Light novel publisher Overlap readies for IPO

Plus: Manga publishers' licensing rights sales jump; Nagoya jeweler expands anime IP collaborations; Weekly Shonen Jump searches for next hit sports manga; and more

This is your weekly Animenomics briefing, covering the business of anime and manga. Today is Wednesday, September 3, 2025.

For your information: Animenomics will present a primer on how the anime industry works as part of Anime Lockdown’s online-only programming—streamed on Twitch—on Sunday, September 7, at 2:30 p.m. United States Eastern Time.

Overlap IPO signals confidence in light novel market

Tokyo-based light novel and manga publisher Overlap has received approval to offer 40 percent of its holding company’s shares on the Tokyo Stock Exchange beginning in October.

Why it matters: Overlap’s initial public offering is a sign of optimism in the market for Japan’s digital-first light novels—fantasy titles first serialized online on web novel platforms that gave birth to the isekai genre boom like Shōsetsuka ni Narō.

Catch up quick: Overlap president Katsuharu Nagata founded the company in 2012 after his then-employer, longtime light novel publisher Media Factory, was acquired by publishing giant Kadokawa.

Nippon Investment Company, which invested in Overlap in 2022 and whose funds today control more than 59 percent of the company’s shares, is relinquishing part of its stake as part of the stock listing.

The first anime adaptation of an Overlap light novel title aired in 2019, and since then the pace of adaptations increased, with six new anime based on in-house IPs launched in 2024.

Overlap also publishes Pokémon video game strategy guides and soundtrack CDs, thanks to a relationship between Nagata and The Pokémon Company that dates back to his time at Media Factory.

By the numbers: Overlap’s consolidated revenue for the fiscal year ending in August 2024 totaled ¥8.4 billion (US$56.9 million), an 8 percent increase over the prior fiscal year, according to the company’s securities report submitted for the listing application.

Among light novel and manga titles whose rights are owned by the company, digital sales made up 78 percent of total publishing revenue.

Three-quarters of the Overlap’s revenue come from about five dozen titles (and growing) that generate more than ¥25 million (US$170,000) a year.

The group’s operating profit grew nearly 44 percent year-over-year in the nine months through May 2025, and net profit more than doubled.

The bigger picture: Overlap’s strategy of adapting light novel titles into manga and then into anime reinforces current trends in anime production.

Animenomics found that the proportion of television anime series based on light novel titles has doubled in the last decade, according to an analysis of Association of Japanese Animations anime production data.

