Toho sets new 3-year-plan for anime business

Plus: Digital distribution extends Shogakukan girls' manga lifespan; IG Port cautious on U.S. tariff outlook; AI voice startup ElevenLabs enters Japan; and more

This is your weekly Animenomics briefing, covering the business of anime and manga. Today is Wednesday, April 16, 2025.

In case you missed it: Toho’s acquisition of GKIDS in October has a final price tag of ¥19.2 billion (US$129 million), paid in cash, the Japanese film production giant’s year-end consolidated financial results show.

The figure includes approximately ¥19.1 billion in assets for the New York-based anime film distributor, ¥12.7 billion in liabilities, and ¥12.8 billion in goodwill.

As previously reported by Animenomics, Toho said in January that the acquisition would cost an estimated US$140 million.

Toho establishes anime and Godzilla IP business pillar

Toho is carving out anime production, distribution, licensing from its film business and creating a “fourth pillar” of the company’s operations, effective the new fiscal year that began in March, the Japanese film production giant told investors on Monday.

Why it matters: Anime is increasingly important for Toho and its financials, with net sales more than doubling in the last two fiscal years to ¥55.4 billion (US$364 million).

Net sales from anime now account for 17.7 percent Toho’s operating revenue, up from 9.9 percent two years ago.

The details: Toho’s film business will shift about 30 percent of revenue and 40 percent of operating profit to a new intellectual property (IP) and anime business pillar.

Toho Animation, Singapore-based Toho Global, and Los Angeles-based Toho International, along with recent acquisitions Science SARU, New York City-based GKIDS, and Toho Animation Studio will be organized under the new umbrella.

Licensing related to Toho’s flagship Godzilla property will also shift to the IP and anime business, accounting for about 10 percent of segment revenue.

What’s next: Toho’s latest three-year management plan announced this week aims to more than double the operating profit of the IP and anime business, to more than ¥40 billion (US$280 million).

By 2032, the company wants to double the number of anime titles aired under the Toho Animation brand and the number of employees at its head office.

It will invest ¥70 billion (US$489 million) in production of new content and ¥120 billion (US$838 million) in acquisitions, the Nikkei financial newspaper reports.

The company will also launch its own membership service in Japan next year, giving fans access to exclusive merchandise, free movie tickets, and studio tours.

What we’re watching: Toho seeks to establish a European base of operations as part of a wider effort to grow its international presence.

One strong candidate is Paris, where anime companies like Toei Animation, TMS Entertainment, and Bandai Namco already have subsidiaries.

Shogakukan expands long tail strategy for girls’ manga

More than half of readers of Shogakukan’s girls’ and women’s manga titles now read the publisher’s works digitally, the company told The Tsukuru magazine in its annual coverage of the manga and anime industry.

Why it matters: Digital publishing is extending the lifespan of Shogakukan’s manga properties aimed at girls and women, creating new opportunities for the publisher to expand its long tail strategy.

Zoom in: Hanshin: Half-God, the 1984 one-shot by renowned girls’ manga artist Moto Hagio, was a trending topic on Japanese social media last year despite the work being out of print for years.

Many popular manga artists celebrated Hanshin’s digital release 40 years after its original publication, leading young readers to discover the work for the first time.

“We are now thinking about how to deliver the many treasured works that have accumulated throughout our history and bring them to new readers,” Masami Hatanaka, Shogakukan’s head of girls’ and women’s manga, told The Tsukuru.

What’s happening: Women who grew up reading Shogakukan’s Ciao, once Japan’s most popular girls’ manga magazine, are now introducing daughters to their favorite manga titles.

Pop-up stores selling merchandise from classic titles such as Mirmo Zibang!, Ask Dr. Rin!, and Kirarin Revolution have reportedly sold out some of their inventories in a single day.

The intrigue: On the other end of the publishing lifecycle, digital distribution has also helped Magical Girl Dandelion, a title that began serialization last year, become more popular in the United States than in Japan.

Thanks to social media chatter among American manga readers, more readers in Japan are now beginning to explore the series.

Clippings: ‘One Piece’ bullet train begins Osaka service

Osaka-based West Japan Railway began service of a One Piece-themed Shinkansen bullet train service between Shin-Osaka and Hakata to celebrate the 50th anniversary of the route’s opening and the 2025 World Expo in Osaka. (The Mainichi)

Japan’s Agency for Cultural Affairs will launch a program to promote the creation of anime programs at universities and vocational schools in order to tackle the shortage of labor at anime production companies. (The Yomiuri Shimbun)

Seoul-based Billions Plus entered into an agreement with Media Castle, the importer of Japanese films that brought Makoto Shinkai’s Suzume to South Korea, to distribute more than 10 Japanese live-action and anime films this year. (The Chosun Ilbo)

South Korean internet conglomerate Kakao is looking to at least partially sell some of its shares in Kakao Entertainment amid struggles in the unit’s web novel and music label businesses. (The Korea Times)

Rumors around Kakao Entertainment are circulating as rival Webtoon Entertainment’s LINE Manga overtook Kakao Piccoma as Japan’s top-selling manga app in the first quarter of the year, based on data from Sensor Tower.

Detective Conan anime fans caused a tenfold increase in visits to the Nobeyama Radio Observatory in Nagano Prefecture last month ahead of the release of the anime franchise’s latest film One-eyed Flashback, which features the site. (The Nikkei)

An endurance competition simulating the Hunter × Hunter manga’s fictional Hunter Examination at a Virginia equestrian site earlier this month drew 800 participants after initially registering 1,000. (Anime News Network)

Riyadh-based Manga Arabia will partner with manga publisher Coamix to translate and publish popular manga titles in Arabic in the Middle East. (Press release)

IG Port posts cautious outlook on impact of U.S. tariffs

“We recognize that the deterioration of the macroeconomic environment will lead to a decrease in disposable income for entertainment, which will also affect the animation business. We believe that it is necessary to continue to closely monitor the macroeconomic environment.”

