CyberAgent buys anime, game maker Nitroplus

Plus: Medialink takes Chinese animation global; Life-size Gundam moves to Osaka; Piccoma, LINE Manga lead manga mobile app usage; and more

This is your weekly Animenomics briefing, covering the business of anime and manga. Today is Wednesday, July 3, 2024.

Situational awareness: Look out for a deluge of announcements this week as the anime industry gathers in Los Angeles for Anime Expo, North America’s biggest anime convention.

Animenomics will bring you updates from the ground throughout the event on Substack Notes, X (formerly Twitter), and Bluesky.

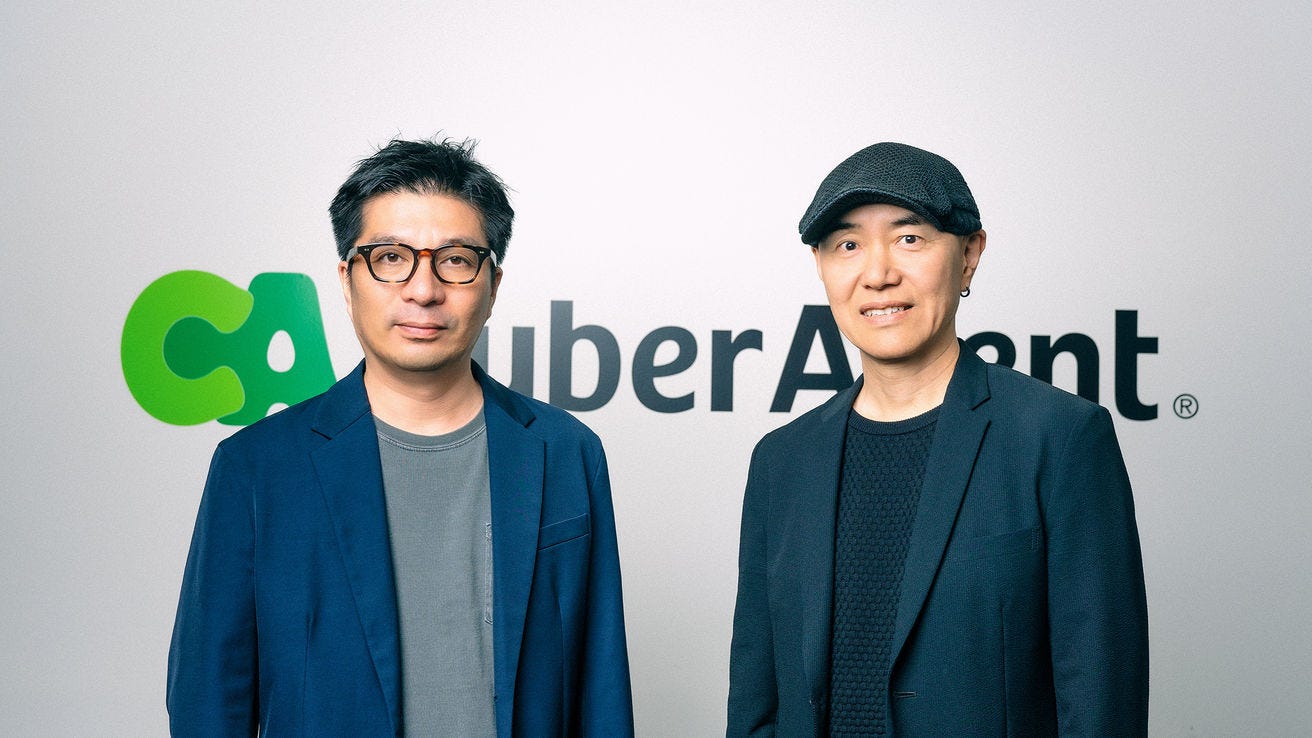

CyberAgent buys majority stake in game dev Nitroplus

Tokyo-based Nitroplus, a developer of visual novel titles that has also invested in numerous anime productions, will be acquired by digital advertising and entertainment group CyberAgent in a deal worth ¥16.7 billion (US$103 million).

Why it matters: As previously reported by Animenomics, CyberAgent is feeling the urgency to diversify from digital advertising ahead of CEO Susumu Fujita’s planned retirement in 2026.

The company has established a special task force to focus on efforts to create new intellectual properties in video game and anime.

Backgrounder: Nitroplus, founded in 2000, has created and funded marquee anime and video game productions such as Steins;Gate, Touken Ranbu, Psycho-Pass, and Puella Magi Madoka Magica.

In a press statement, Nitroplus founder and CEO Takaki Kosaka, also known by the pseudonym Dejitaro, said it had received offers of a merger or acquisition in the past, but the company turned down all of them.

How it happened: Kosaka was introduced to CyberAgent and Fujita while he was an independent board member of theater production company Nelke Planning.

“I had the impression that the people at CyberAgent respected Nelke’s policies and culture,” Kosaka said in a public relations interview published by CyberAgent.

He was also impressed by the production quality of The Idolmaster Cinderella Girls and Umamusume: Pretty Derby, two titles by CyberAgent’s video game subsidiary Cygames.

What’s next: Kosaka and vice president Gen Urobuchi, a screenwriter popular among anime fans, will remains at the helm of Nitroplus’s operations.

CyberAgent will take over administrative and distribution aspects of the business, allowing Nitroplus to focus on content production.

