First 'Demon Slayer' finale film tops box office charts

Plus: Anime mobile game revenue grows outside Japan; Disney to invest in Webtoon Entertainment; Publishers prefer coin payments in third-party manga apps; and more

This is your weekly Animenomics briefing, covering the business of anime and manga. Today is Wednesday, September 17, 2025.

In case you missed it: A trend of social media users creating images of themselves as 3D character figures using generative artificial intelligence tools like Google Gemini has prompted warnings by Bandai about copyright and trademark infringement after the company identified images that appear to use logos mimicking its own.

‘Demon Slayer’ film tops box office charts worldwide

The first installment of the Demon Slayer: Infinity Castle anime film trilogy opened in 49 territories around the world over the weekend, significantly expanding the film’s global reach as Sony and Crunchyroll expand their anime distribution footprint.

Why it matters: A successful global run for Infinity Castle could raise expectations and generate additional excitement for Sony’s two upcoming anime film releases, Chainsaw Man: Reze Arc in October and Mamoru Hosoda’s Scarlet in December.

By the numbers: Infinity Castle brought in US$70.6 million in its first three days in the U.S. and Canada after opening on more than 3,300 screens—six times more screens than the average anime film release in the last ten years, according to a White Box Entertainment analysis.

U.S. and Canadian box office earnings surpassed that of Pokémon: The First Movie in 1999, which earned US$31 million (US$60 million when adjusted for inflation) in its first three days.

Film analysts in Mexico, citing data from the country’s film trade group Canacine, say Infinity Castle grossed Mex$184.2 million (US$10 million), earning more in one weekend than Dragon Ball Super: Broly—until now the highest grossing anime in the country—during its entire run in 2019.

In Brazil, where Infinity Castle opened on Thursday, the film sold 1.1 million tickets and earned R$26.5 million (US$4.99 million) through Sunday, making it the fourth best opener in the country this year.

The film earned £3.46 million (US$4.72 million) in the United Kingdom and Ireland and had the biggest weekend opener of any anime film in the territory’s history, Screen International reports.

India, a critical growth market for Sony and Crunchyroll, saw Infinity Castle earn up to ₹410 million (US$4.65 million), 45 percent of which came from dubs in Hindi, English, Telugu, and Tamil, according to film tracker Sacnilk.

Zoom in: Screenings in the high-resolution IMAX film format contributed significantly to the film’s total weekend earnings, bringing in US$20 million worldwide, two-thirds of which came from North America.

To date, Infinity Castle has earned US$58.5 million in the IMAX format in more than 70 markets. It’s the highest grossing Japanese release of all time in IMAX.

Between the lines: Infinity Castle’s blockbuster box office earnings in North America come despite the film being rated R, requiring children under 17 years old to be accompanied by an adult guardian, due to its violent scenes.

In Brazil, an intervention by the Ministry of Justice and Public Security to raise the film’s age rating from age 14 and above to age 18 and above—a move that Sony has appealed—disappointed young moviegoers looking to watch it in theaters with friends.

What’s next: Infinity Castle opens in French-speaking markets today and will open in German-speaking markets tomorrow.

