Toho acquires U.S. Ghibli film distributor

Plus: German manga translators demand fair pay; Manga artists face chronic assistant shortage; Japanese webtoon studio invests in Indonesia; and more

This is your weekly Animenomics briefing, covering the business of anime and manga. Today is Wednesday, October 16, 2024.

In case you missed it: Bandai Namco Entertainment has released a One Piece mobile app that appears to use generative AI to transform portraits of people into drawings in manga artist Eiichiro Oda’s art style.

The intrigue: Promotional materials don’t describe the resulting images as AI portraits and instead characterizes them as caricatures.

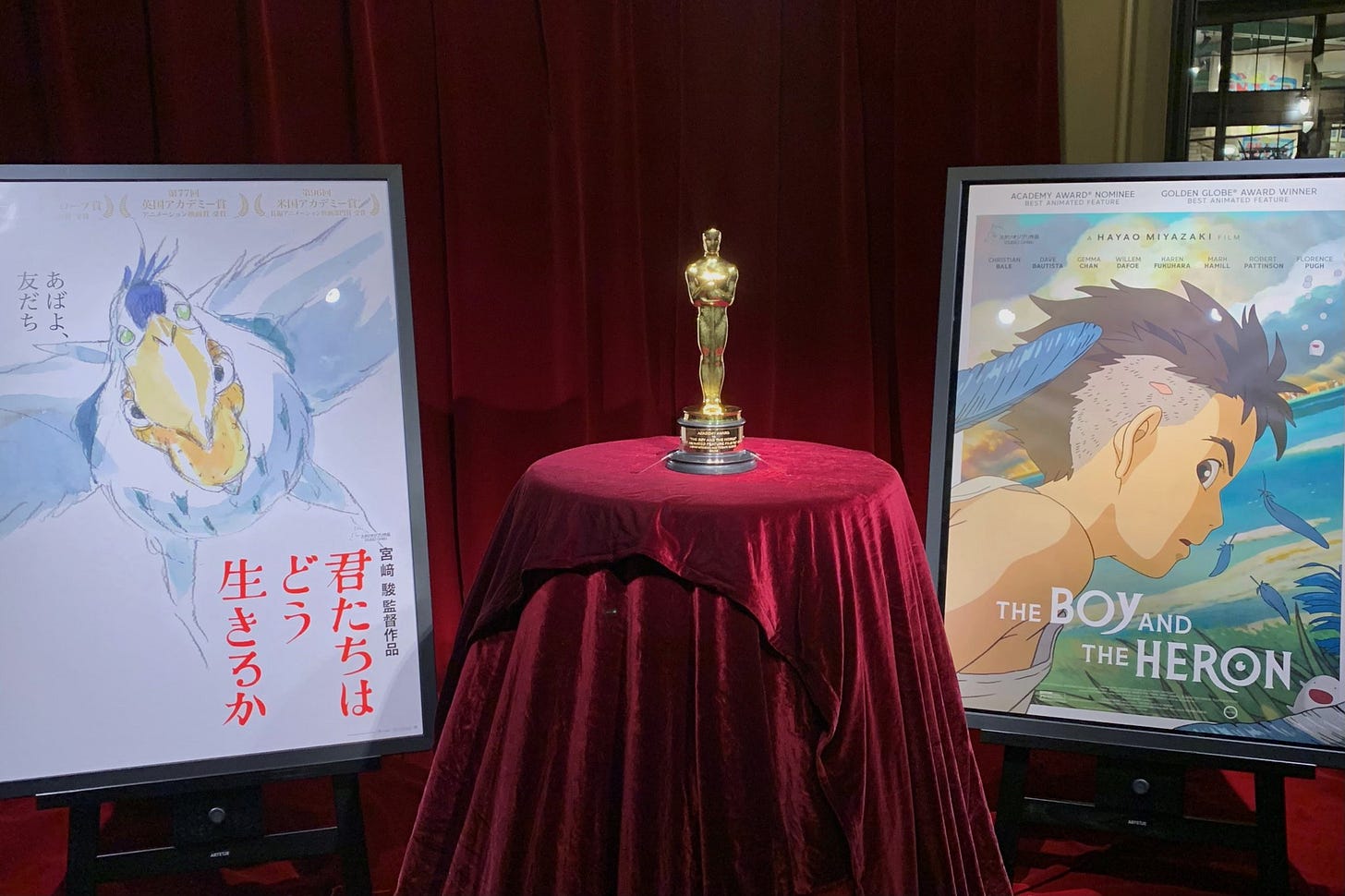

Toho acquires GKIDS, boosts North American anime biz

New York-based animation film distributor GKIDS, whose work on Hayao Miyazaki’s The Boy and the Heron won the film an Academy Award in March, is being acquired by Toho through its Los Angeles subsidiary, the two companies announced yesterday.

Why it matters: Toho is building a direct distribution business in North America for anime films it finances, forgoing its relationship with Crunchyroll Films, Animenomics reported last week.

“North America is superior in terms of profits and revenue,” Toho president Hiroyasu Matsuoka said last November in reference to global anime film markets.

The details: GKIDS’s film production and distribution will be combined with Toho International’s licensing, merchandising, and e-commerce services, Toho said in a statement.

Toho International originally built its North American operation to promote the group’s Godzilla property.

Toho intends to retain the GKIDS brand and its management team, currently led by CEO Eric Beckman and President Dave Jesteadt.

