Manga captures 90% of Japan e-book market

Plus: Kadokawa signs manga joint venture deal in France; Anime production budgets need more transparency; Shibuya catches anime culture wave; and more

This is your weekly Animenomics briefing, covering the business of anime and manga. Today is Wednesday, January 31, 2024.

In case you missed it: Japanese public broadcaster NHK aired a feature program on its international service over the weekend that highlights the anime industry’s male idol anime boom.

Digital manga grows to 2nd-largest publishing segment

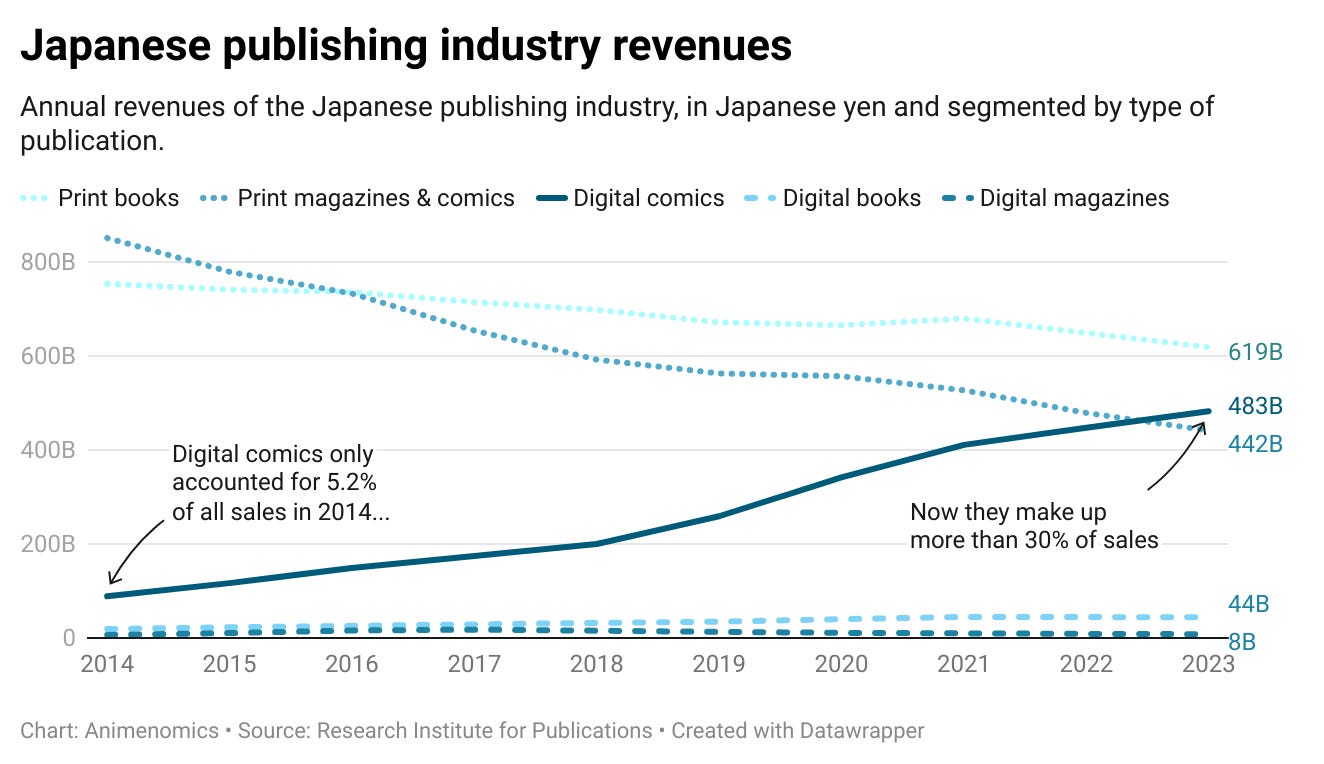

For the second year in a row, digital manga was Japan’s only publishing segment that saw growth year-over-year, according to the latest annual data published by the Research Institute for Publications.

Why it matters: Digital manga now account for 30 percent of all publication sales in Japan, and the category has become the publishing industry’s second-largest market segment.

By the numbers: Sales of digital manga climbed 7.8 percent in 2023 over the prior year to ¥483 billion (US$3.3 billion).

Digital manga now control a 90-percent share of the digital publishing market thanks to aggressive advertising and sales tactics by sellers.

Overall publishing industry revenues fell 2.1 percent to just under ¥1.6 trillion (US$10.8 billion), the second year in row that the market has shrunk.

The other side: Print manga sales volume declined approximately 10 percent despite a number of popular anime adaptation of manga titles.

Sales of webtoons (vertically-scrolling digital manga) are performing well, along with digital sales of light novels, though no specific numbers were immediately provided by the Research Institute for Publications.

What we’re watching: A more detailed sales breakdown for the manga category will be released in late April.

Joint venture to grow Kadokawa’s manga biz in France

Éditions Dupuis, one of Europe’s largest publishers of Franco-Belgian comics, has signed a joint venture agreement with publishing conglomerate Kadokawa to distribute manga and light novels in French-speaking markets.

