New app store law benefits Japan's manga apps

Plus: Japan faces glut of secondhand anime merchandise; 'Demon Slayer: Infinity Castle' ends China run amid political tensions; Toho touts vertical integration in anime; and more

This is your weekly Animenomics briefing, covering the business of anime and manga. Today is Wednesday, December 17, 2025.

In case you missed it: Crunchyroll this month began streaming in the Indian market all eight anime films by director Makoto Shinkai, including Hindi-language dubs of Your Name, Weathering with You, and Suzume.

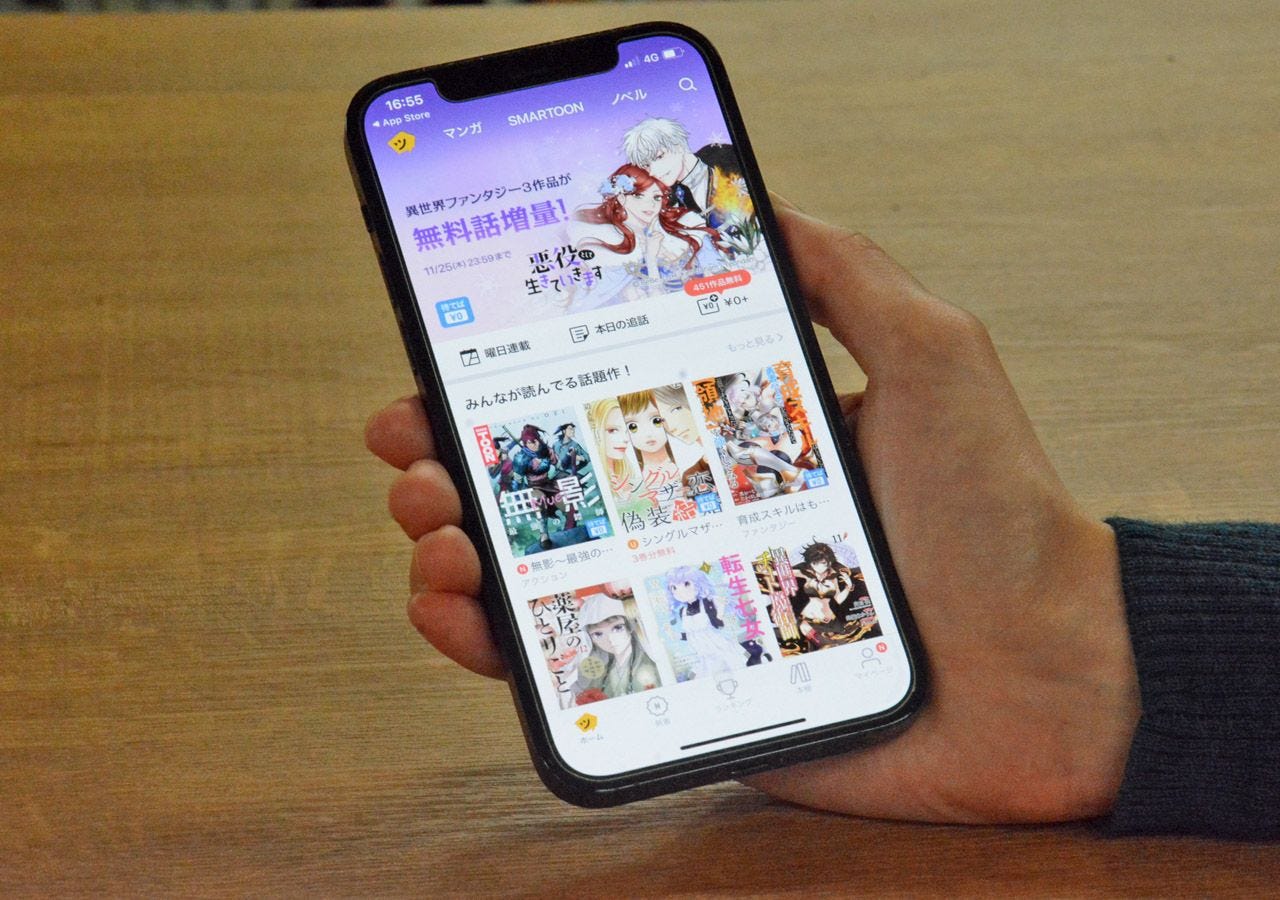

New app store law could benefit digital manga market

Japan’s digital manga market stands to benefit from a mobile app store antitrust law starting Monday that allows developers to sidestep Apple’s and Google’s 15–30 percent app store fees by directing users to their own websites to make purchases.

Why it matters: Promoting off-app payments could allow digital manga platforms to keep more revenue from users amid slowing growth as a result of the digital manga market reaching maturity.

The law is already expected to boost the average operating profit of mobile gaming companies like Bandai Namco and CyberAgent by as much as 6 percent, the Nikkei financial newspaper reports.

By the numbers: Japan’s 50 highest-earning mobile apps for reading manga earned a cumulative ¥200 billion (US$1.3 billion) in revenue in 2024, according to estimates by entertainment researcher Atsuo Nakayama based on data from mobile analytics firms Sensor Tower and AppMagic.

These mobile apps, whose primary business model is the sale of points or coins that users can spend to purchase newly published manga chapters, stand apart from web-based platforms that sell digital manga.

“In Japan, the players in the [manga] application market and mobile web market are very different from one another,” Sinbae Kim, chief growth officer at LINE Digital Frontier, operator of the LINE Manga mobile app, told Animenomics in July.

