New anime merchandise licenses retreat

Plus: Anime tourism participants double in number; Record companies ink anime music partnership; Toho invests in anime mobile games; and more

This is your weekly Animenomics briefing, covering the business of anime and manga. Today is Wednesday, December 18, 2024.

In case you missed it: International anime co-production The Lord of the Rings: The War of the Rohirrim earned US$4.6 million on opening weekend in the United States, against a budget of US$30 million.

Anime merchandise contract volume declined in 2023

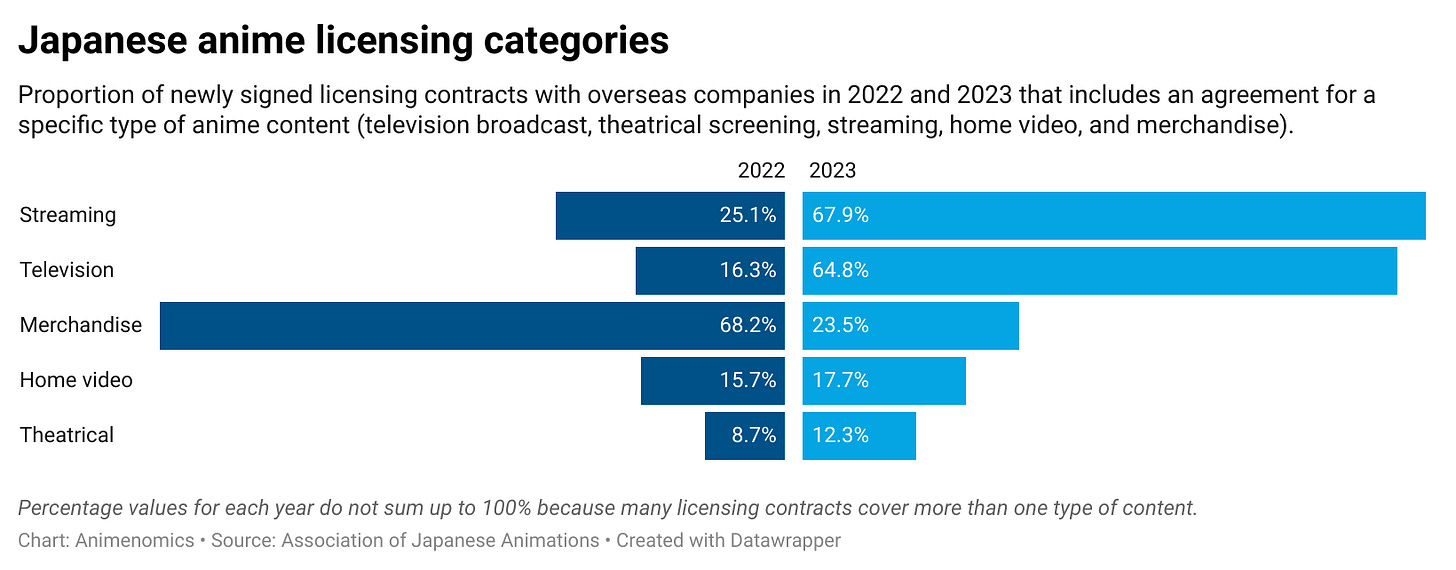

Japan’s anime industry saw overseas licensees shift from merchandise contracts to content-based ones last year in the aftermath of COVID-19 pandemic, according to the latest Association of Japanese Animations anime industry report published Friday.

Why it matters: Anime video content took up a higher ratio of new license contracts in 2023, signaling the return of a more traditional screen-to-shelf business model that prioritizes screened anime before merchandise becomes available.

Rewind: Last year’s report found that pent-up retail demand from people watching more anime at home during the pandemic drove a surge in merchandise deals in 2022.

By the numbers: Three out of four new licenses for anime video content included a digital distribution option, reinforcing streaming video’s position as the most popular viewing format for anime outside Japan.

Licensees executed 90 percent of streaming video contracts but only 32 percent of home video contracts.

Out of 52 anime planning and production companies surveyed in the report, 22 shared overseas revenue and contract details with the authors.

Zoom out: Deals exclusively for merchandise accounted for only 7.5 percent of new licensing contracts last year, down sharply from 66 percent of new contracts in 2022.

The average licensing contract lasts for three to five years, so we may not see the next merchandise surge for another couple of years if and when post-pandemic licenses are renewed.

What we’re watching: Authors of the AJA report think increased awareness of anime through streaming platforms abroad will drive even bigger sales of merchandise and other products later.

Anime tourism participants double pre-pandemic levels

The number of foreign tourists who visit locations in Japan that are featured in anime and films is poised to double this year compared to pre-pandemic levels, according to surveys conducted by the Japan Tourism Agency.

Why it matters: Some locales remain concerned about overtourism as foreign fans of Japanese anime and films flock to so-called pilgrimage sites.

Yes, but: Despite more fan tourists, anime remains a niche product in tourism, says the Association of Japanese Animations in its annual anime industry report.

