Labor deficit muddles anime studio financials

Plus: Anime studios shift foreign transactions to new markets; Japan's SVOD leader publishes novels, targets adaptations; Webtoon apps pivot to short videos; and more

This is your weekly Animenomics briefing, covering the business of anime and manga. Today is Wednesday, August 20, 2025.

In case you missed it: Current import tariffs by the United States have reduced the operating profit of Bandai Namco’s toys and hobby business by an estimated ¥1 billion (US$6.8 million) in the April–June fiscal quarter, the company said in response to a question posed at its quarterly earnings presentation earlier this month.

The company estimates that the impact of U.S. tariffs on operating profit for the first half of the fiscal year could be up to ¥3 billion (US$20.3 million).

Anime labor shortage complicates studio bottom lines

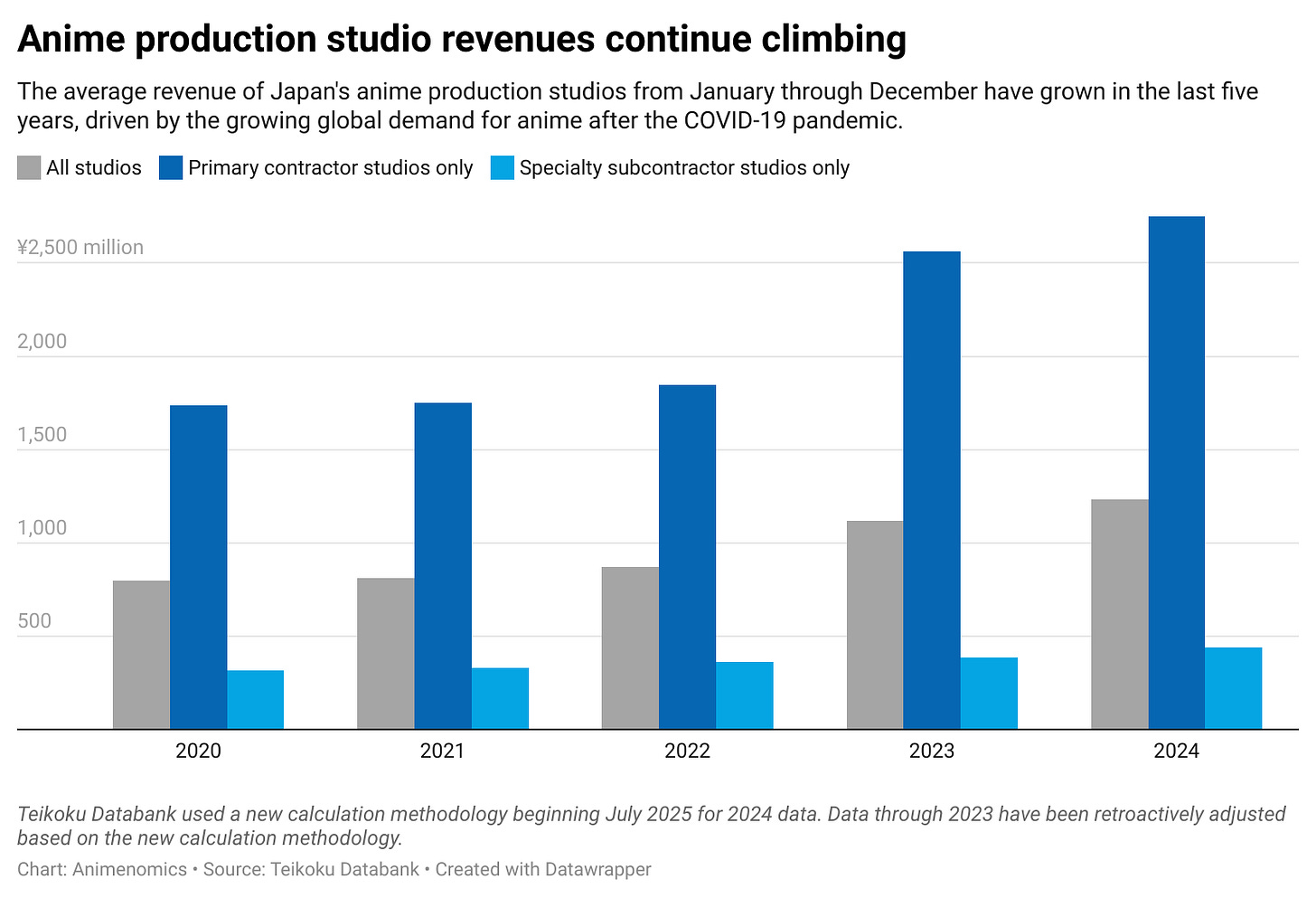

Japan’s ongoing anime labor shortage is creating a mixed fiscal picture for production studios even as their average annual revenue edged up last year, an annual analysis of corporate data by credit reporting agency Teikoku Databank found.

Why it matters: As Japan seeks to quadruple anime exports by 2033, “labor issues among animators could become a high-risk factor that hinders growth in the future,” writes Teikoku Databank researcher Daisuke Iijima, the report’s author.

By the numbers: Primary contractor anime studios’ average annual revenue climbed more than 7 percent last year to ¥2.75 billion (US$18.6 million) thanks to continuing strong demand for anime productions and licensed IPs.

Among subcontractor anime studios, average annual revenue jumped 14 percent to ¥438 million (US$2.96 million), reaching its highest level since 2007, last seen at the end of the 2000s anime bubble.

Yes, but: The share of anime studios reporting higher revenues actually shrank in 2024, meaning growth is concentrated among the largest studios that are able to secure major anime productions.

