Kadokawa writes down Doga Kobo acquisition

Plus: Anime studio closures at highest level in 7 years; 'Demon Slayer: Infinity Castle' sets sights on China; Web novel platform upstart targets romance readers; and more

This is your weekly Animenomics briefing, covering the business of anime and manga. Today is Wednesday, November 12, 2025.

In case you missed it: Animate Girls Festival, a large-scale event centered on otome content—anime, manga, and video games aimed at women—drew a record 168,775 visitors to Tokyo’s Ikebukuro neighborhood last weekend.

Why it matters: The event, which is in its 16th year, is an annual demonstration of female fans’ buying power in Japan’s anime, manga, and video game fandom.

Japanese women spend an estimated 36 percent more on fan merchandise than men, according to a recent survey by marketing research firm GEM Partners.

Kadokawa writes down ¥3 billion Doga Kobo acquisition

Kadokawa is writing down last year’s nearly ¥3 billion (US$19.4 million) acquisition of Doga Kobo, the studio responsible for animating the hit anime series Oshi no Ko, the publishing giant told investors last week.

Why it matters: Kadokawa’s move reflects a broader challenge in the anime industry with calculating the value of studios that make anime but have no ownership stake in the intellectual property rights for those titles.

Catch up quick: Kadokawa said in an annual securities report filed in June that it paid a premium of nearly ¥2.9 billion (US$18.8 million) for Doga Kobo—reflecting expectations around the studio’s reputation, creative potential, and future earnings—but it’s now writing down that value by ¥2.7 billion (US$17.5 million).

What they’re saying: “This goodwill impairment recorded as an extraordinary loss does not indicate any concerns about the future of [Kadokawa’s] studio business,” the company assured analysts at its quarterly financial results presentation.

In choosing to continue to operate Doga Kobo as a subsidiary rather than closing it, Kadokawa signals a commitment to building sustainable studio economics.

“Our strategy is to increase profitability by centralizing indirect costs and non-creative expenses [across seven studios],” the company said during its financial results presentation.

Zoom in: Earlier this year, the publisher established an anime studio business division to improve operations in the group’s seven anime studios, Doga Kobo included.

“While leveraging each studio’s specialized strengths to enhance production capabilities, we are also streamlining management and back-office functions across all companies,” chief studio officer Takeshi Kikuchi said in an interview published in Kadokawa’s annual integrated report.

Kadokawa also plans to optimize the studios’ personnel management operations and bring in its education business to help with recruitment.

