Gen Z is driving the worldwide anime boom

Plus: Non-Japanese animation at Tokyo Int'l Film Fest; Saudi company reboots anime IPs in the Middle East; Pandemic changed the anime voice actor work; and more

This is your weekly Animenomics briefing, covering the business of anime and manga. Today is Wednesday, October 4, 2023.

Don’t miss this: Pan-European film distributor Wild Bunch and Taiwanese film distributor Applause Entertainment have released the first international posters for director Hayao Miyazaki’s The Boy and the Heron.

Anime drives American Gen Z culture and consumption

Anime is having an outsized influence on Gen Z culture in the United States as the older half of the age cohort enters adulthood. Nearly half of Americans aged 18–24 watch popular anime, according to a survey by Dentsu Macromill Insight.

Why it matters: Anime’s ubiquitous presence is catching the attention of brands, who are embracing anime imagery as a means of attracting Gen Z customers.

By the numbers: DMI surveyed 1,800 Americans aged 18–54 in August of last year and found that one in three adults have watched popular anime titles.

Among respondents aged 18–24, 44 percent said they watch anime, and nearly 53 percent have a favorite anime character.

Gen Z anime viewers are also connecting with peers, with 48 percent having found others with whom they can talk about anime.

Zoom in: DMI’s survey notably ranks anime to be more favorable among Gen Z viewers than sports broadcasts by the NFL (American football), NBA (basketball), and MLB (baseball).

Action and adventure titles like One Piece, Naruto, and Attack on Titan are the most popular with this audience.

How it’s playing out: Brands have enthusiastically adopted the anime aesthetic in recent years to make their products look cool to Gen Z adults.

Nissan USA launched its own version of the Lofi Girl music stream earlier this year on YouTube to promote the Ariya sport utility vehicle.

Automaker Acura and fast food chain Taco Bell also developed anime-style campaigns incorporating emotional storytelling.

Bottom line: Being an anime otaku is gaining acceptance among young adults, with 34 percent of Gen Z respondents stating that they identify with the label.

Indonesian Gen Z anime fans emerge on social media

Halfway around the world, Gen Z is driving an explosion of the anime, manga, and video game subculture in Indonesia, fueled by increased use of social media over the course of the COVID-19 pandemic.

Why it matters: Indonesia is Southeast Asia’s most populous country and boasts an Internet-savvy Gen Z population of 75 million that is coming of age as anime and manga become available digitally around the world.

Indonesians are also highly dependent on mobile devices for Internet access, so youths are accessing anime and media content first on mobile apps.

What’s happening: Websites that nurtured Indonesia’s anime and manga fans in the 2010s like KAORI Nusantara and Jurnal Otaku Indonesia are fighting to stay relevant as younger fans flock to social media apps for news.

“Brands seeking to approach the Indonesian anime fan market today often prioritize social media accounts on Instagram and TikTok with a minimum 10,000–50,000 followers as their media partners,” Rafly Nugroho, a former social media specialist at anime streamer Bilibili, told Animenomics.

Yes, but: Licensees and distributors of anime and manga content must also face the reality that piracy and illegal media consumption played a big role in the formation of Indonesia’s anime and manga fandoms.

Zoom out: Anime commands a 28 percent share of viewership across all video-on-demand (VOD) titles in Indonesia, according to a recent study by Singapore-based lifestyle marketing agency Culture Group.

One in two Netflix subscribers in Indonesia use the service to watch anime.

Last year, Spy × Family had more than half as many viewers in the country as the FIFA World Cup and ranked fifth in viewership across VOD platforms.

Clippings: TIFF opens animation line-up beyond Japan

Tokyo International Film Festival has expanded its animation line-up this year to include works from foreign countries, whereas previous editions of the festival have limited it to Japanese films. (Animation Business Journal)

Nippon Television’s acquisition of Studio Ghibli won’t guarantee the broadcaster full control over studio management since major domestic media companies and film investors are thought to hold the remaining 57.6 percent of the studio shares, write journalist Tadashi Sudo. (Japan Business Press)

Shueisha’s international manga app MANGA Plus is under criticism for using an artificial intelligence tool developed by Tokyo-based Orange Inc. to generate the lettering of English translations of Rugby Rumble. (The Beat 1, The Beat 2)

As previously reported by Animenomics, Orange Inc. has received substantial funding from investors to speed up the process of manga localization.

