Short anime maker gets ¥1b growth funding

Plus: Kadokawa expands share of light novel rankings; Comitia introduces Indonesian-made manga; Piracy keeps anime licensors hesitant in India; and more

This is your weekly Animenomics briefing, covering the business of anime and manga. Today is Wednesday, November 27, 2024.

In case you missed it: Six anime and anime-adjacent titles are eligible for consideration in the Animated Feature Film category of the 97th Academy Awards, the Academy of Motion Picture Arts and Sciences announced last week.

They are The Colors Within (screened in the United States, as required by award eligibility rules, by GKIDS), Ghost Cat Anzu (GKIDS), The Imaginary (Netflix), Look Back (GKIDS), The Lord of the Rings: The War of the Rohirrim (Warner Bros.), and Ultraman: Rising (Netflix).

Top producer of short anime targets Gen Z mobile users

Tokyo-based venture company Plott will launch a mobile application next year for streaming short anime, which are popular among teens and twentysomethings in Japan, the Nikkei financial newspaper reports.

Why it matters: Plott plans and produces short anime and distributes its titles today on YouTube on 11 separate channels, drawing a combined 10 million subscribers and 500 million views per month.

If the company had operated a single channel, it would rank within the top 20 of all YouTube channels in Japan.

What’s happening: Plott earlier this month raised ¥1 billion (US$6.6 million) in Series B funding from six companies, including social media operator Mixi and video game giant Bandai Namco Entertainment.

The company will use the new funds to double its headcount to 200 and create 100 new intellectual property (IP) titles over the next two years.

Revenue from secondary use of Plott’s properties grew 450 percent in the fiscal year ending in August compared to the previous year.

What they’re saying: “We were able to achieve results with the current 100-person organization, and in fact, we didn't need finding to continue expanding normally,” CEO Shota Okuno, 29, told entertainment researcher Atsuo Nakayama on Gamebiz.

“However, we decided to go a step further and invest in IP to become a company that generates over ¥10 billion in sales, and we decided at the same time to raise funds to find partners who will cooperate with us,” Okuno explained.

The bigger picture: Short anime is popular with Japan’s Generation Z audiences, who adopt vertical video services like YouTube Shorts and TikTok at high rates.

Okuno says an algorithm change by YouTube to promote Shorts forced Plott to pivot in 2022 to remaking some of its anime content as vertical videos to reverse slowing growth.

