Toho buys UK anime distributor from Embracer

Plus: Overseas anime merchandise licensing contracts jump; Shifts in anime streaming subscription revenues; Genda and Bushiroad enter into an alliance; and more

This is your weekly Animenomics briefing, covering the business of anime and manga. Today is Wednesday, December 24, 2025.

Programming note: Merry Christmas! Animenomics will be on break next week. The next newsletter issue will be in inboxes on Wednesday, January 7, 2026.

Toho sets sights on Europe with UK regional head office

Toho has selected the United Kingdom as its regional headquarters in Europe, the film distribution and production giant announced last week, capping a two-year expansion that also saw it acquire anime companies in North America and Southeast Asia.

Why it matters: Toho has hinted in investors presentations over the last year that a European base of operations would eventually serve as a launchpad for the company to build its presence in the Middle East, a quickly growing anime market.

How it happened: Animenomics reported in April that other anime companies have established their European operations in Paris, but London emerged as a contender for Toho thanks to successful West End performances of its stage theater productions, such as Spirited Away.

Toho Theatricals UK, a subsidiary established last year to promote the company’s stage theater business in the United Kingdom and elsewhere, will be elevated to regional headquarters status, similar to operations in Los Angeles and Singapore.

As part of the effort, Toho is injecting an additional £16 million (US$21.6 million) into the regional office, which could be used to acquire local companies.

Zoom in: Toho’s first acquisition in Europe is that of Glasgow-based Anime Limited, an anime film, home video, and streaming distributor that was last sold to Embracer Group-owned Plaion Pictures in 2022.

Embracer has been criticized in the video game industry for amassing high debt levels from aggressive acquisitions over the last decade, a pattern also seen in Anime Limited financial statements reviewed by Animenomics.

In the fiscal year ended March 2025, Anime Limited reported a net loss of £2.15 million (US$2.9 million) and had a negative balance sheet for the third year in a row due to high levels of debt.

What’s next: Anime Limited is expected to benefit from access to Toho’s vast IP portfolio as it expands beyond the United Kingdom and France into Germany, Italy, and other European countries.

As part of the deal, Toho has agreed to keep Plaion Pictures as a partner in local merchandise marketing and distribution, a business segment that Toho is trying to grow.