— IG Port on the impact of U.S. tariffs on the anime industry

Context: IG Port, whose subsidiaries include anime studios Production I.G and WIT STUDIO, preemptively answered questions about escalating U.S. tariffs in its third quarter financial results presentation on Friday, giving insight into what the broader anime industry may be thinking about the topic.

What they’re saying: Even while indicating there would be no impact on income from copyright sales, which are not affected by tariffs, the company said it needs to reevaluate plans for expanding the merchandising business to North America.

As previously reported by Animenomics, IG Port is building a merchandise development business in order to double the group’s operating profit by 2027, but that effort has been focused on China and Southeast Asia so far.

ElevenLabs plans AI dubbing service for Japanese media

London-based speech synthesis startup ElevenLabs is developing a service in Japan that uses artificial intelligence technology to translate audio from films, anime, and TV programs into multiple languages.

Why it matters: ElevenLabs’s expansion into Japan this month follows a US$180 million Series C funding round in January that valued the company at US$3.3 billion.

NTT Docomo Ventures, a venture capital firm backed by the Japanese mobile phone operator NTT Docomo, is among ElevenLabs’ investors.

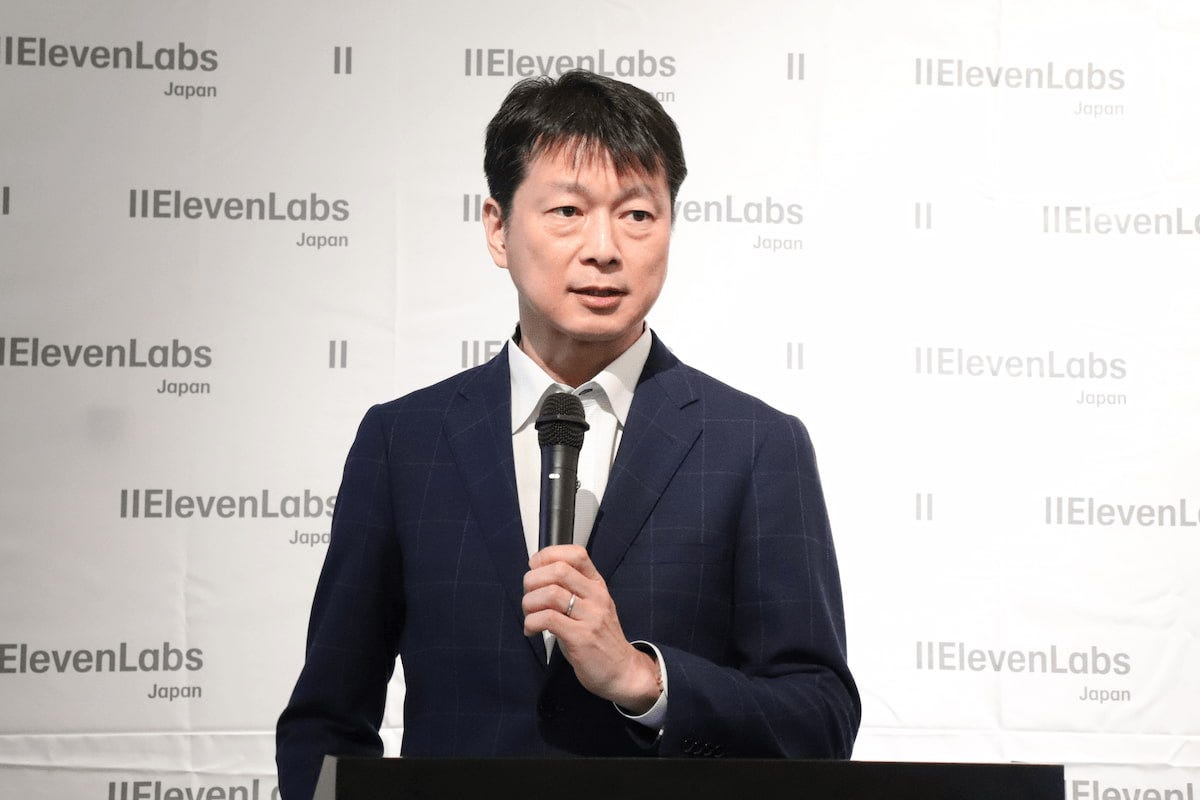

What they’re saying: Speaking to local media on Monday, ElevenLabs Japan general manager Hajime Tamura said that the company is already conducting experiments in the country.

“For example, it’s possible to realize a service that uses AI to reproduce the voice of an idol or anime character that you love and have a conversation with them,” Tamura said, per the Nikkei.

Japanese broadcaster TBS has also been working with ElevenLabs to dub KASSO, a skateboarding game show into other languages.

Yes, but: Many Japanese companies and users remain concerned about safety and compliance issues related to generative AI technologies.

Tamura said ElevenLabs Japan will introduce mechanisms to prevent reproduction of voices, especially those of public figures, without permission from rightsholders.

Animenomics is an independently run and reader-supported publication. If you enjoyed this newsletter, consider sharing it with others.

Thanks for the concise explanation on Toho!

Question: How much of a financial and strategic benefit is Toho's acquisition of Science Saru?

They are imo one if the top studios in terms of animation studio quality lately. And with there new GITS on the horizon the trend seems to continue upward. Does it simply just lower the cost for anime Toho wants to produce? Or are there other benefits?

>Toho seeks to establish a European base of operations as part of a wider effort to grow its international presence

C'moooon, Portugal!

>One strong candidate is Paris

Aw... Ah well, a man can dream...