Japanese spending drives anime’s mobile game growth

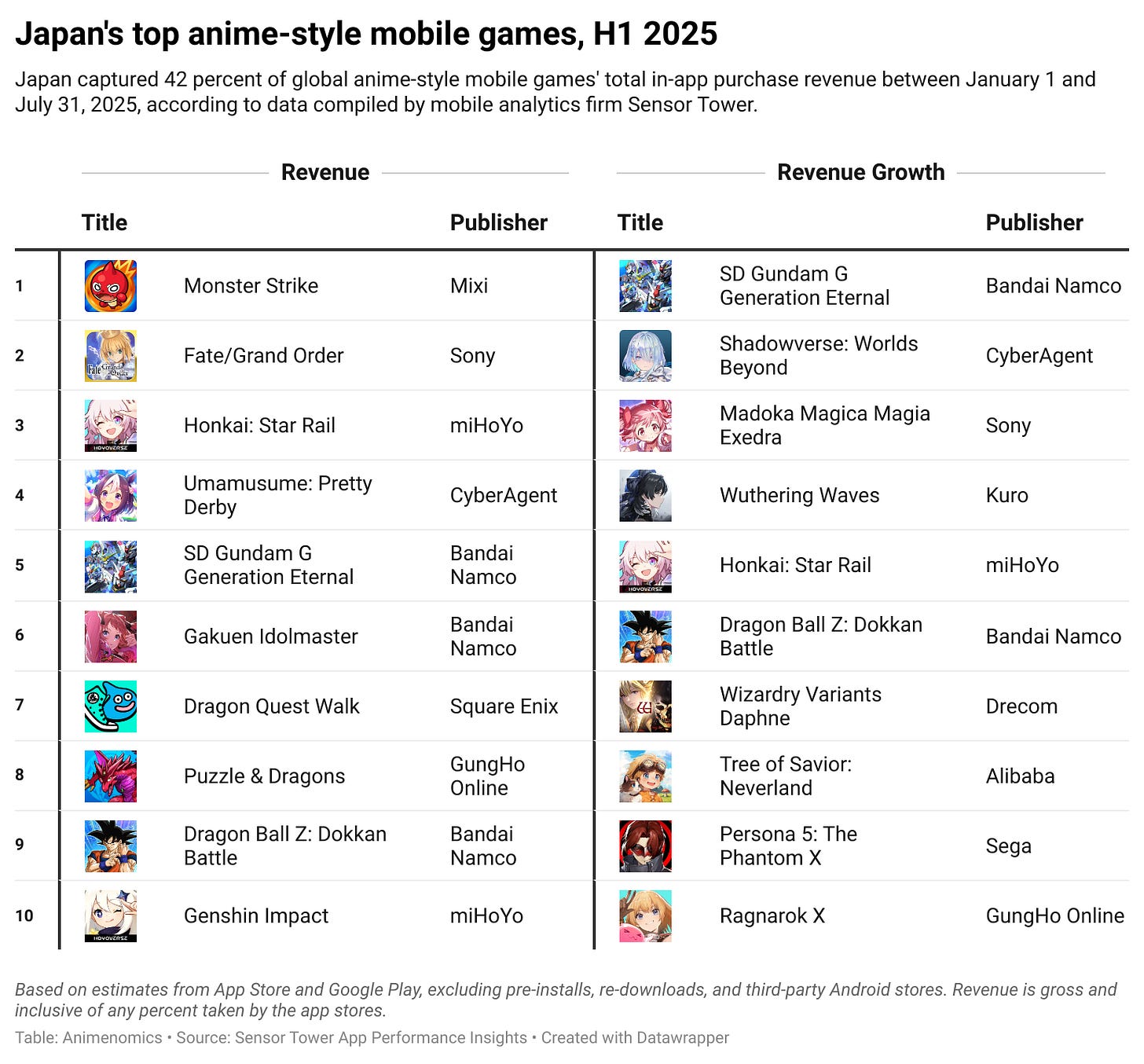

Japan accounted for 42 percent of worldwide total in-app purchase revenue on global anime-style mobile games in the first half of 2025, double the share of China, the next biggest spender, according to new data from mobile analytics firm Sensor Tower.

Why it matters: Anime mobile games’ strength in Japan’s domestic market is driving the anime industry’s growing investments in them.

Catch up quick: Legacy titles like Monster Strike, Fate/Grand Order, and Umamusume: Pretty Derby continue to place at the top of the revenue rankings for the first half of the year.

Honkai: Star Rail by Shanghai-based video game publisher miHoYo also continues to perform well in Japan thanks to spending during in-game events.

New games in the SD Gundam, Shadowverse, and Puella Magi Madoka Magica franchises were the fastest-growing titles during the six-month period.

