Digital manga double pre-pandemic sales

Plus: Anime broadcasts converge on 11:00 pm time slot; IG Port consolidates anime studios; Shogakukan bets IP business on AI-driven light novel app; and more

This is your weekly Animenomics briefing, covering the business of anime and manga. Today is Wednesday, January 29, 2025.

In case you missed it: Toei Animation’s Magic Candies, based on South Korean children’s books, is nominated for Best Animated Short Film in the 97th Academy Awards.

Digital manga take 94 percent of e-book market growth

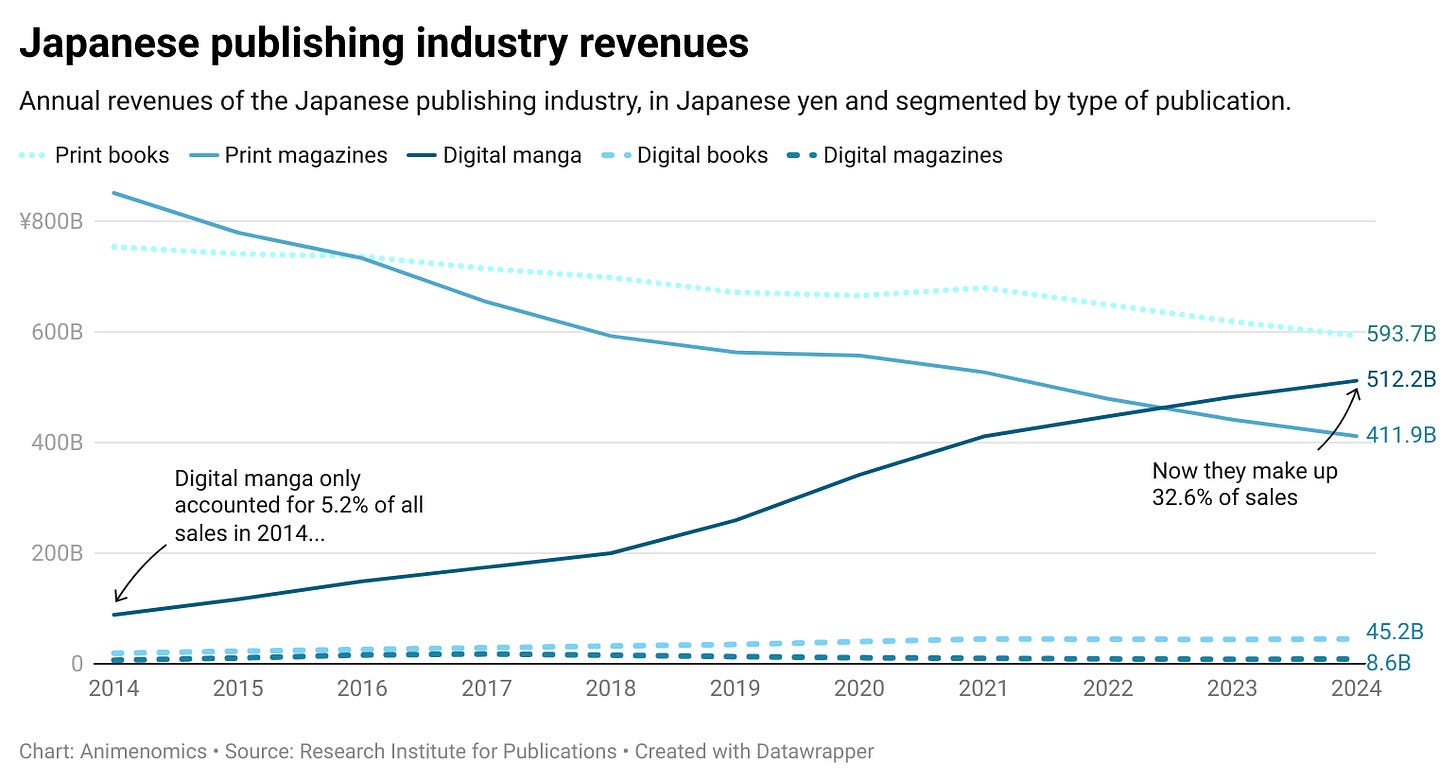

Japan’s digital manga market last year grew to twice the magnitude of its pre-COVID-19 pandemic levels, newly released annual publishing industry data compiled by the Research Institute for Publications show.

Why it matters: Manga remains the overwhelming driver of Japan’s e-book market, contributing 90 percent of sales revenue in the publishing segment and more than 94 percent of its growth last year.

By the numbers: Digital manga sales revenue grew 6 percent year-over-year in 2024 to more than ¥512 billion (US$3.3 billion).

Manga collected volumes in the print books category grew 8.2 percent last year to nearly 5,600 unique releases and have doubled since 2016.

This category includes deluxe editions of previously released manga and new collected volumes of manga whose chapters are published by digital platforms.

The other side: Annual sales of all print manga volumes saw its third consecutive year of decline, falling about 10 percent to the lowest level since tracking began in 1995.

Despite the decline of print manga publishing, popular titles can still move print units, the Research Institute of Publications said in its January monthly report.

December releases of the final volumes of My Hero Academia, Oshi no Ko, and Jujutsu Kaisen helped push monthly in-store sales of magazine-serialized manga volumes up by 8 percent year-over-year.

The bigger picture: Japan’s broader publishing market, meanwhile, fell 1.5 percent to ¥1.57 trillion (US$10.2 billion), the third consecutive year of decline.

Sales of print publications fell 5.2 percent amid bookstore closures nationwide, while the e-book market was up 5.8 percent.

Anime competition grows fiercer in 11:00 pm time slot

Anime’s growing importance as an investment avenue for Japanese television stations is leading several major broadcasters to shift or introduce new programming blocks at the 11:00 pm hour for anime.