Overseas licenses of anime merchandise jumped in 2024

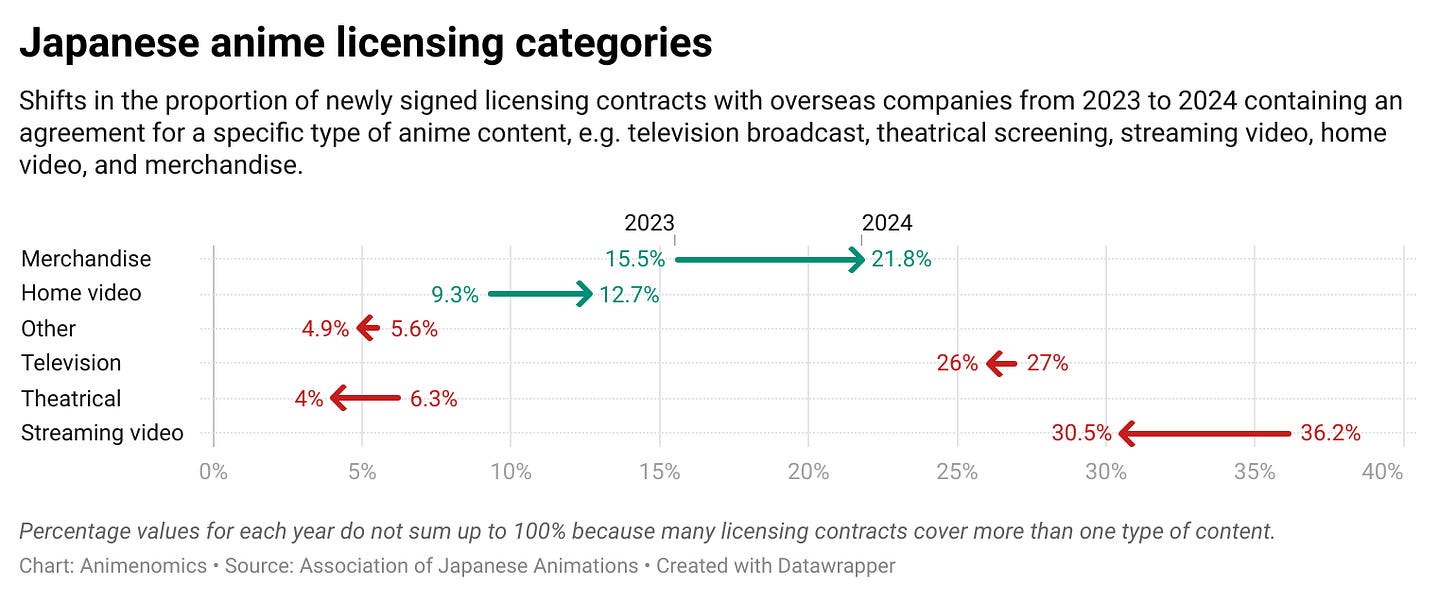

Growth in anime merchandise licenses outside Japan outpaced growth in licenses for other anime content and product types in 2024, according to the results of an annual anime industry survey by the Association of Japanese Associations.

Why it matters: Japanese anime rightsholders see availability of merchandise abroad as a critical gap in their quest to grow overseas anime revenues.

“While works of anime have reached audiences worldwide through streaming services, the surrounding ecosystem of merchandise and various fan events has lagged behind, and fans continue to flock to Japan in search of a ‘fan paradise’,” the report’s authors wrote.

By the numbers: Of the more than 5,000 anime licensing agreements with overseas partners signed in 2024 that was tracked by the AJA, 21.8 percent included an option for merchandise, up from 15.5 percent in 2023.

Two out of five agreements that included anime merchandise rights didn’t involve rights for any other type of anime content.

Nearly all of the remaining agreements involving merchandise were paired with rights for anime television broadcast.

Zoom in: Streaming video remains anime’s most popular viewing format outside of Japan, with two-thirds of new licenses for anime video content including a digital distribution option.

