CyberAgent names head of anime as next CEO

Plus: Print manga decline reduces Japanese children's access to manga; Bandai Namco focuses on royalty income; Startup to launch English manga platform in 2026; and more

This is your weekly Animenomics briefing, covering the business of anime and manga. Today is Wednesday, November 19, 2025.

Programming note: Animenomics will be on break next week. The next issue will hit inboxes on Wednesday, December 3.

CyberAgent founder picks head of anime as successor

CyberAgent founder and chief executive Susumu Fujita plans to turn over the reins of the digital advertising and entertainment company to Takahiro Yamauchi, a 19-year veteran of the company and the head of its anime and IP business division.

Why it matters: Fujita’s selection of Yamauchi, who was picked to lead CyberAgent’s anime and IP division last year, reflects the company’s transformation from a digital advertising agency to an entertainment company in the last five years

Catch up quick: As previously reported by Animenomics, CyberAgent is feeling the urgency to diversify its business as the digital advertising industry faces an uncertain future.

Following the financial success of Umamusume: Pretty Derby’s mobile game and anime at its Cygames video game development affiliate, CyberAgent sought to replicate Umamusume’s success at a group level.

Since then, the company has acquired visual novel development studio Nitroplus and recruited veteran producers from Bandai Namco and WIT STUDIO to lead new anime studio subsidiaries.

Last year, CyberAgent won a joint bid to lead a production an anime production committee for Shueisha’s Kagurabachi manga with film production giant Shochiku.

Zoom in: CyberAgent’s year-end financial results presentation last week reported that its media and IP business, which also includes the Abema streaming television service, posted its first profitable year since launch in 2015.

Yamauchi, who was appointed Abema’s chief operating officer two years ago, was also instrumental in turning around the service to become profitable.

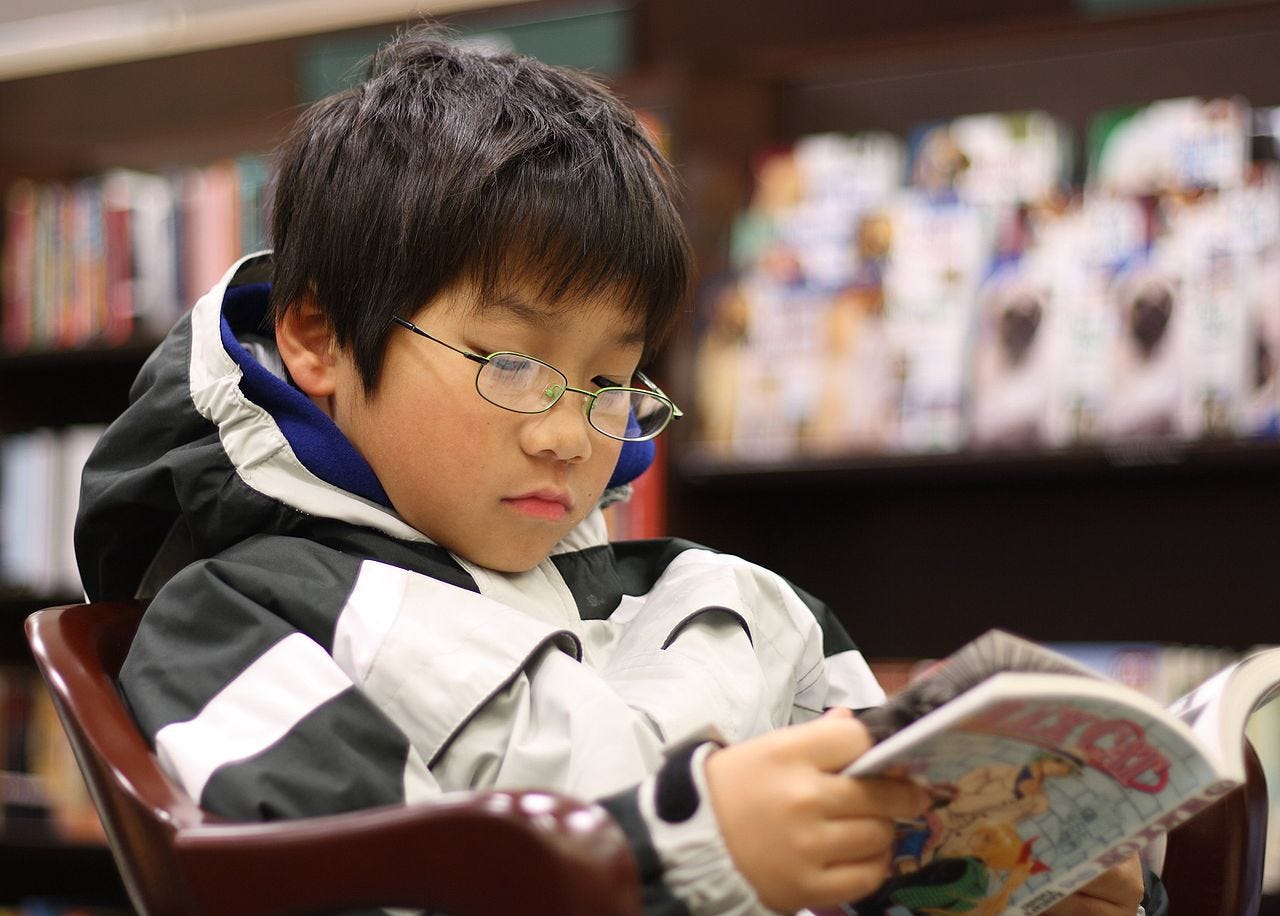

Japanese children manga access falls with print manga

Increasing bookstore closures around Japan plus the need to use a credit card to buy digital manga mean fewer Japanese children are interacting with manga on a day-to-day basis now than in the past, says a board director at manga publisher Kodansha.