Between the lines: The share of primary contractor studios reporting higher profits in their 2024 fiscal years shrank more than 13 points compared to the previous year to 40 percent due to pressure from higher production costs.

Primary contractor studios are more sensitive to the higher costs associated with labor shortages because those costs are often passed on to them by subcontractor studios.

Among specialty subcontractor studios, the share reporting higher profits rose more than 9 points thanks to the expansion of digital processes and an increase in more profitable projects from mobile game companies.

Anime studio overseas deals move out to new markets

Business transactions between Japanese anime studios and global streaming services and foreign animation studios continue to increase, but recent changes in anime’s global market are also causing a shift in the countries that studios do business with.

Why it matters: As anime’s overseas revenues overtake domestic revenues, anime studios’ fortunes are increasingly tied to global business and consumer trends.

By the numbers: Out of 177 anime studios surveyed by Teikoku Databank through July, 45.2 percent reported having done business transactions with foreign companies, up 4.4 percentage points since 2023.

Contracts with other countries in East and Southeast Asia have increased as more regional studios join the anime production process as subcontractors to Japanese studios.

Since 2023, the share of Japanese anime studios that conduct business with South Korean companies jumped 3.9 points to 10.2 percent.

Zoom in: The United States remain the most common country of origin of all foreign companies that Japanese anime studios conduct business with, but that share fell 4.5 points to 23.7 percent in the last two years.

Driving that decline is a decrease in the number of projects directly commissioned by U.S.-based global streaming companies like Netflix as they shift to a traditional licensing model.

China, which has long been a destination for animation work being outsourced from Japan, also saw its share of transactions fall 3.7 points to 14.7 percent as studios do more work with other countries in Asia.

