Dozens of anime at stake in Warner Bros. sale

Plus: Sony to issue stablecoins for anime, game payments; Japanese prime minister appeals to Saudi investors; Kadokawa dominates annual light novel rankings; and more

This is your weekly Animenomics briefing, covering the business of anime and manga. Today is Wednesday, December 10, 2025.

In case you missed it: I spoke with The Japan Times recently about potential impacts of the latest political spat between China and Japan on anime exports to the world’s second-largest movie market.

Warner Bros. sale includes 20 years’ worth of anime IPs

Warner Bros. Entertainment, the streaming and studios half of Hollywood media and entertainment giant Warner Bros. Discovery, has spent the last two decades investing in Japan, but a possible sale of the company could impact dozens of anime titles in its portfolio.

What’s happening: Warner Bros. Entertainment said last week that it will sell itself to video streaming giant Netflix after a pending break-up of Warner Bros. Discovery, but it now faces a hostile takeover bid by rival conglomerate Paramount Skydance for all of Warner Bros. Discovery’s assets.

What’s at stake: Since the mid-2000s, Warner Bros. has invested in around 90 anime titles in Japan, including leading production committees for popular shows like JoJo’s Bizarre Adventure and Record of Ragnarok.

“As part of our strategy to bring Japanese creative content globally, we currently release four to five titles per year, but we plan to further expand this number in the future,” Warner Bros. Discovery Japan general manager Buddy Marini told the Keizaikai business magazine earlier this year.

An analysis of production committees of anime aired in 2022–2023, published at Tokyo’s Comic Market last year, found that Warner Bros. Japan is ranked among the top ten companies that lead the most anime production committees.

What we’re watching: A successful sale of Warner Bros. to Netflix would significantly expand the streamer’s owned anime IP catalog and reduce licensing costs, though it’s uncertain how rising investments in anime at Warner Bros. would square with Netflix’s shift to funding fewer of its own anime productions.

“If Netflix buys Warner Bros., they’ll almost certainly reduce their output compared to the before times,” Entertainment Strategy Guy, a highly respected and anonymous Hollywood expert, hypothesized in his newsletter.

Netflix would also gain the Warner Bros.-owned streaming service HBO Max, which has an exclusive partnership with anime film distributor GKIDS to stream films by Studio Ghibli and other iconic anime directors in North America.

Conversely, a sale to the other bidder would instantly make Paramount Skydance a major player in anime production and distribution despite the company never having invested in the anime industry.

The bigger picture: In Japan, the prospect of Warner Bros. properties and HBO Max titles joining Netflix threatens recent gains made by domestic streaming video leader U-NEXT, which hosts HBO Max titles in the country today.

“Looking at Japan’s media and content industry, if one foreign company becomes too powerful, it could potentially destroy others. In fact, in South Korea, Netflix has become a monopoly, dealing a blow to the broadcasting and film industries. I think Japanese companies need to work together to create an axis of opposition,” U-NEXT chief executive officer Yasuhide Uno told Kyodo News agency last month.

Clippings: Sony plans anime, game stablecoin payments

Sony Financial Group’s banking unit will issue a United States dollar-denominated cryptocurrency known as a stablecoin in 2026, with plans for the coins to be used to pay for anime and video games in Sony’s ecosystem. (Nikkei Asia)

Why it matters: The combination of consumer reach and media infrastructure makes Sony’s stablecoin stand out against other corporate-issued stablecoins, Payment Expert reports.

Demon Slayer: Infinity Castle’s first anime film picked up a Best Animated Motion Picture nomination in the 83rd Golden Globe Awards, the first time a franchise anime film has been selected over an auteur-driven standalone feature. (Cartoon Brew)

Crunchyroll will end ad-supported on-demand streaming at the end of the year. The company still has several free ad-supported streaming television channels on services like YouTube Primetime Channels and Samsung TV Plus. (Anime News Network)

Dōjinshi retailer Melonbooks will open its first store outside Japan in Taiwan later this month, selling self-published adult manga from both markets, as well as anime merchandise and books from local publishers. (Otaku Lab)

Japan’s government plans to form a consortium of manga industry, government, and academic entities to fund and create a unified digital platform for distributing manga to foreign markets. (The Yomiuri Shimbun)

Japan’s oshikatsu spending on fandom experiences and merchandise shows little sign of retreating despite concerns about inflation among consumers. (Bloomberg Opinion)

Takaichi appeals to Saudi investors with anime, manga

“Just shut your mouths and invest everything in me!”

— Sanae Takaichi, Japanese prime minister, to investors from Saudi Arabia

Context: Takaichi ended her address to attendees of a Saudi investment summit in Tokyo last week with a reference to an exclamation by Attack on Titan protagonist Eren Yeager, anchoring Tokyo’s invitation for Saudi investors on the country’s love for Japan’s manga and anime.