Why it matters: France is one of manga’s biggest markets outside Japan, and sales of manga now account for more than half of the French comic book market.

How it happened: Dupuis is one of the oldest Franco-Belgian comics publishers, but it has previously lagged rivals in the local manga market, the Libération newspaper reports.

Dupuis’s manga label Vega has no popular licenses, while rivals like Kana has Naruto, Glénat has Dragon Ball, and Ki-oon has My Hero Academia.

Kadokawa, which lags rivals Shogakukan and Shueisha in Europe, intends to grow the partnership to also operate a digital manga and novel platform, according to Tadashi Sudo of the Animation Business Journal.

Between the lines: Dupuis editorial director Stéphane Beaujean told Libération that French manga publishers have been overly reliant on print licenses and are ill-prepared for the growing consumer demand for digital manga.

Shueisha launched the MANGA Plus app in France in 2021 and is now selling titles like One Piece, Jujutsu Kaisen, and Dragon Ball directly to readers at lower price points than French print editions.

Beaujean, who is also former artistic director of the Angoulême International Comics Festival, said the deal gives Dupuis privileged access to Kadokawa’s catalog and protects it from Japanese manga publishers that choose to bypass French intermediaries.

Clippings: KyoAni regains footing after arson attack

Kyoto Animation’s employee headcount has returned to 2019 levels. An arson attack on one its studio buildings that year killed or injured 40 percent of staff members. (Kyodo News)

Convicted arsonist Shinji Aoba accepted a death penalty judgment handed down last week but told The Asahi Shimbun that he is appealing the case to continue sharing his experience with mental illness “as lessons for others”.

Crunchyroll and Funimation told North American anime retailers last week that distribution of the combined company’s home video titles will be moved to Sony Pictures Home Entertainment starting in March. (Robert’s Anime Corner Store)

“This move will serve to tighten up [Sony’s] control over their downstream distribution, marketing, and dealer network. And, it will give them more power to build a wider moat around their ‘newly acquired’ e-tailer division,” Anime Corner Store owner Robert Brown Jr. wrote in a company newsletter.

Former Netflix head of anime Rob Pereyda launched a management consulting practice for the anime industry. Before Netflix, he created the revenue-sharing model that transformed Crunchyroll as an anime streamer. (Anime News Network)

Film studio Shochiku and private broadcaster TBS are teaming up on anime IP development and co-production. The two will also establish an anime theater and event business to capitalize on the growing live events market. (Animation Business Journal)

Anime veteran calls for transparent production budgets

“It’s also bad practice that corporations and creators are completely separated from one another. Series directors and animation directors are never shown the total budget of their work. I’ve been doing this work for 40 years, and while I’ve heard pieces of the overall budget when I worked at Studio Junio, I’ve never seen a breakdown. How is a budget plan for anime made? Someone please tell me.”

— Shigeo Akahori, animation director

Context: Entertainment business expert Atsuo Nakayama interviewed Akahori to discuss an entertainment industry policy proposal created by the Japan Business Federation (or Keidanren) last year in the context of the anime industry.

Akahori, a 40-year animation veteran, wants corporate executives of planning companies to be more transparent when making anime production budgets.

Planning companies often give anime studios no room to negotiate a budget or royalty payments while expecting high-quality work in a short amount of time.

Between the lines: Akahori believes the trend of planners commissioning high-quality adapted works is changing the makeup of the anime talent pool.

“In the past, there was a wide range of creative freedom when it came to creating works based on manga, but now it’s important for manga adaptations to be faithful to the original work, so people who are more like craftsmen than creators are now in demand,” said Akahori.

Fashion hub Shibuya catches wave of anime culture

Anime’s growing presence in Shibuya is challenging the Tokyo district’s identity as the epicenter of indie pop and youth fashion, and blurring the line between its microculture and that of Akihabara, the center of anime fan culture.

Why it matters: Anime merchandise is popping up all over Shibuya and the rest of Japan as the anime retail market grows, writes Ken Motoki for the Real Sound news website.

Driving the story: The iconic Tsutaya book and video rental store at the heart of Shibuya is reopening on April 25 after it closed for remodeling last October.

Renovations have transformed the store’s main floor and two basement floors into space dedicated to high-end anime and music merchandise.

Shibuya Tsutaya’s upper floors will feature experiential entertainment with content from Japan’s leading entertainment IPs.

Zoom out: Kyoto, which is experiencing an influx of foreign tourists, has also seen increased foot traffic at anime specialty stores, says Motoki.

Animate’s retail branch in the Avanti Kyoto shopping center will become one of the country’s largest anime stores when it finishes expansion in March.

Kyoto Animation opened a merchandise store at Kyoto Station last year, and Tokyo-based secondhand retailer Mandarake is also opening a pop-up branch.

The bigger picture: Sales of anime merchandise in Japan are at their highest levels in a decade, reaching ¥669 billion (US$4.5 billion) in 2022, according to data compiled by the Association of Japanese Animations.

One-fifth of merchandise sales now come from titles traditionally aimed at hardcore anime fans, a share that has grown over the years as even casual fans are watching more anime.

Animenomics is an independently-run and reader-supported publication. If you enjoyed this newsletter, consider sharing it with others.