Clippings: Japan SVOD leader starts IP publishing label

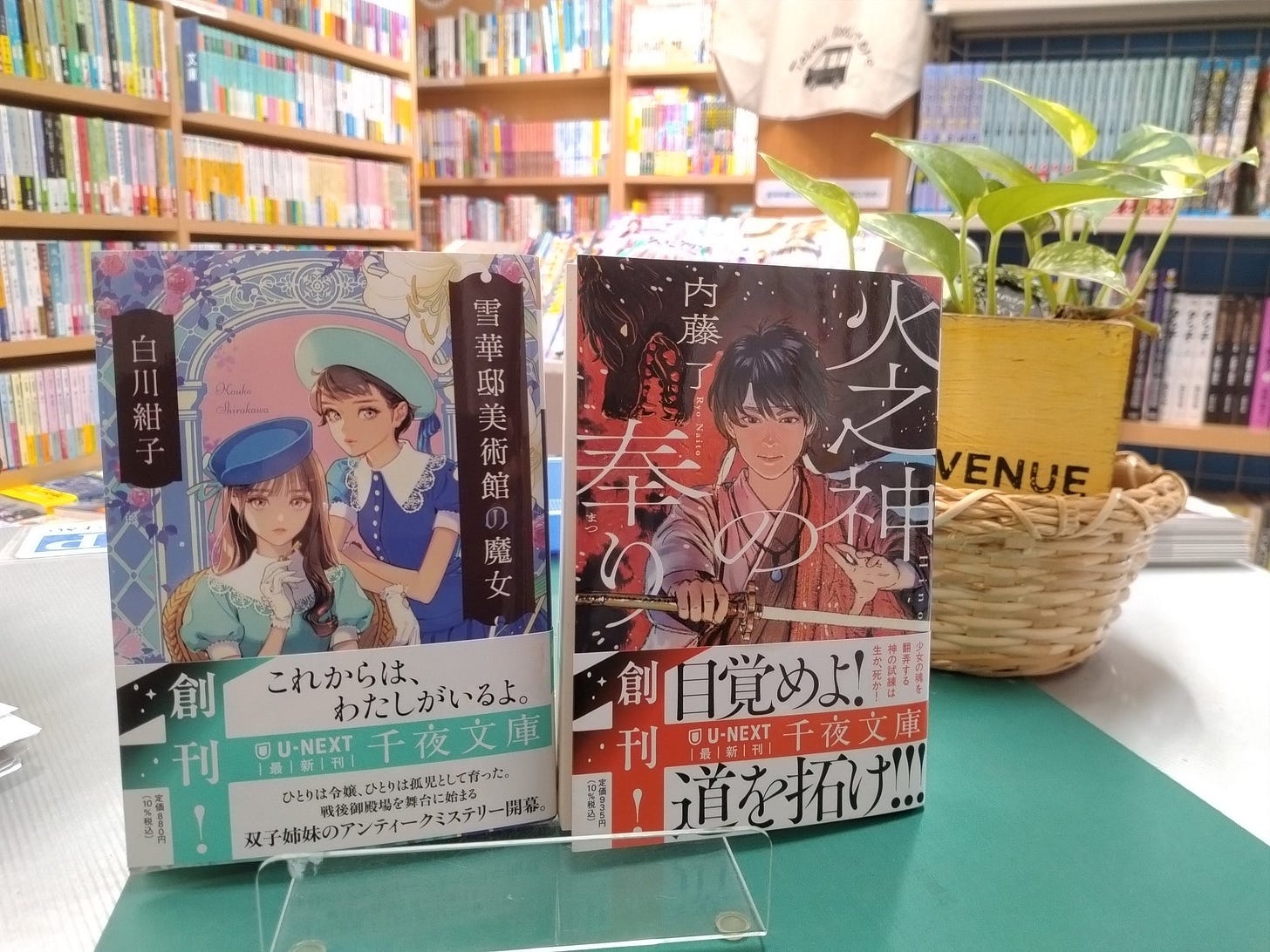

Streaming service U-NEXT, Japan’s domestic subscription video-on-demand leader, is launching a paperback entertainment fiction label named Senya Bunko and aims to adapt works under the label into live-action and anime productions. (The Bunka News)

How it happened: U-NEXT entered the e-book distribution business in 2019, and e-book originals publishing began in 2020. Both operations are led by Kodansha and Amazon Japan veteran Michael Staley.

Drama film Kokuho has become the first Japanese live-action film in 22 years to earn at least ¥10 billion (US$67.7 million) in the domestic box office and is only the country’s fourth live-action film to ever cross that earnings threshold. (The Nikkei)

The intrigue: The film, whose production committee is led by Sony-owned anime production company Aniplex, achieved the milestone thanks to fan-first publicity tactics commonly used by top-grossing anime films like Detective Conan.