Financial terms were not immediately disclosed, but the 100 percent equity share transfer is scheduled to be completed within the fiscal year.

Zoom out: The GKIDS deal caps Toho’s three-year buying spree to boost its anime business, which included acquiring anime studio Science SARU in May.

Toho expects its operating profit to set a new record for the fiscal year ending in February, about 12.7 percent higher than the film distributor initially forecasted.

In addition to Godzilla Minus One’s success on streaming platforms, Toho credits better-than-expected license sales from anime properties Haikyu!!, Jujutsu Kaisen, and My Hero Academia.

Backgrounder: GKIDS has distributed 13 animated films from Japan and elsewhere that were nominated for the Academy Award for Best Animated Feature.

Translators seek fair pay in hot German manga market

German-language translators of manga and light novels released an open letter to publishers last week demanding higher pay rates as the country’s burgeoning market for manga and light novels has led to an overwhelming demand for new releases.

Why it matters: The letter is signed by two-thirds of all active German-language translators in the field and is endorsed by VdÜ, a 1,400-member association of literary and scientific translators in the German language.

Driving the story: Sales of German-language manga in Germany ballooned over the COVID-19 pandemic, growing from €38 million (US$42 million) in 2018 to €106 million (US$116 million) in 2022, book wholesaler Libri told the daily Der Tagesspiegel.

Manga published in print rose from 945 titles to 1,390 between 2017 and 2022, while digital manga grew from 324 titles to 1,003 titles, the Tagesschau news program reports.

Today, print manga account for two out of three comic books sold in Germany.

What they’re saying: “Despite the increase in prices for their end products, German-language manga publishers have hardly increased their fees for translations over the last twenty years,” translators argue in the open letter.

Translating an average manga volume takes one week, but translators must work on five to seven volumes a month to be able to earn a living wage.

The bottom line: Germany is selling more manga and light novels each year, but German-language translators are earning less per volume.

Zoom in: An internal VdÜ survey found that manga translators earn €28.32 (US$30.89) per hour on average, while light novel translators earn €29.09 (US$31.73) per hour.

The association claims this pay rate is far below the estimated product value of €70–120 (US$76–130) per hour that their translation work delivers.

Yes, but: Professional associations like VdÜ aren’t labor unions and can only make recommendations, so publishers aren’t compelled to negotiate with them.

Go deeper: Public broadcaster HR explains Germany’s manga boom

Clippings: Manga industry faces shortage of assistants

Japanese manga artists are facing a shortage of assistants, with some resorting to posting on social media to recruit aspiring artists to join their studios. (Real Sound)

Publishers are releasing new manga at a faster rate than ever, totaling 14,761 new releases last year compared to 12,161 new releases in 2013, according to annual data compiled by the Research Institute on Publications.

Japan’s top business lobby, Keidanren, has proposed the establishment of a content ministry with a recommended budget of more than ¥200 billion (US$1.3 billion) to support efforts to grow anime, manga, films, and music exports. (The Sankei Shimbun)

Vietnam’s Pops Entertainment, a digital entertainment provider that licenses anime and webtoons throughout Southeast Asia, aims to list on the Tokyo Stock Exchange in 2027 under a program to attract more foreign listings. (Nikkei Asia)

Film distributor Toho has taken a 6 percent stake in anime studio CoMix Wave Films, which made four of director Makoto Shinkai’s anime films that were distributed by Toho. (Press release)

IG Port’s anime studios reported a widening operating loss in the June–August quarter compared to the same period last year due to production delays and higher costs in 3D CG production and outsourced labor. (Animation Business Journal)

Asahi Production and Pierrot, two anime studios founded in the 1970s, are forming a business alliance to share human resources and technical knowledge to produce new anime works. (Gamebiz)

Pierrot is known for long-running anime titles like Naruto and Bleach, while Asahi Production’s strength comes from post-production processes.

Sorajima invests in Indonesian webtoon powerhouse

An Indonesian webtoon studio is receiving US$1 million in funding from Japanese and local partners, as the country emerges as a key player in anime and manga production pipelines in Japan and around the world.

Driving the story: Kisai Entertainment, Indonesia’s largest webtoon studio, received two-thirds of its latest funding from Japanese webtoon startup Sorajima and one-third from a local gaming and digital entertainment venture.

The studio employs more than 300 people and supports the work of webtoon companies worldwide like Sorajima and Comico in Japan, Webtoon Factory in Belgium, and Webtoon Entertainment in the United States.

What we’re watching: CEO Tessa Yadawaputri told Indonesian news agency Antara that that Kisai Entertainment will use the funds to increase production capacity and to strengthen its position in Southeast Asia’s webtoon market.

How it happened: Sorajima has partnered with Kisai Entertainment on webtoon co-production since 2022, co-CEO Kojuro Hagihara writes in a blog post.

When Kisai Entertainment was considering an investment from a South Korean webtoon company last year, Hagihara convinced Tessa to decline the offer and accept an investment from Sorajima instead.

Hagihara says the partnership will allow Kisai Entertainment to distribute future original titles outside Indonesia with the help of Sorajima.

The bigger picture: Capital alliances allow Japanese webtoon studios to compete against other countries by encouraging the overseas contractors to prioritize orders from Japan, says Takeshi Kikuchi, a manga industry researcher.

Animenomics is an independently-run and reader-supported publication. If you enjoyed this newsletter, consider sharing it with others.