Why it matters: Broadcasting anime at the start of the so-called platinum time slot (11:00 pm to 1:00 am) ensures that a series gets more eyeballs and social media buzz compared to later time slots that are commonly occupied by late night anime.

What’s happening: Private broadcaster Fuji Television drew attention last month by announcing that the One Piece anime will move from a Sunday morning time slot to an 11:15 pm one in April, the show’s first move in 19 years.

Fuji TV is also moving the iconic noitaminA anime programming block to Fridays at 11:00 pm, putting it in direct competition with Friday Anime Night, the Nippon Television programming block that has aired at that same time since 2023.

In quarterly earnings presentations, Nippon TV says television viewership data from audience measurement company Video Research show that the network has the highest audience rating in the Kanto region for the 11:00 pm time slot.

Zoom out: Public broadcaster NHK has called the 11:00 pm time slot on its flagship channel a “zone for younger generations” and offers new content every quarter.

TV Asahi established in October the anime programming block IMAnimation on Saturdays at 11:30 pm. It will start a second block on Wednesday nights in April.

The initiative isn’t limited to national broadcasters. Last April, Nagoya-based CBC Television also began producing a Sunday 11:30 pm anime programming block.

What we’re watching: Fuji TV this week appointed television and anime producer Kenji Shimizu as president amid an ongoing sexual misconduct scandal at the company, triggering media speculation about anime’s future role at the broadcaster.

Shimizu, a Fuji TV veteran of more than 40 years, was the network’s producer for popular anime like Dr. Slump Arale-chan and Dragon Ball and helped create the noitaminA programming block.

Clippings: IG Port to dissolve Signal M.D anime studio

Anime studio Production I.G will absorb sister studio Signal M.D as group parent IG Port seeks to consolidate resources and improve overall profitability. Signal M.D was founded in 2014 to accelerate the adoption of digital anime drawings. (Gamebiz)

Two men were arrested for allegedly selling posters of copyrighted anime characters generated using AI in one of Japan’s first criminal cases involving charges of copyright violations using AI technology. (The Mainichi)

Ultra Super Pictures shareholders approved a decision to dissolve Ordet, the anime studio that has been dormant since 2016 following the departure of anime director and founder Yutaka Yamamoto. (Gamebiz)

Tokyo-based IID is hiring a lead editor to oversee two Japanese-language anime-related publications, the anime industry news site Anime! Anime! and entertainment business news site Branc. (Branc)

Convenience store group Lawson is using anime merchandise collaborations to help drive the expansion of its footprint in inland China. Store locations in Sichuan province have doubled since 2022. (Nikkei Asia)

Manga publishers in Spain released 1,565 manga titles in the Spanish, Catalan, and Basque languages last year, down 5.7 percent from the previous year but still about double pre-pandemic levels. (MangaLand)

Solo Leveling’s anime adaptation was the most-watched new series on Crunchyroll in 2024. (Rahul Purini on LinkedIn)

Kadokawa looks to increase weekly manga publications

“Up until now, Kadokawa's manga production system has been based on monthly releases, so my personal goal is to spread across the entire company a system where it’s natural for each editorial team member can create works on a weekly basis.”

— Toshihiko Hanawa, Tatesc Comics deputy editor-in-chief

Context: Speaking with Da Vinci magazine, editors of Kadokawa’s webtoon platform Tatesc Comics, launched in 2021, reflect on the learnings of the past four years and envision its future role in the publisher’s manga business.

Between the lines: Increasing the number of weekly manga releases would go a long way toward helping Kadokawa increase IP production following a ¥50 billion (US$320 million) investment by Sony.

Shogakukan bets on AI tech as IP business launchpad

Shogakukan last week launched its Novelous website and mobile app for reading light novels and manga in North America, making it the latest major Japanese publisher to directly sell its content IPs and source new creators in the region.

Yes, but: While Japanese media have reported that works on Novelous are translated with the help of artificial intelligence, English-language marketing materials and app documentation reviewed by Animenomics are silent on AI’s involvement in the service.

Why it matters: Shogakukan intends to use Novelous secondarily as a platform for writers and artists outside Japan to submit their own works to be published, and the involvement of AI could spook creators.

What they’re saying: “Even though it’s interesting as a topic of conversation, it’s only natural that the idea of AI being behind the creation of entertainment creates a negative image,” Novelous producer Yuki Wada, who was editor-in-chief of Shogakukan’s MangaONE platform, admitted to website High-Five in October.

Catch up quick: As previously reported by Animenomics, Shogakukan partnered with Tokyo-based AI translation startup Mantra to make Novelous possible.

Mantra uses image recognition and natural language processing technology to identify text on a page and translate them, after which translations are sent for review by human professionals.

In the review process, about 80 percent of the AI-translated text end up being published without edits, Wada told High-Five.

What we’re watching: Wada foresees a future where character dialogue data that’s processed by AI can be used to create IP-driven immersive experiences where those characters can interact with readers, possibly using machine-generated voices.

“Whenever we bring up AI, the conversation tends to go in the direction of ‘AI will take away human jobs,’ but in fact it will create more jobs for humans,” he argued. “As AI increases the number of translations, new projects that have never existed before will appear, which means the total amount of work increases.”

Animenomics is an independently-run and reader-supported publication. If you enjoyed this newsletter, consider sharing it with others.

Funnily enough, Square Enix digital vs physical share seems to be almost frozen in the last few years, given you mentioned The Apothecary Diaries. Has been surprising me fro a while.

Re: IG Port... they need to improve their corporate structure, because due to that they can't compensate the losses in some areas and profits in others, and end up paying huge effective tax rates (48% in their last report). But Wit is the biggest offender, and that one is harder to tackle, given IG Port does not own 100%