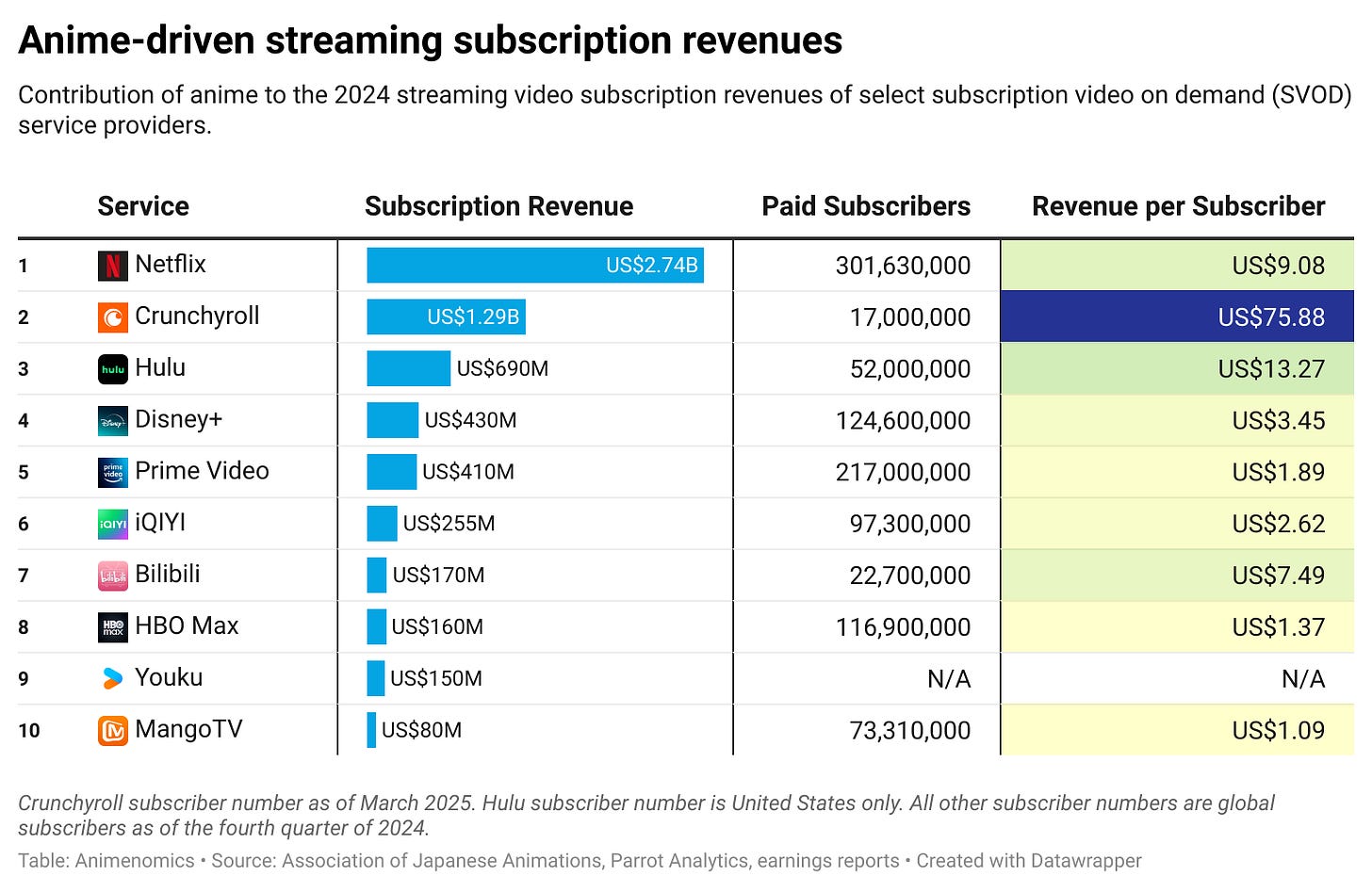

An analysis conducted by Parrot Analytics and published in the AJA report found that both Netflix and Crunchyroll increased streaming video subscription revenue attributable to anime viewers in 2024, compared to the previous year.

The Walt Disney Company’s combined streaming portfolio of Hulu and Disney+ continued to closely trail Crunchyroll by the same measure.

What we’re watching: HBO Max’s anime-associated subscription revenue more than doubled from 2023 to 2024, according to the Parrot Analytics data, which highlights the platform’s growing importance for anime distribution.

With HBO Max part of the Warner Bros. Discovery streaming portfolio, a sale of Warner Bros. to Netflix, if successful, would reshape a growing corner of the anime streaming market.

Clippings: Genda forms strategic alliance with Bushiroad

Genda and Bushiroad are forming an alliance that could see Genda’s gaming arcades around the world serve as distribution points and event venues for Bushiroad’s anime trading cards. (Animation Business Journal)

Go deeper: Genda’s gaming arcades are sweeping North America, and Bushiroad is benefiting from growing demand for anime trading cards.

Publishing giant Kadokawa is accelerating recruitment of production staff for its game office as the company makes game adaptations of its own manga, light novels, and anime properties a priority. (Denfaminicogamer)

In 2026, Kadokawa will publish Oshi no Ko: Match Star, a mobile game based on the Oshi no Ko anime that has earned the company ¥9.4 billion (US$60 million) in licensing sales revenue, to coincide with the anime’s third season.

Webtoon Entertainment’s in-house anti-piracy tool Toon Radar, which uses artificial intelligence, has allowed the company’s Korean-language platform to reduce same-day leaks of new webtoon chapters by 80 percent. (The Chosun Biz)

Organizers of ComicUp, one of China’s largest animation, comics, and gaming (ACG) fan conventions, is removing exhibitors of Japanese-themed content from this weekend’s event amid an ongoing diplomatic dispute between Beijing and Tokyo over Taiwan. (South China Morning Post)

Anime retailer Animate has launched a ticketing platform in an attempt to create a central service for ticket sales and promotion for anime, manga, and video game events in Japan. (Press release)

1 last thing: Animenomics expertise recognized in 2025

Amid a tumultuous year in the entertainment business in 2025, Animenomics regularly provided expert analysis of the evolving anime and manga business, which continues to become increasingly global and complex.

Driving the story: A story we ran in February about the end of duty exemptions on low-value imports to the United States and its potential impact on Japanese anime merchandise was chosen by the Los Angeles Press Club earlier this year as a finalist in the 18th National Arts & Entertainment Journalism Awards.

Animenomics was interviewed throughout the year by media outlets like BBC News, Screen Daily, and The Japan Times.

Our reporting was also cited by publications like Variety, Semafor, and Anime News Network.

One big thing: Animenomics began publishing stories by outside contributors this year and conducted interviews with company and studio executives, with more to come in 2026.

Reporters interested in writing for Animenomics should review our submissions guide.

By the numbers: Over 2,000 people started subscribing to Animenomics in the last 12 months, and paid subscribers have grown from 24 to 50.

Monthly views peaked in August thanks to a crowded publication schedule that included 4 newsletter issues for free subscribers and 5 issues for paid subscribers.

An appeal: Consider upgrading to a paid subscription to keep Animenomics going in the new year. Thank you!

Animenomics is an independently run and reader-supported publication. If you enjoyed this newsletter, consider sharing it with others.