Kadokawa’s reach grows in annual light novel rankings

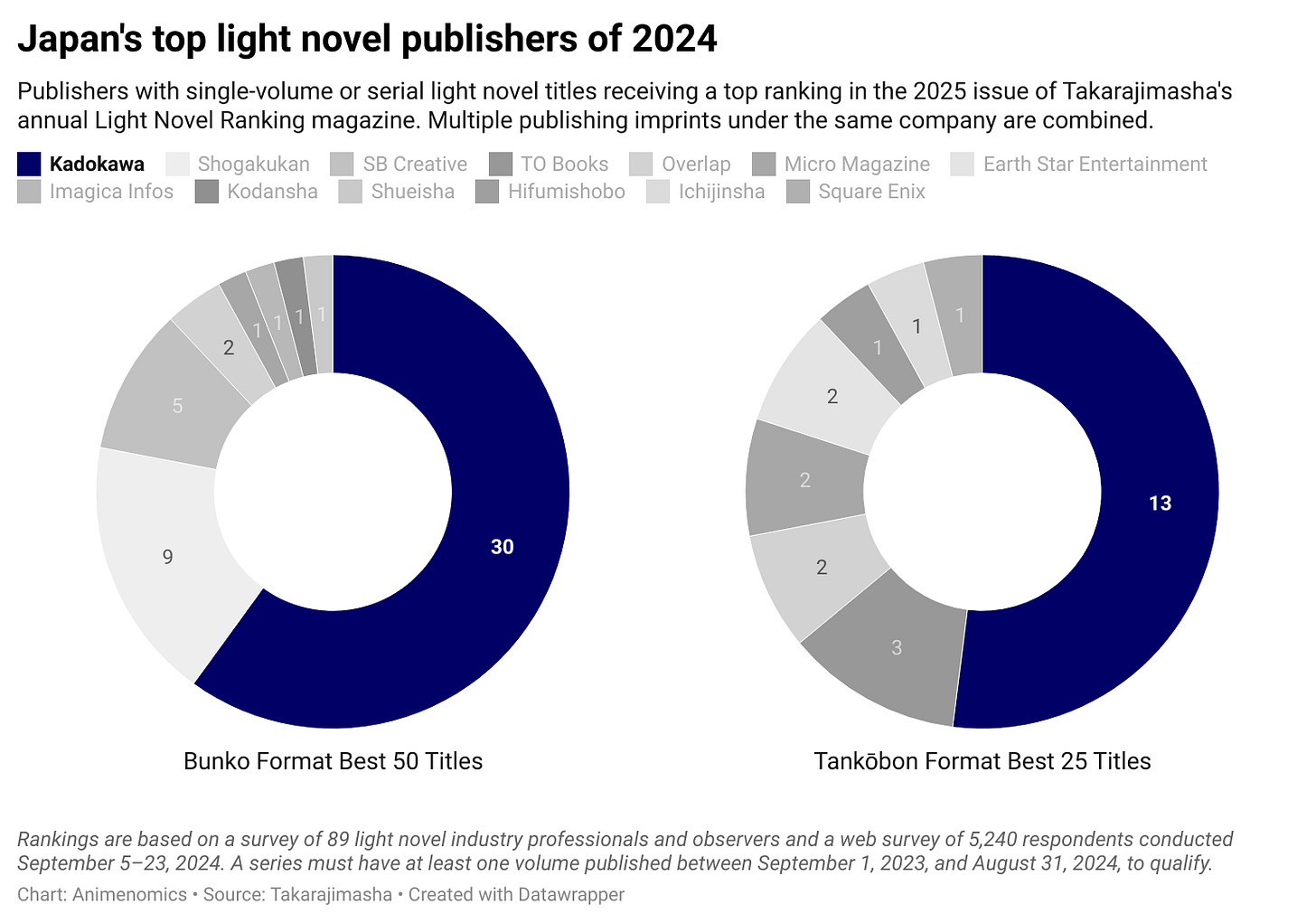

Publishing giant Kadokawa grew its share of titles listed in Takarajimasha’s annual best light novel rankings this year, claiming a majority of both the top bunko (mass-market paperback) and top tankōbon (large paperback and hardcover) releases.

Why it matters: Kadokawa grows its anime business using stories adapted from the 1,000 light novels—serial novels with anime-style illustrations—it releases every year.

Sony recently extended an acquisition offer to Kadokawa in an attempt to expand the entertainment conglomerate’s own IP portfolio and secure future growth in its anime business.

By the numbers: Kadokawa’s publishing imprints have 30 titles on the list of the top 50 bunko titles and 13 of the top 25 tankōbon titles.

This is an improvement from Kadokawa’s performance in last year’s rankings in both format categories.

Titles published by Kadokawa also make up more than half of new works that debuted in the bunko category this year and two thirds of new tankōbon titles.

Zoom out: More than 60 light novel works have been adapted into anime every year in the last few years, says Kanichi Okada, one of the editors responsible for compiling Takarajimasha’s latest rankings.

With 250 new and returning anime series aired on television and streaming platforms this year, that means one in four anime is adapted from a light novel.

Nearly half of the anime adapted from light novels in 2024 are based on a title published by Kadokawa, according to an independent analysis by Animenomics.

What we’re watching: Older light novel titles are showing signs of a comeback, in both print and anime, as seen in this year’s remake of the Spice and Wolf anime.