Yes, but: Developers that choose to support off-app payments would need to spend additional money to develop and promote a web store and build relationships with payment processors.

They would also be responsible for user data storage and security according to Japan’s information security regulations.

Friction point: Three out of five Japanese mobile app users surveyed by mobile app marketing firm Repro say they aren’t aware of off-app payments, potentially creating a substantial adoption hurdle for manga app developers.

While more than half of survey respondents would be interested in using off-app payments because of the potential cost savings, the same ratio of respondents is concerned about data security when making purchases outside apps.

Japan sees an excess of secondhand anime merchandise

Japan faces a glut of anime merchandise from the convergence in anime’s production boom and the surge of the oshikatsu economy, leading to excess stock at secondhand anime merchandise stores.

Driving the story: Last month, the Osaka branch of the K-Books chain of used goods stores specializing in anime and manga merchandise said it would stop purchases and sales of secondhand items for more than a dozen anime and video game properties.

The list includes titles like The Quintessential Quintuplets, My Dress-Up Darling, and Blue Archive, which comes as a surprise since many of these have become popular only within the last five years.

What’s happening: Anime merchandise, which was once sold only in specialty stores, can now be found in convenience stores, pop-up stores, ¥100 shops, and more retail outlets, the Daily Shincho news outlet reports.

Acrylic plates printed with anime characters, priced affordably in the ¥1,000–2,000 (US$6–13) range, have also grown in popularity over the last decade, leading manufacturers to produce them abundantly.

Products sold in blind boxes or randomly through lottery have also grown in number, leading to increased sales to secondhand stores by consumers who end up receiving a product they aren’t interested in.

Zoom out: With more than 300 individual anime titles aired every year, the lifecycle of the average anime series is also becoming shorter, making it more difficult to keep up audience interest before they move on to character merchandise for the next property.

What we’re watching: Japanese households have amassed a cumulative ¥91 trillion (US$585 billion) in used goods, 22 percent of which are hobby and leisure products, according to a survey by e-commerce giant Mercari.

Seeing the situation as an opportunity to redistribute supply, Mercari earlier this year launched a mobile app that lets consumers abroad buy products like anime merchandise that are listed on its domestic secondhand goods marketplace.

Mercari’s app launched first in Taiwan and Hong Kong and plans to launch in the United States in the spring of 2026.

Clippings: ‘Demon Slayer: Infinity Castle’ ends China run

Demon Slayer: Infinity Castle’s first anime film ended its planned theatrical run in China last week amid political tensions between Tokyo and Beijing, earning a total of CN¥677 million (US$96 million) in 28 days. (Kyodo News via The Mainichi)

Infinity Castle’s box office earnings make it the third highest-grossing anime film ever released in China, after Suzume and Your Name.

Voice actor agency 81 Produce and speech synthesis technology firm ElevenLabs are partnering on an effort to convert anime and other Japanese-language programs into other languages with permission from rightsholders. (ITmedia)

Osaka-based Round One’s gaming arcades with anime-related prizes are bringing new life to empty shopping malls in the United States. Profit margin of the company’s U.S. business exceeds that of the domestic Japanese business. (Nikkei Asia)

NTT Solmare’s MangaPlaza digital manga service in North America is entering print publishing with three original romance titles from its Japanese imprint C’moA Comics, to be printed and distributed by printing giant Dai Nippon Printing. (Press release)

Backgrounder: As previously reported by Animenomics, MangaPlaza serves a predominantly female audience, and the move signals NTT Solmare’s growing confidence in the demand for female-oriented manga in print in the United States.

TV Asahi screened its Indo-Japanese joint production of Obocchama-kun in Japan for the first time last weekend at the inaugural Aichi Nagoya International Animation Film Festival. (Mantanweb)

Singapore and Malaysia are cracking down on undeclared imports of Pokémon cards that exceed air travelers’ duty-free allowance limits as the value of the trading cards surges worldwide. (South China Morning Post)

Toho CEO touts vertical integration in anime as strength

“Compared to other sectors, anime and IP are currently growth areas within the entertainment industry. We also want to focus our efforts there, so we’re receiving quite a few [merger and acquisition] proposals from those areas and are actively considering them. However, it isn’t to the extent that we feel it absolutely has to be this particular company or that this specific area is lacking in our company. We’re actually looking at things quite broadly.”

— Hiroyasu Matsuoka, Toho chief executive officer

Context: Matsuoka, in an interview with business media outlet Pivot, recognizes that a business like Toho is rare around the world because not many countries allow vertical integration across film production, distribution, and exhibition.

What he’s saying: He considers Toho’s integrated approach to IP as its strength, allowing the company to adapt Spy × Family (whose anime adaptation it funded) and Spirited Away (whose film it distributes) into stage productions.

“More and more people are learning what we can do with an integrated approach and are considering teaming up with Toho,” Matsuoka said. “As a result, I think Toho’s presence in the anime industry is gradually becoming more apparent.”

What’s next: Toho is also moving into merchandising, this week establishing a 60–40 joint venture with character figurine maker Good Smile Company, giving the company the ability to develop, make, and distribute products from its own anime IPs.

Animenomics is an independently run and reader-supported publication. If you enjoyed this newsletter, consider sharing it with others.

This is incredable how regulatory shifts can unlock new distribution models! The 15-30% fee bypass could fundamentally reshape manga app economics, especially for platforms already struggling with margins. Whats interesting is how this might incentivise Japan's digital manga market after the recant slowdown, giving developers more flexibility to innovate on pricing and user acquisition strategies.