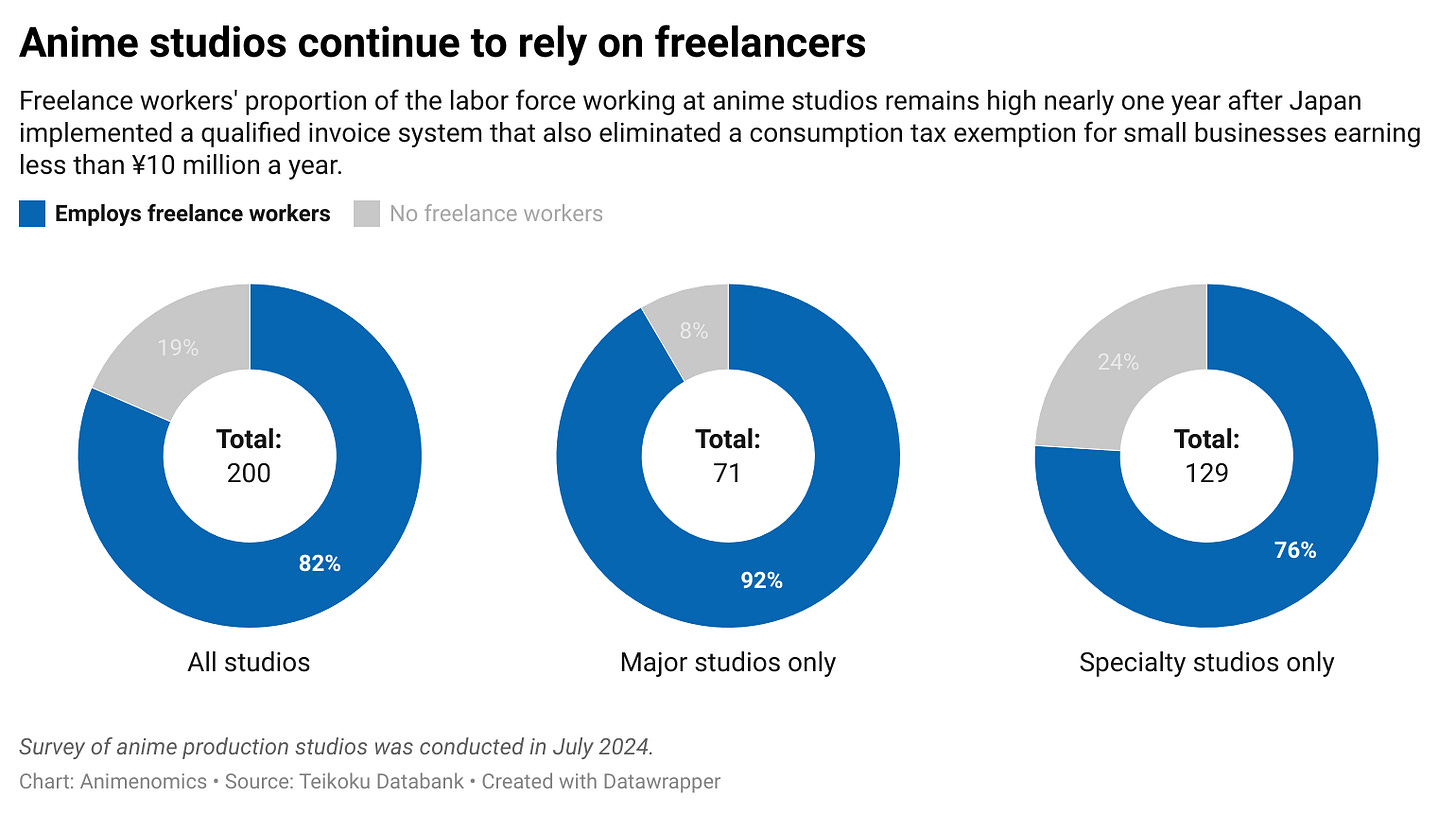

One year after a consumption tax reform implementation that was expected to negatively impact the anime industry, anime studios continue to hire freelance workers at a high rate, a survey conducted in July by Teikoku Databank found.

Why it matters: Fears that up to 30 percent of anime and manga workers could go out of business from the tax increase and additional bureaucratic burden of filing qualified invoices haven’t become a reality.

More than half of workers in the anime industry work under non-permanent contracts, according to a survey by the Japan Animation Creators Association.

Where things stand: Among 200 anime studios surveyed by Teikoku Databank, 4 out of 5 studios continue to do business with freelancers like animators and voice actors.

At studios that are primary contractors, more than 90 percent still contract with freelance workers and owners of sole proprietorships.