Reality check: As previously reported by Animenomics, despite a push by Saudi Arabian companies to form collaborations with anime and manga properties, rightsholders as a whole are in no rush to welcome Saudi money.

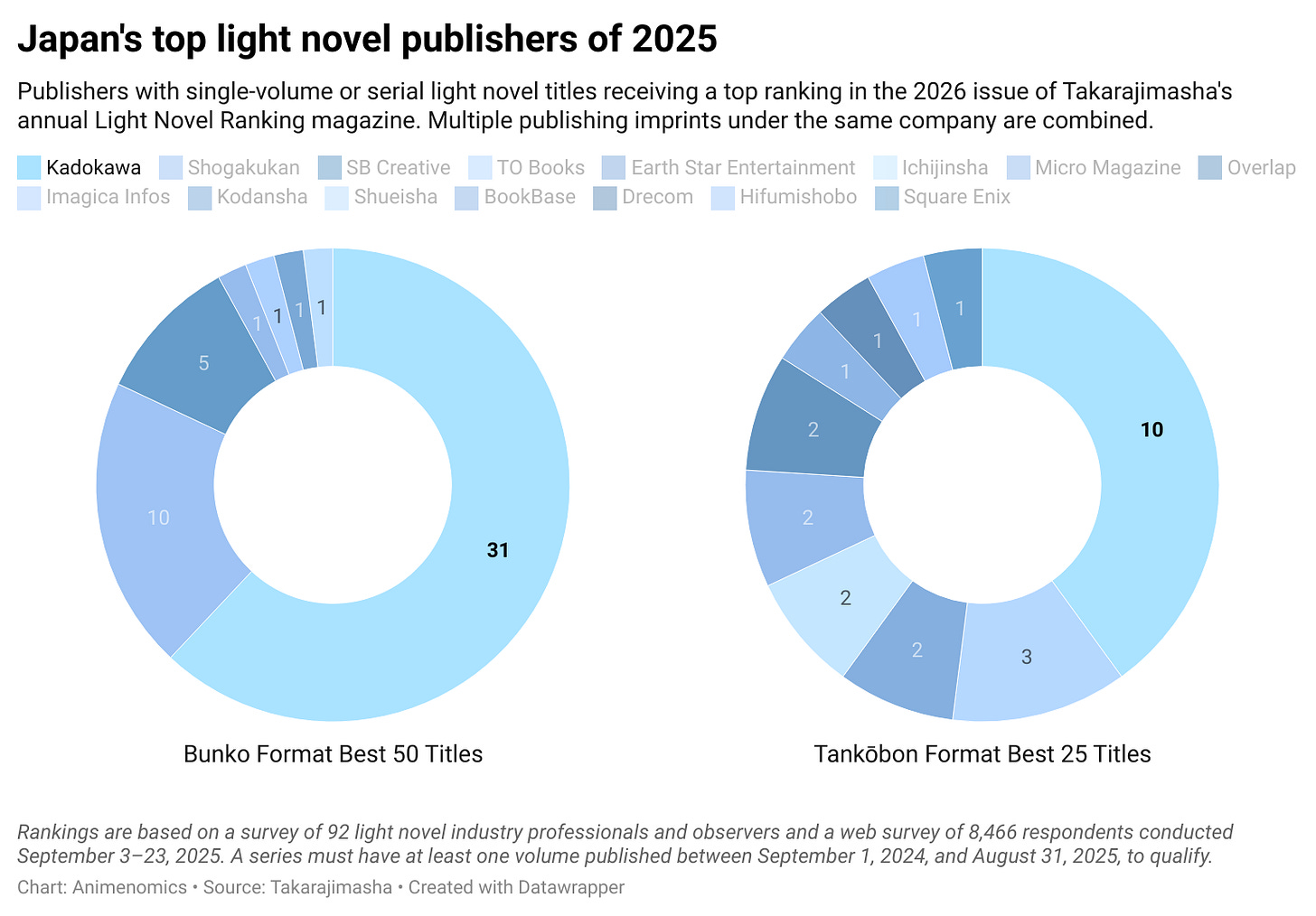

1 chart to go: Kadokawa dominates light novel rankings

Takarajimasha has published its annual rankings of the best light novel serials of the past year, with titles published by Kadokawa’s imprints dominating both the bunko (mass-market paperback) and tankōbon (large paperback and hardcover) categories.

Zoom in: This year marks ten years since Takarajimasha published a special edition that ranked user-generated web novels, and the light novel industry has now fully embraced web novels as sources of original stories to be turned into printed books.

Shōsetsuka ni Narō remains the dominant platform where publishers seek out web novels to acquire, but publishers have also begun to set up their own web novel platforms in recent years.

As previously reported by Animenomics, these web novel sites are now contending with a growing number of works that are generated using artificial intelligence.

Animenomics is an independently run and reader-supported publication. If you enjoyed this newsletter, consider sharing it with others.