Top manga publishers see jump in rights licensing sales

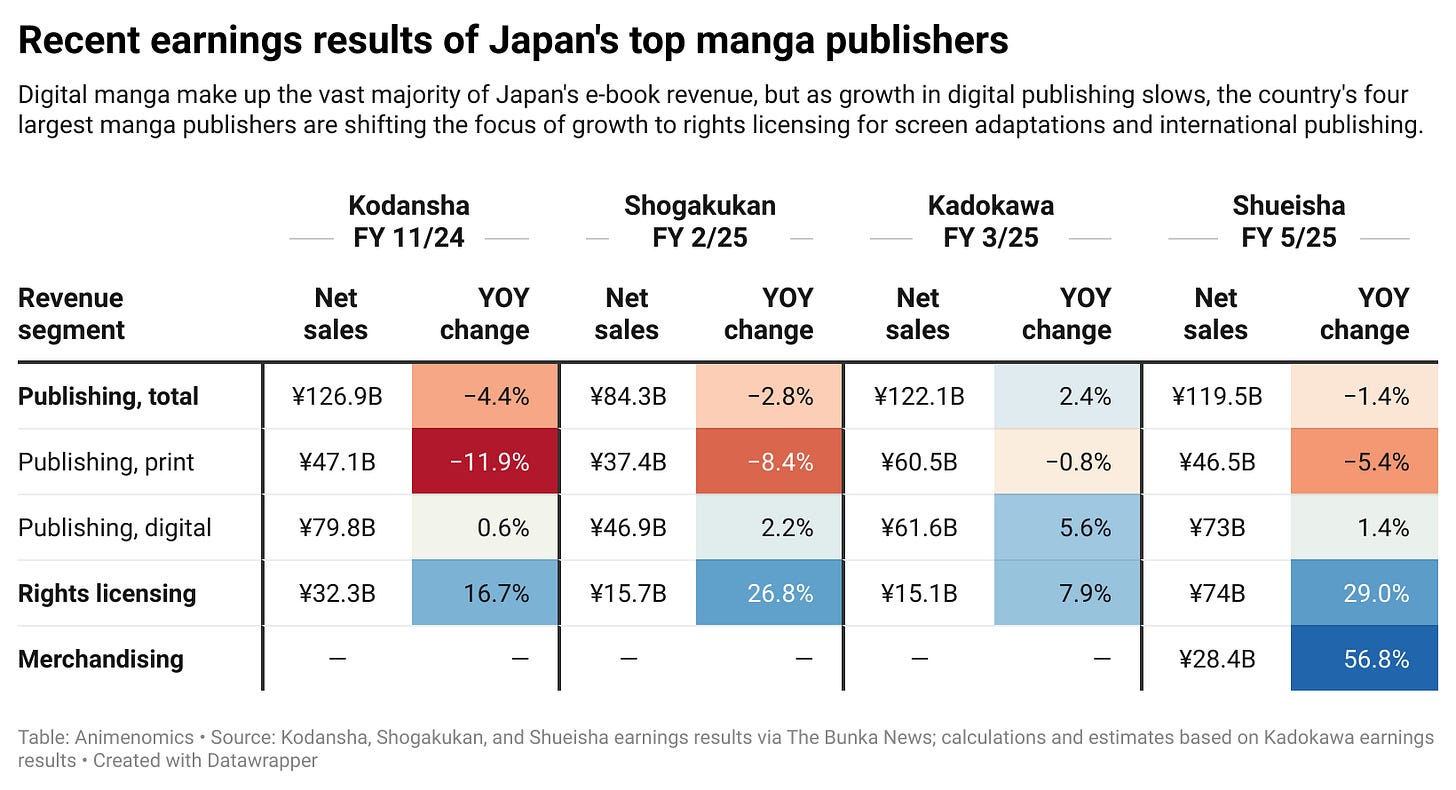

Japan’s largest manga publishers are reporting rapid growth in rights licensing sales in their earnings results, helping offset revenue declines caused by a slowdown in digital manga and e-book sales.

Driving the story: Manga publishing giant Shueisha last week reported a 29 percent jump in rights licensing sales—to nearly ¥74 billion (US$498 million)—for the most recent fiscal year ended in May.

Why it matters: A stagnating manga publishing market means anime and live-action adaptations and exports to overseas licensees become more important to publishers’ bottom lines.

As previously reported by Animenomics, publishers whose manga titles are made into anime have already raised royalty fees in recent years.

Zoom out: Growth in rights licensing also correlates with the growing proportion of television anime based on manga titles.

Animenomics analyzed Association of Japanese Animations anime production data and found that adaptations of manga make up about 45 percent of anime serials today, up from a 35 percent annual average a decade ago.

What we’re watching: Manga publishers and distributors are also opening digital manga stores abroad and making more titles available to international licensees in a race to find new revenue sources.

Nearly half of Kodansha’s rights licensing sales last fiscal year came from abroad, and Kadokawa saw a 23.8 percent growth in international publishing sales last fiscal year.

Clippings: Nagoya jeweler to expand anime IP collabs

Custom-made jewelry based on anime and entertainment IP characters is a growing business segment at K.Uno, with the Nagoya-based jeweler aiming to double IP-related sales to ¥10 billion (US$67 million) within the next five years. (The Nikkei)

Sales within the company’s line of IP-based products, such as miniature gold figures of Godzilla and engagement rings featuring Pokémon characters, have more than doubled in the six months ending in March compared to last year.

Anime merchandise vendors in the United States are starting to feel the effects of the country’s tariffs on imported products and the end of the de minimis exemption for low-value imports. (Kyodo via The Mainichi)

Avex-owned Anime Times was a lead sponsor of Anime India, India’s first dedicated convention for anime fans and businesses, last month. Organized by local news outlet AnimationXpress, the event drew 29,000 visitors. (Press release)

Tokyo-based software testing firm Shift has become an unlikely business partner for Bahraini broadcasters seeking to bring licensed anime and manga content into the country. (Nikkei xTrend)

Gaudiy envisions IP-centric platforms for anime, games

“More than 99 percent of MyAnimeList users are from overseas. As a platform that disseminates Japan’s renowned content, we collect information on what overseas audiences enjoy and what products they desire, creating and delivering precisely what is already in demand globally.”

— Yuya Ishikawa, Gaudiy chief executive officer

Context: Ishikawa spoke with business magazine Toyo Keizai about the goals of his company’s acquisition of anime and manga fan community website MyAnimeList and recent investments by Sony and Bandai Namco in Gaudiy.

What he’s saying: “We believe that by combining fandom [groups of passionate fans and the culture that arises from them], entertainment, IP, and the latest technology, we may be able to realize our ideal society,” Ishikawa explained.

With the help of data from MyAnimeList, he envisions IP-centric platforms that can simultaneously deliver multiple services like games, videos, and music rather can having service-centric ones hosting content from multiple IPs.

Weekly Shonen Jump chases its next hit sports manga

Over a period of four weeks in June and July, Shueisha’s Weekly Shonen Jump manga anthology launched three new sports titles, replenishing the magazine’s sports manga offerings for the first time in months.

Why it matters: Weekly Shonen Jump has a long history of giving birth to popular sports manga like Slam Dunk, Kuroko’s Basketball, Haikyu!!, but observers say such long-running sports-centric titles have been absent from the magazine for some time.

What’s happening: “Jump often starts multiple titles at once,” says an editor of the Comic Natalie news portal. “However, out of the four titles this time, three—Harukaze Mound, Ekiden Bros, and Ping-Pong Peril—are sports manga, which I think is quite rare.”

In the two years prior to launching these three titles, the magazine has started five different sports titles, but they all ended serialization after just a few months.

Zoom in: Blue Box, whose protagonists are student athletes, has run in the magazine since 2021, but it’s considered by many manga critics as primarily a school romance story than a sports-centered one.

The bigger picture: Weekly Shonen Jump’s search for the next hit sports manga comes as sports teams around the world are also exploring manga collaborations to bring in new audiences.

Animenomics is an independently run and reader-supported publication. If you enjoyed this newsletter, consider sharing it with others.