Manga publisher Kodansha will distribute for free in the United States 30,000 copies of a special English-language edition of its Young Magazine men’s manga anthology in an effort to introduce rookie manga artists to U.S. readers. (The Asahi Shimbun)

An online vote for the most popular titles in the anthology will serve as a gauge for Kodansha to determine the needs and interests of U.S. manga readers for the seinen demographic.

Animation film Nobody by Shanghai Animation Film Studio has overtaken director Makoto Shinkai’s Suzume as the highest-grossing 2D animated film in Chinese box office history, earning more than CN¥1 billion (US$139 million) as of Monday. (South China Morning Post)

New York-based GKIDS is expanding its partnership with Warner Bros. Discovery’s HBO Max streaming platform to add 18 anime film titles in the United States from the GKIDS catalog of licensed titles. (Variety)

The Walt Disney Company has hired Netflix vice president and regional co-head for Asia Pacific Tony Zameczkowski as the general manager of its direct-to-consumer business in the same region. (The Hollywood Reporter)

New webtoons registrations fell 18 percent in the first half of the year compared to the same period in 2024, reinforcing a slowdown in South Korea’s webtoon market as key platforms shuttered operations. (Webtoon-ish)

‘GQuuuuuuX’ director wants to redefine robot anime

“I think [today’s younger generation] won’t understand the meaning of riding a robot. The generation that dreamed of motorcycles and cars is still alive and well, but in another 10 years, the Gundam series may not even survive. I’m reminded of the need to update the meaning of robots, something I felt while making the Evangelion series.”

— Kazuya Tsurumaki, Mobile Suit Gundam GQuuuuuuX anime director

Context: Tsurumaki, who grew up in 1970s Japan when robot anime television shows were abundant, told anime critic Ryota Fujitsu in an interview that he believes the robot anime genre needs to redefine itself to attract a new generation of viewers.

“Looking at current manga and anime, the protagonists more intuitively wield superpowers—magic and psychic abilities—that surpass the abilities of adults,” Tsurumaki observed.

Zoom out: Mobile Suit Gundam GQuuuuuuX’s popularity drove up Bandai Namco’s Gundam IP sales by 81 percent in the April–June fiscal quarter compared to the same period last year.

The series is the second in the Gundam franchise to feature a female protagonist as Bandai Namco seeks to draw a new generation of fans.

South Korea’s webtoon platforms pivot to short videos

South Korean internet giants Kakao and Naver are betting on new tools allowing users to create short-form animated videos in an effort to reverse declining readership and stagnant growth on their companies’ webtoon platforms.

Why it matters: As reported by Animenomics, Japanese business magazine Nikkei Trendy predicted last year that low-cost animation production tools adding motion to manga and webtoon panels would become a top consumer trend in 2025.

While so-called “light anime” are often shown on traditional broadcast channels in Japan, South Korea’s efforts focus on vertical videos for smartphone viewing.

What’s happening: Naver-controlled Webtoon Entertainment this week began uploading short-form videos for select titles on the English-language edition of its global Webtoon platform.

Next week, Naver’s domestic webtoon platform will launch a new service called Cuts that more broadly allows users to create new animated short-form videos and existing comics creators to animate their illustrations.

Catch up quick: Naver is playing catch-up to Kakao Entertainment, which in April launched an automated tool powered by artificial intelligence called Helix Shorts that creates animated shorts out of webtoon illustrations.

Kakao claims that Helix Shorts has shortened the average production time per video from three weeks to three hours and slashed average cost from ₩2 million (US$1,400) to ₩60,000 (US$40).

The bigger picture: Webtoon industry observers interviewed by The Korea Herald say webtoon platforms’ pivot into short videos is an attempt to lower barriers for new users while adapting to the very content formats that are taking away their audience.

An estimated 70.7 percent of South Koreans reported viewing short-form content online last year, according to a report by the Korea Communications Commission.

Animenomics is an independently run and reader-supported publication. If you enjoyed this newsletter, consider sharing it with others.