Yes, but: “Although there has been no noticeable movement by anime studios to dissolve transactions with freelancers, the increase in the consumption tax burden is significant for freelancers with low incomes,” writes Daisuke Iijima, the author of the Teikoku Databank report.

There have also been several instances where anime studios assumed the tax burden for freelancers who can’t afford to generate the qualified invoices.

Clippings: Crunchyroll boosts offerings in Asian markets

Crunchyroll’s dubbed anime titles in India contribute to more than 65 percent of the streaming platform’s total viewership in the country. Crunchyroll has dubbed more than 80 anime shows in Hindi, Telugu, and Tamil. (Rest of World)

In Indonesia, another emerging market for the platform, Crunchyroll recently added more than 100 anime titles with Indonesian subtitles. (The Indonesian Anime Times)

Anime home video sales in the domestic Japanese market for the first six months of the year rose 2.7 percent over the same period last year to ¥12.7 billion (US$87.6 million), driven by strong sales of The First Slam Dunk. (Animation Business Journal)

Publishing giant Kadokawa has been threatened with additional cyberattacks after the company refused to pay the BlackSuit hacker group a US$8 million ransom for files stolen in a June attack. (Kyodo News)

Pachinko maker Kyoraku Industrial will establish an offshore anime and manga digital coloring studio with the assistance of Tokyo-based AI development firm Global Walkers, which also has an office in Myanmar. (Animation Business Journal)

Bandai Namco’s Gundam Base pop-up store is touring around 14 locations across the United States through the end of October. The store will display a two meters tall Gundam robot statue. (The Yomiuri Shimbun)

Inaugural American Manga Award winners include three titles published by VIZ Media, which is jointly owned by publishers Shogakukan and Shueisha. Two are by Kodansha, and one is by Kadokawa-owned Yen Press. (Publishers Weekly)

Anime pirate streaming websites affiliated with the defunct pirate streaming giant Fmovies, one of which drew 170 million visits a month, have gone offline. (TorrentFreak)

Print books stay dominant in 49 years of Comic Market

“In Japan, the doujinshi culture is very significant. For people who want to create doujinshi, printing is easy here in Japan. It’s easy to print in small quantities, and there are numerous printing houses. This is difficult and expensive to do in other countries. [For people who] want to sell goods at Comiket, logistics services are also very obtainable. Their doujinshi are sent directly from the printing house to their Comiket booth. After the event, the goods are sent back [to them].”

— Koichi Ichikawa, Comic Market Committee co-representative

Context: Ichikawa, in an interview with The Indonesian Anime Times, explains why Tokyo’s twice yearly Comic Market continues to be a marketplace of self-published fanzines and comics after 49 years in operation.

Indonesian comic market events, however, frequently see sales of fan-made keychains and other merchandise, says The Indonesian Anime Times chief executive officer Kevin Wilyan.

What we’re watching: Ichikawa says the Comic Market team is aware of the potential environmental impact that so much printing could create, so it has started donating to forest conservation organizations.

Zoom out: Manga industry journalist Debora Aoki observes that Japanese manga editors visiting anime conventions in the United States are often puzzled at the number of fan artists selling merchandise instead of comics.

Aoki sees booth cost as one differentiating factor. An artist alley booth in the U.S. cost at least US$1,000 to US$2,000, whereas comic show booths in Japan are much cheaper at US$50 to US$75, putting less pressure to recoup costs.

‘Look Back’ anime film mobilizes 1 million moviegoers

Look Back, an anime film adaptation of Tatsuki Fujimoto’s award-winning manga, has a run time of only 58 minutes, but its top ten box office performance in Japan could change how future anime films are brought to the market.

Why it matters: Look Back’s run time is nearly half that of any other anime film that is screening today, allowing cinemas to turn over theaters quickly from one screening to the next to efficiently accumulate revenue.

By the numbers: To date, Look Back has drawn over 1 million moviegoers and has earned nearly ¥1.7 billion (US$11.7 million) in ticket sales since it was released on June 28.

Tickets are priced at ¥1,700 (US$11.70), cheaper than the standard ¥2,000 (US$13.80) ticket to see a feature film in large Japanese cinemas today.

On the ground: For distributor Avex Pictures, the film’s short run time has been especially popular with young adults, the Nikkei financial newspaper reports.

“Some young people find 120-minute films too long, and for them, shorter films are less difficult to watch,” Kosuke Ushiro, of ad agency Hakuhodo’s Content Business Lab research group, told the newspaper.

Animenomics is an independently-run and reader-supported publication. If you enjoyed this newsletter, consider sharing it with others.