Russian pirate manga sites are now targeted for copyright enforcement as comics produced by Japanese, South Korean, and Chinese companies gain favor among readers over American comics amid the ongoing Ukraine war. (TorrentFreak)

Saudi company reboots anime IPs in the Middle East

“I believe Manga Productions, in my personal opinion, is playing the same role as Aramco in the oil industry. Aramco started, supported other companies, and empowered Saudi talent. Then we had this leading position globally in the oil industry. We’re trying to do this in the creative content industry.”

— Essam Bukhary, CEO of the anime-inspired Saudi production studio Manga Productions

Context: Bukhary was interviewed by VentureBeat’s video game journalist Dean Takahashi on Saudi Arabia’s anime, manga, and video game ambitions and how Manga Productions is drawing from the experience of working with Japanese production companies.

Just last week, Manga Productions also announced a licensing agreement for soccer anime Captain Tsubasa in the Middle East and North Africa.

The company also secured rights last year for a reboot of the 1970s robot anime UFO Robot Grendizer, which is popular in the Middle East.

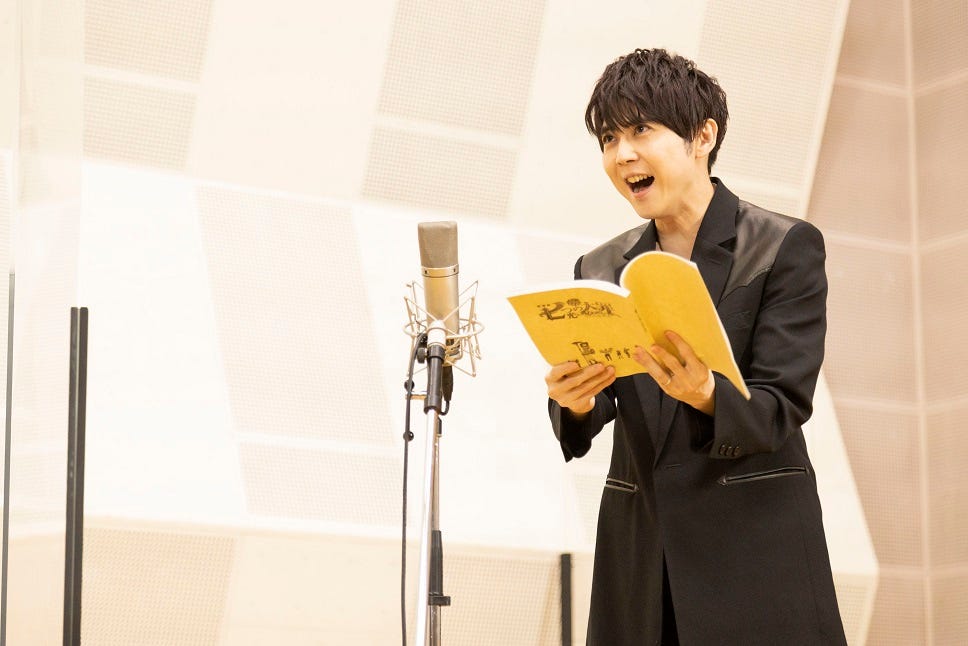

Anime director: Pandemic changed voice actor work

Capacity restrictions enacted during the COVID-19 pandemic has made anime dubbing work more challenging for rookie voice actors, says anime director Takashi Otsuka, who is the co-author of a book published last year that explains the anime production process.

Why it matters: Anime voice actors record in groups at dubbing studios, and the pandemic-related restrictions in small spaces means recording sessions could no longer be done in large groups in a single session.

What’s happening: In an interview with Diamond Online, Otsuka says recording sessions that used to be done in four hours for a single anime episode had to be broken up into 30-minute or one-hour sessions with fewer voice actors.

Splitting up the sessions and groups make it more difficult for voice actors to create a more natural flow of conversation from scene to scene, especially for those with less experience.

On the other hand, shorter sessions allow for the casting of more popular voice actors who often are unable to set aside time for a full recording session. This means less work available for rookie voice actors.

Reality check: Data compiled by Diamond Online shows that the estimated average annual income for voice actors is ¥1.44 million (US$9,700) for those in their 20s and ¥2.04 million (US$13,700) for those in their 30s.

This means anime dubbing work alone is often not enough to make a living, and voice actors must take on additional part-time jobs or participate in event activities to supplement their acting pay.

Animenomics is an independently-run and reader-supported publication. If you enjoy this newsletter, consider sharing it with others.

Despite the growing popularity of the anime worldwide, the anime industry in Japan still is in the worst state it has ever been with no hope for recovery