Why it matters: This reality facing the domestic manga market has pushed Kodansha to use its manga properties to move into anime and merchandising to create new fan touchpoints, Hirotoshi Kurita, also a former Weekly Shonen Magazine editor-in-chief, told the magazine of the Japan Business Federation (the Keidanren).

Rewind: As previously reported by Animenomics, Kodansha has invested in efforts to bring more of its manga properties into cinemas, like rivals Shogakukan and Shueisha.

In the fiscal year that ended in November 2024, Kodansha’s revenue from rights sales abroad climbed 14.5 percent year-over-year, driven by growth in sales of anime film rights and merchandising rights, The Bunka News newspaper reports.

Revenues from license rights sales have also jumped at other manga publishers as interest in rights for secondary use grow at home and abroad.

Zoom out: Kurita, who oversees Kodansha’s global strategy, wants the proportion of digital manga sales at the company to grow beyond 10 percent, but online piracy is a challenge to that vision.

“Even though we know there is a demand [for digital manga], pirated copies prevent the formation of a market,” he observed.

What we’re watching: Whether a push toward digital manga sales in North America—if the fight against online piracy is successful—could leave out young readers like in Japan despite a growing need for middle grade manga in places like the United States.

Clippings: ‘Demon Slayer: Infinity Castle’ a hit in China

Demon Slayer: Infinity Castle’s first installment earned an estimated CN¥381 million (US$53.6 million) in its opening weekend in Chinese cinemas, and attendance was the biggest for an anime film since The First Slam Dunk in 2023. (ETtoday)

It likely won’t surpass Suzume’s box office record in China, according to ticket sales forecasts, but the bookings were enough to make Infinity Castle the first Japanese film to earn more than ¥100 billion (US$690 million) worldwide.

San Francisco-based manga startup KiraKira Media renamed its Azuki digital manga service, originally launched in 2021, to Omoi due to “brand confusion” with the former name being used by other companies. (Anime News Network)

Between the lines: United States Patent and Trademark Office records reviewed by Animenomics found that KiraKira Media reassigned its Azuki trademark to Los Angeles-based web3 content studio Azuki Labs as part of a settlement agreement that the companies signed in May.

KiraKira Media, which received the Azuki trademark in 2022, opposed Azuki Labs’s three trademark applications for the Azuki name in other categories in 2023, and the companies took the next 18 months to negotiate the settlement.

KiraKira Media licensing and marketing director Evan Minto declined to comment on the details of the settlement. Azuki Labs chief executive officer Alex Xu didn’t respond to questions sent by Animenomics.

Webtoon Entertainment will select ten Korean- and English-language webtoon titles to be adapted by Hollywood animation studio Warner Bros. Animation with help from teams at subsidiaries Webtoon Productions and LINE Digital Frontier. (Deadline)

Our thought bubble: Webtoon’s declining global readership—down 8.5 percent year-over-year for the quarter ended in September—continues to be a challenge for the company, as noted earlier this year, and this deal is an investment bet to draw curious readers down the road.

Manga’s Arab readership is growing, but the lack of Arabic-language releases has pushed readers in the United Arab Emirates to instead purchase English and Japanese editions. (Gulf News)

Anime studio DLE has been creating “alternative anime” productions with medium-quality animations that focus on shorter delivery times to producers and rightsholders using know-how from anime’s Flash animation era. (Otaku Lab)

Docomo Anime Store’s anime subscription video on-demand platform ranked first in a customer satisfaction survey of more than 8,800 Japanese streaming platform users, the second year in a row the service has ranked first among anime streamers. (Oricon)

Bandai Namco executive seeks focus on end customers

“What matters [in the content business] is how much royalty income flows back to Japan through IP licensing. Since the business model is fan-based, maximizing IP licensing royalty revenue is key. What we should truly focus on isn’t the export value of anime or video games themselves, but rather the total end-user market value: how much money fans worldwide ultimately spend on products and services born from that IP.”

— Nobuhiko Momoi, Bandai Namco Holdings executive vice president

Context: Momoi, Bandai Namco’s second-in-command, argues in an interview with the monthly magazine of the Japan Business Federation that the government’s latest plan to support anime, manga, video games, and other entertainment sectors should be measured by more than just exports.

What he’s saying: “[Content’s] complex, multi-layered business structure involves distribution, secondary use, and related businesses, making it difficult to gauge the overseas market size and economic impact,” Momoi explained.

He favors a ground-up approach of calculating the overseas market based on the royalty rate and income that Japanese IP licensors receive from sales to retail consumers abroad.

Manga SaaS startup to launch English platform in 2026

Tokyo-based manga technology startup Comici plans to launch an English-language manga reading platform in 2026, founder and chief executive officer Daisaku Manda announced at last week’s International MANGA Assembly Reiwa Toshima.

Why it matters: Comici is best known domestically as the developer of the Comici+ software-as-a-service platform that allows smaller manga publishers to build hosted digital manga services without needing to build their own web infrastructure.

The company also has a direct-to-consumer platform that allows webtoon and manga creators to publish their works directly to readers.

The details: It’s unclear which version of the platform Comici plans to create in English, but company plans to launch its service in North and South America, Europe, and Southeast Asia.

Animenomics is an independently run and reader-supported publication. If you enjoyed this newsletter, consider sharing it with others.