Zoom out: Story-driven games aimed at women pioneered by Japan, known as otome games, have surged in China and the United States in the last two years.

Two-thirds of worldwide otome game in-app purchase revenue now come from outside the Japanese market.

Japanese players spent more than US$160 million on otome games in the first half of the year.

Clippings: Disney seeks stake in Webtoon Entertainment

The Walt Disney Company is in talks to acquire a 2 percent stake in South Korean digital comics company Webtoon Entertainment, just weeks after the two companies announced a content deal that would bring 100 Disney comics titles to the Webtoon platform. (The Wall Street Journal)

The expanded collaboration will also result in a new platform that will host more than 35,000 current and past comics from Disney’s portfolio of Marvel, Star Wars, and 20th Century Studios properties and more, the companies said on Monday.

Disney is positioning the new platform as an expansion to the existing Marvel Unlimited digital comics service, and some titles will also become accessible to Disney+ subscribers.

Fuji Television’s holding company Fuji Media is selling ¥30 billion (US$205 million) in shares of Toei Animation, reducing its shareholding in the anime production studio from 8.31 percent to an estimated 3.19 percent. (The Nikkei)

The sale, part of corporate reforms at the broadcaster seeking to restore investor confidence after a sexual misconduct scandal involving a celebrity program host, is not expected to impact Fuji Media’s seat on Toei Animation’s board of directors.

Anime and manga retailer Animate will open its first permanent store in Malaysia in October, months after the company ran a pop-up store in the same shopping mall for six months through May. (Otaku Lab)

Animate-owned Frontier Works launched a new anime production label, Animatica, in collaboration with Tokyo-based motion comic-style anime studio Doraku, aiming to sidestep traditional anime production amid rising production costs. (Animate Times)

Shueisha’s Shonen Jump+ digital manga platform is ending the operation of World Maker, a web platform that helps aspiring manga writers to create storyboard drafts for their story ideas without needing to be able to draw. (Press release)

Mobile technology company DeNA is piloting in collaboration with E&H Production, an anime studio founded by MAPPA veteran Sunghoo Park, a software for anime production that reduces by 80 percent the time required for offline editing. (Gamebiz)

Orange explains Emaqi digital manga store coin system

“Many manga authors and publishers still decline subscription deals [unless they are on the publishers’ own platforms], so building Emaqi around a subscription plan would immediately exclude hundreds of titles we want to showcase.”

— Shoko Ugaki, Orange founder chief executive officer

Context: Ugaki told Anime Trending that his AI-assisted manga translation company’s goal of accelerating the number of manga titles available in English led it to choose a coin-based, pay‑per‑title model over an all-you-can-read model for its Emaqi digital manga store.

“As of today, only about 2 percent of Japanese manga has an official English edition [by volume],” Ugaki said. “For most manga authors, there is no outlet to reach English‑speaking readers and losing today’s backlog with the previous, fully manual workflow would take roughly 50 years and a nine‑figure budget.”

Yes, but: North American users are divided on the use of coin-based payments in digital manga stores, with columnists questioning whether the system is cost-effective for consumers or criticizing it for turning reading manga into gamification.

Animenomics is an independently run and reader-supported publication. If you enjoyed this newsletter, consider sharing it with others.

ANN ran an early review for Hosoda-sensei’s “Scarlet” screening at TIFF. It wasn’t very positive. I think that Sony should expect to see decent returns for Reze Arc, and temper their expectations for Scarlet. TBH, I’m questioning their decision to takeover Hosoda’s financing and distribution. He’s not made a cohesive movie since Wolf Children. Mandem needs a co-writer. Same goes for Shinkai-sensei. He hasn’t made anything remotely as good as Your Name. He also needs a strong co-writer. I wish anime auteurs would give accomplished screenwriters their due. It’s rare that you see an animation director take on sole writer/director duties and stick the landing so to speak. 🤷♂️