Anime studio closures reach highest level since 2018

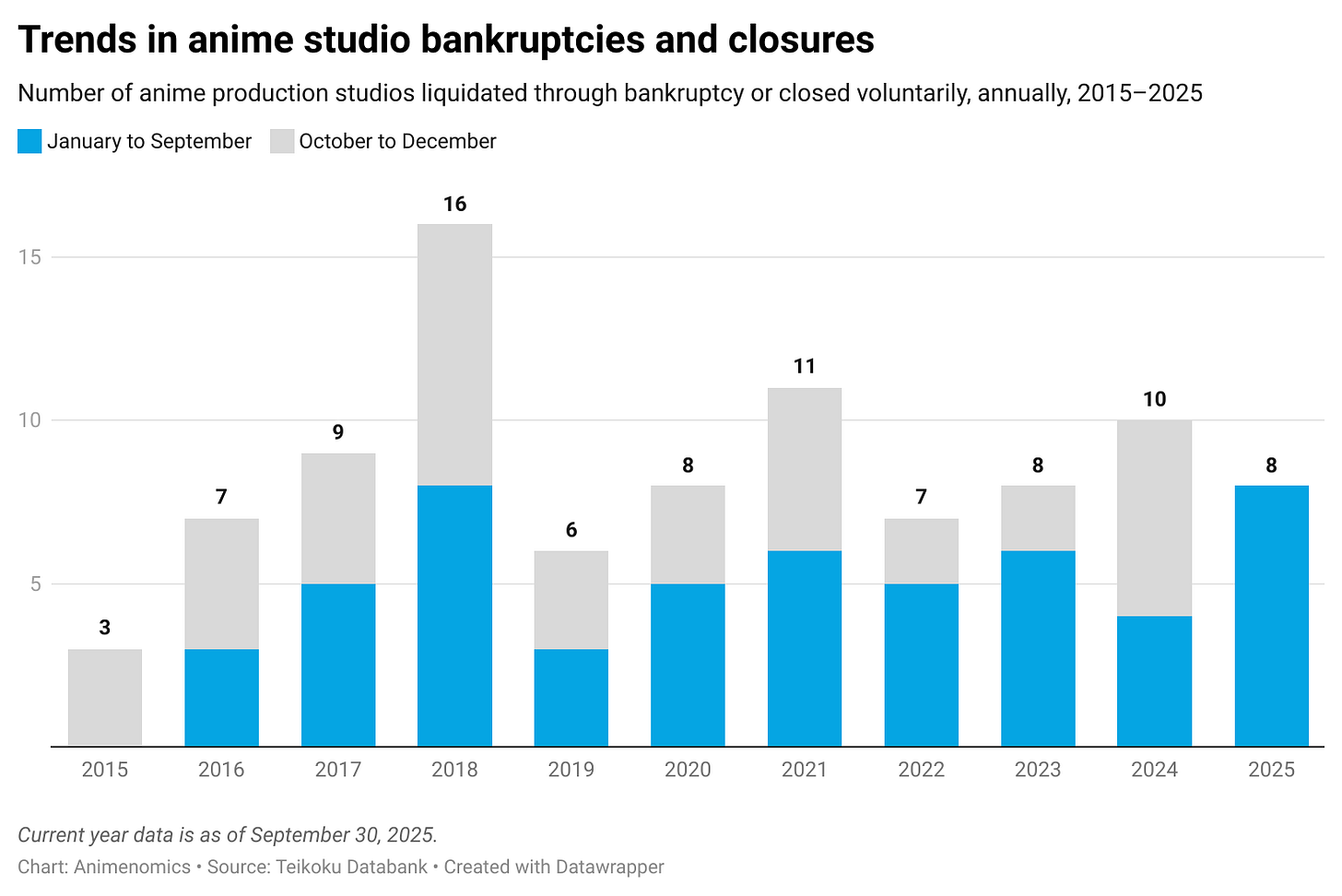

Japanese anime studio bankruptcies and closures for the first nine months of the year are at their highest level since 2018, according to an analysis of corporate data by the Teikoku Databank credit reporting agency.

Why it matters: Despite the anime market’s continued expansion, “production sites are falling into a state of ‘busyness without profits’, unable to pass on rising costs to prices,” writes Teikoku Databank researcher Daisuke Iijima, the report’s author.

Where things stand: More than three years have passed since the Japanese yen started rapidly depreciating against the United States dollar, putting pressure on anime studios that rely on foreign outsourced labor.

Because an anime can take three to four years to make from the time agreements with production partners are signed, there may be some anime productions today whose contracts are still based on exchange rates when the yen was stronger.

When producers hire anime studios as domestic primary contractors, these lead studios are paid in yen, and they become responsible for filling the gap in foreign labor expenses that are denominated in dollars.

The two primary contractor studios that became insolvent this year—Ekachi Epilka and Cloud Hearts—were known to rely heavily on outsourced labor.

Between the lines: Further analysis of 72 anime studios that have closed since 2016 found that about 70 percent were smaller studios that specialized in specific tasks, like in-between animation, coloring, and 3D CG production.

While these smaller studios primarily operate within the country, some domestic material and labor costs have also risen the past couple of years.

Some anime industry observers also point to Japan’s continued phasing out of consumption tax reporting exemptions for small businesses as a possible cause of specialty anime studios choosing to close voluntarily.

Clippings: ‘Demon Slayer: Infinity Castle’ opens in China

Demon Slayer: Infinity Castle’s first anime film arrives in cinemas in mainland China on Friday, where first-day ticket presales have already exceeded CN¥50 million (US$7 million). (Gamebiz)

If Infinity Castle earns more than CN¥807 million (US$113 million) over the course of its run, it will surpass Makoto Shinkai’s Suzume to become the highest-grossing Japanese anime film ever released in China.

Japanese entertainment companies are driving gains in profits in nonmanufacturing sectors for the six months ended in September, buoyed by low exposure to tariffs by the United States. (Nikkei Asia)

Four of the country’s five top commercial broadcasters also reported higher sales and profits thanks to strong sales of their programming IP portfolios abroad, the Nikkei financial newspaper reports.

Otaku USA magazine, the last remaining anime news magazine in North America, is moving to a twice-yearly publishing schedule, nearly two years after the periodical first switched from a bimonthly schedule to a quarterly one. (Anime News Network)

Kadokawa plans to appoint an executive officer to oversee manga and light novels separately from general publications after operating profit fell 94 percent year-over-year in the combined publishing business from April through September. (Otaku Lab)

Cool Japan Fund has invested US$10 million in Singapore-based apparel company Coolmate, which primarily operates and manufactures in Vietnam, to expand sales and development of merchandise that use anime and manga characters. (Press release)

Neopage targets Japanese romance web novel readers

Neopage, a web novel platform launched last year with a ¥3 billion (US$19.4 million) investment from a Hong Kong firm, is using its founder’s Chinese market expertise to develop emerging genres in Japan’s web novel market.

Why it matters: As previously reported by Animenomics, Japan’s web novel market is dominated by isekai fantasy titles where a protagonist is transported to or reborn in a fantasy world, crowding out other genres.

Many of these isekai fantasy web novels are acquired by Japanese publishers and are eventually adapted into anime.

What’s happening: Neopage wants to grow the market for romance and boys’ love web novels, which are popular in the Chinese market but underrepresented in Japan, The Bunka News reports.

“Similar to BL, [female-oriented romance] is a highly popular genre in Japan for manga and short dramas, but in web novels, the number of works is low, and the market is still very small,” Yasuhiro Kawabata, who oversees Neopage promotion and marketing in Japan, told the publication.

The company envisions successful titles being adapted into short dramas and audio media, creating IPs that can be exported outside Japan.

By the numbers: Some romance novels published on Neopage have already earned more than ¥1 million (US$6,500), showing the potential for the genre.

The company has contracts with 400 writers and has paid a total of ¥100 million (US$647,000) in manuscript fees as of October.

In order to continue growing its catalog of romance titles, Neopage is focused on recruiting Japanese housewives and young women demographics.

Backgrounder: Neopage’s founder is Ivan Luo, one of the founders of Chinese web novel platform Qidian and also a former executive at Tencent-backed web publishing giant China Literature.

Animenomics is an independently run and reader-supported publication. If you enjoyed this newsletter, consider sharing it with others.