What’s happening: Quarterly surveys done by the Japan Tourism Agency found that the share of foreign visitors who visited locations featured in anime and films this year was 8.7 percent over the January–March period and 8 percent over April–June.

Japan National Tourism Organization officials said in July that a record 35 million foreign arrivals is expected by the end of the year.

If the trend holds, as many as 3 million fan tourists could visit anime and film locations this year, double the 1.47 million in 2019, about 4.6 percent of foreign visitors that year.

On the ground: Promoting anime tourism at scale in order to disperse visitors across the dozens of anime pilgrimage sites around the country remains a difficult task, says the AJA report.

Each region around the country has different marketing needs to make their destinations attractive to foreign tourists.

An event celebrating the 2013 Nagi-Asu: A Lull in the Sea anime in Mie Prefecture in January managed to draw a small percentage of foreign visitors despite only promoting it starting one month prior.

What’s next: The Anime Tourism Association won a ¥61 million (US$400,000) contract from the government earlier this year to survey overseas anime and manga fans.

The goal of the survey is to present local governments and travel agencies with data on anime and manga fans’ interest in different aspects of Japanese culture.

Clippings: Record companies form anime music alliance

Warner Music Japan will manage digital distribution of NBCUniversal Entertainment Japan’s anime music catalog and see its artists perform theme songs for anime made by NBCUJ in a strategic partnership between the two record companies. (Press release)

Japan’s largest crowdfunding platform Campfire is partnering with anime news website Anime! Anime! to provide planning and promotional assistance for anime crowdfunding projects at a 25 percent commission rate. (Press release)

A shortage of capital at anime studios has driven an increase in the number of anime crowdfunding projects since 2012 as an alternative source of production finance, according to a study published last year in the Journal of Anime and Manga Studies.

A digital manga magazine by Kadokawa and digital manga platform operator Kakao Piccoma aims to draw 3 million to 5 million monthly readers and generate between ¥3 billion and ¥5 billion (US$19.5 million and US$32.5 million) in annual sales. (The Nikkei)

Anime retailer Animate is seeing high foot traffic and sales in its stores in mainland China. The retailer moved its flagship Shanghai store downtown last year and opened its fifth store last month in Chengdu. (TV Asahi)

Toho tackles anime production costs, profit bottlenecks

“Anime is a global content and the most effective promotion tool in the IP business. As a result, the number of productions in the industry as a whole is steadily increasing, leading to a chronic shortage of talent and soaring production costs, and there is an urgent need to improve the production system. Expanding the business to a size that can recoup the soaring production costs will create a healthy cycle of growth in the industry.”

— Keiji Ota, Toho managing executive officer, head of anime group

Context: Japanese film production giant Toho is tackling rising costs in its burgeoning anime business by eliminating production bottlenecks and striving for economies of scale, Ota says in an interview published in the company’s latest integrated report.

Cumulative operating profit in Toho’s anime business for the two-year period ending in February 2024 stood at ¥10 billion (US$65 million), more than triple the figure from the previous two-year period.

Toho boosts investments in anime-based mobile games

Toho, in a multi-pronged strategy to further grow its anime business that has included acquisitions of anime studios and distributors, is looking to adapt more anime titles in the company’s portfolio into mobile games.

Why it matters: Revenues from anime, media mix, and IP-based mobile games in Japan stood at ¥548 billion (US$3.57 billion) in 2023, according to a survey conducted by the Association of Japanese Animations.

This figure accounts for one-quarter of Japan’s video game industry revenues and about one-third of revenues from all mobile games domestically.

Driving the story: Toho reported in the first ever overview of its anime business for investors last week that the mobile game Jujutsu Kaisen: Phantom Parade has passed 15 million downloads after a global version launched in November.

It also announced earlier this year the production of a Kaiju No. 8 video game for mobile devices and PC after the first season of the anime ended broadcast.

What they’re saying: Toho believes the video game titles will help drive merchandise sales and also lead to more anime films.

Toho established in 2021 a video game publishing arm that has since published a number of games for its flagship Godzilla property.

The bigger picture: In an analysis of the top 200 mobile games by annual revenue in 10 foreign markets, the AJA found that games based on anime or manga made up the vast majority of non-evergreen titles.

Authors of the report concluded from this data that anime remains an effective way to increase awareness of mobile games.

The bottom line: With Toho funding 10 seasons’ worth of anime on average per year, expect to see more mobile games from its anime properties to boost the company’s profits.

Animenomics is an independently-run and reader-supported publication. If you enjoyed this newsletter, consider sharing it with others.

While you and many of your readers are probably already familiar with this place, I live relatively close to the giant dam that appears in Shingeki no Kyojin. By downloading an app, it's possible to recreate some of the scenes from the anime using AR. Located in Hita, Oita Prefecture down in Kyushu, it's a bit off the beaten path, but well worth a visit. More sites in Japan should try using AR to attract anime tourism.