Hong Kong’s Medialink takes Chinese animation global

Hong Kong-based Medialink, a media rights group that holds anime content and merchandise distribution rights throughout Asia, is building on its expertise with Japanese content to help grow Chinese animation audiences abroad.

Why it matters: Medialink, which celebrates its 30th anniversary this year, has grown rapidly in Asia under the leadership its founder and CEO Lovinia Chiu.

The Sing Tao Daily newspaper wrote in February that Medialink excels at detecting the pulse of cultural trends in the region.

By the numbers: Medialink’s revenue and net profit both grew by 3 percent in the fiscal year ending March 2024, according to financial results published Thursday.

Zoom in: Content distribution, Medialink’s primary business, saw revenue grow 2.6 percent year-over-year to HK$322.5 million (US$41.3 million).

The Ani-One anime streaming platform, which is served over YouTube, has grown to 5.5 million paying subcribers, up from 3.15 million last year.

Medialink is the Asian licenseholder of Solo Leveling, which climbed to Netflix’s top 10 viewership rankings in nine Asian countries.

In October, Medialink launched Ani-Mi, a new streaming service for Chinese animation that has grown to nearly 150,000 subscribers.

Ani-Mi opened with more than 30 titles licensed from China’s Bilibili, including titles like Heaven’s Official Blessing and Link Click.

Zoom out: Medialink also saw revenue in its brand licensing business, which includes merchandise rights to popular anime titles like Chainsaw Man and Jujutsu Kaisen, grow 4.1 percent to HK$166.3 million (US$21.3 million).

The intrigue: When broken down by geography, Medialink’s content distribution revenue from buyers in the United States exceeded that of Hong Kong for the first time in the most recent fiscal year.

Clippings: Life-size Gundam robot moves to Osaka Expo

Bandai Namco’s life-size Gundam robot model, whose Yokohama exhibit closed at the end of March, will be reconstructed at the company’s Expo 2025 pavilion in Osaka. (The Asahi Shimbun)

AI translation service Mantra, founded by University of Tokyo researchers in 2020, received a ¥780 million (US$4.83 million) investment from manga publishers Shueisha, Shogakukan, Kadokawa, and Square Enix. (Nikkei Asia)

Mantra offers translations to 18 languages and has been used in translations of works like One Piece, Spy × Family, and The Ancient Magus’ Bride.

Blue Lock: Episode Nagi earned US$1.04 million during its opening weekend in the U.S., beating The Quintessential Quintuplets Movie as the territory’s highest-earning anime film based on a recent Kodansha manga title. (Box Office Mojo)

Shogakukan and paper conglomerate Marubeni are forming a new joint venture MAG.NET to establish direct sales channels with potential international buyers of the publisher’s manga titles. (RTB Square)

Marubeni also previously formed a joint venture with Kodansha, Shueisha, and Shogakukan to reform supply chains in Japan’s publishing industry.

Private broadcaster Fuji Television signed a content licensing agreement with Netflix that will bring the network’s original content to the streaming platform’s global audience and develop new content for overseas markets. (Press release)

Gen AI, VTubers signal emergent low-end anime market

“Much in the way YouTube and TikTok free content has emerged as a viable alternative to legacy media, I believe there is a classic disruptive innovation opportunity for faster and cheaper options to anime, starting at the ‘lower end’.”

— Rob Pereyda, Henshin anime consultancy founder

Context: Pereyda, a former anime industry executive at Crunchyroll, Bandai Namco, and Netflix, contends in a column published on Anime News Network that the anime consumer market is quickly splitting into a high-end segment for traditional productions and a low-end segment made up of content from virtual YouTubers and creators using generative artificial intelligence.

What they’re saying: At the same time, Pereyda dismisses fears that hand-drawn anime would disappear with new technologies. “I love high-end anime myself and believe it will always be around,” he told Animenomics.

The theory of emergent low-end products taking market share from high-end products comes from The Innovator’s Dilemma, the monumental volume by the late Harvard professor and businessman Clayton Christensen.

Rewind: As reported by Animenomics earlier this year, the anime studio Toei Animation has already found that the surging popularity of virtual YouTubers has significantly lowered the hurdles for acceptance of CG anime.

Piccoma, LINE Manga lead manga’s mobile app usage

Piccoma and LINE Manga maintain substantial leads in digital manga readership in Japan over rival mobile applications, with users spending four or more hours on either service a month, according to an analysis by Nielsen Mobile NetView.

Why it matters: Piccoma’s and LINE Manga’s continuing popularity show how much the two platforms benefit from the relationships with their South Korean parents and their webtoon businesses.

By the numbers: Nielsen Mobile NetView estimates Piccoma has 12.5 million monthly active users, followed by LINE Manga at 10.9 million users and Cmoa Comics at 8.5 million users.

The average Piccoma user uses the app 31 times and spends 3 hours 59 minutes on it a month.

LINE Manga users open the app 26 times a month, but they read for 4 hours 19 minutes over that period, the most among all manga reading apps.

Users aged 18–34 use manga apps twice every three days, whereas older users open them nearly every day.

Yes, but: Nielsen’s report cautions that usage trends of other entertainment services like streaming video and social media can affect the amount of time spent by younger users on manga apps.

The bigger picture: Mecha Comic, which was recently acquired by investment fund Blackstone, has an older readership compared to Piccoma and LINE Manga.

Women in their 30s and 40s make up the majority of readers on the fourth largest manga app, presenting a unique demographic for Blackstone.

Animenomics is an independently-run and reader-supported publication. If you enjoyed this newsletter, consider sharing it with others.