Clippings: Mandarake sales, profits grow double digits

Secondhand anime retailer Mandarake reported record net sales, operating profit, and net profit in the most recent fiscal year ending in September. All three metrics saw double-digit growth as foot traffic from overseas customers increased. (Gamebiz)

The Walt Disney Company Asia Pacific won exclusive rights distribute some future anime titles produced by Kodansha on Disney+. The streaming platform already runs shows like Go! Go! Loser Ranger! from the publisher. (Bloomberg)

Shogakukan’s MangaONE digital manga application was named Google Play Japan’s best app of 2024. The app ranked sixth in monthly active users among digital manga apps in a June survey of data from 500,000 Android devices in Japan. (Google Japan)

Gundam plastic model kits will see prices on 71 products rise an average 15 percent in April due to the rising cost of raw materials. It will be the first time prices increase since the kits entered production in 1980. (The Sankei Shimbun)

Zoom out: Toymaker Bandai Spirits has also been producing more and more premium Gundam plastic model kits with higher price points in the last decade.

Bandai Namco Entertainment will dissolve and consolidate in April its online video game subsidiary Bandai Namco Online, which saw deepening financial losses in recent years despite the early success of its IDOLiSH7 property. (SubCulture Press)

Rewind: As previously reported by Animenomics, the IDOLiSH7 LIVE 4bit BEYOND THE PERiOD concert film last year became one of the 100 highest-grossing anime films of all time.

Comitia marketplace debuts Indonesian-made manga

“When we introduced manga created by Indonesian artists at the Comitia event, many Japanese people were surprised because the quality was very good. Many Japanese people think that manga is only produced in Japan, so they were quite surprised when there was manga from outside Japan with quality that was as good as manga from Japan.”

— Shoichiro Mizutani, DouDouDoujin founder and CEO

Context: Mizutani, a former Kadokawa publishing executive who runs Nagoya-based digital manga distributor DouDouDoujin, told Indonesian news outlet PlayEatSleep that Indonesian artists have the potential to gain readership in the Japanese market.

Why it matters: Comitia, a marketplace for self-published manga held four times a year, has gained a reputation among Japanese publishers and manga editors as a place for discovering new talent.

Mizutani began compiling Indonesian works in a print edition of his company’s manga magazine this past summer to distribute at Comitia.

Twice a year, he attends Jakarta’s Comic Frontier marketplace, which draws more than 20,000 visitors, to recruit Indonesian artists to his platform.

Anime licensors remain hesitant in India due to piracy

Widespread content piracy in India remains a detractor for the Japanese companies seeking to license out anime and the companies that distribute them locally, a panel of industry experts told attendees of the Nagpur Anime Club’s Coscon event.

Driving the story: Japan Foundation New Delhi director of arts and cultural exchange told a gathering of Indian anime clubs in September that the usage of pirated anime content discourages Japanese licensors from engaging with local events.

Zoom in: Taiwan-based Muse Communication and Avex subsidiary Anime Times are among regional distributors that have launched anime streaming services in India.

“Copyright is a very important issue, so it’s our position to bring non-official [methods of anime consumption] to become official and to raise awareness,” Muse Communication director of India operations Julia Cheng said.

“The majority of people, not only in India, but all over the world, watch content on illegal sites, and that’s not a good thing for anybody involved in the entertainment business,” Anime Times service director Takeshi Ashida added.

Rewind: “If we do our job right, we can convince fans to switch over to an official site,” Crunchyroll president Rahul Purini also told Bloomberg last year, as previously reported by Animenomics.

Animenomics is an independently-run and reader-supported publication. If you enjoyed this newsletter, consider sharing it with others.

Another fantastic blog. Thank you. I worked on a young-adult animated series development project last year. It is YA novel adaptation for anime. The book's Indonesian edition came with some additional illustrations and new covers, and the artwork produced by a local artist knocked my socks off. I like the idea of Indonesia adding to the mix of Asian Animation in general, along with the Philippines, Singapore, China, Malaysia and Korea to name a few. It's an exciting time for anime and manga creators across South-East Asia. Seeing some of them receive recognition from new Japanese publishing start-ups is very encouraging. I always suspected the intense gate-keeping that happens within Japanese manga publishing would lead to these types of developments.