Bandai Namco to invest billions in IP growth

Plus: Japan Fair Trade Commission probes anime labor practices; Sony names new CEO; Anime films expand Japan box office footprint; and more

This is your weekly Animenomics briefing, covering the business of anime and manga. Today is Wednesday, February 5, 2025.

In case you missed it: San Francisco’s M. H. de Young Memorial Museum will host the first major manga art exhibition in the United States starting in September.

It will showcase more than 700 drawings by nearly a dozen manga artists.

Bandai Namco targets 50 percent of sales from abroad

Bandai Namco Group will spend ¥600 billion (US$3.9 billion) over the next three years to grow anime, video game, and capital investments, the entertainment conglomerate announced earlier today as part of its third quarter earnings presentation.

Why it matters: The announcement marks an escalation in the fierce competition for profitable intellectual properties by Japanese entertainment companies.

Conglomerate Sony Group, publishing giant Kadokawa, and digital entertainment group CyberAgent are among those that have announced investments in recent months.

Catch up quick: Bandai Namco’s latest three-year business plan calls for aggressive IP expansion globally across multiple product categories.

Bandai Spirits will soon begin operation of a 195,000 sq. ft. Gundam plastic model factory in Shizuoka, increasing production capacity by 35 percent.

Bandai Namco Filmworks will form a U.S. subsidiary to coordinate investment in Legendary Pictures’ upcoming Mobile Suit Gundam live-action film.

The gaming arcade business will be reorganized to focus on retail experiences, signaled by new openings of Bandai Namco Cross Stores abroad.

Aside from Mobile Suit Gundam, additional properties identified for development and licensing opportunities include Pac-Man, The Idolmaster and Tamagotchi.

Zoom in: The plan calls for growing increasing the share of overseas revenue to more than 50 percent by 2028, up from about 30 percent today.

Bandai Namco saw total group revenue cross ¥1 trillion (US$6.5 billion) for the first time last year, and it’s projected to bring in ¥1.23 trillion (US$8 billion) this fiscal year.

What we’re watching: Bandai Namco wants to deepen its relationships with external partners, and that includes potential equity investments in other companies.

Last month, the Sunrise anime studio subsidiary responsible for the Mobile Suit Gundam anime franchise announced its first-ever collaboration with Evangelion’s Studio Khara.

Japan Fair Trade Commission opens anime labor inquiry

Japan’s Fair Trade Commission last week began soliciting comments from the public as part of an investigation into potentially unfair labor practices in the country’s film and anime industries.

Why it matters: Former prime minister Fumio Kishida instructed the JFTC last year to investigate possible abuses in contract negotiations between production companies and freelance workers in film and anime.

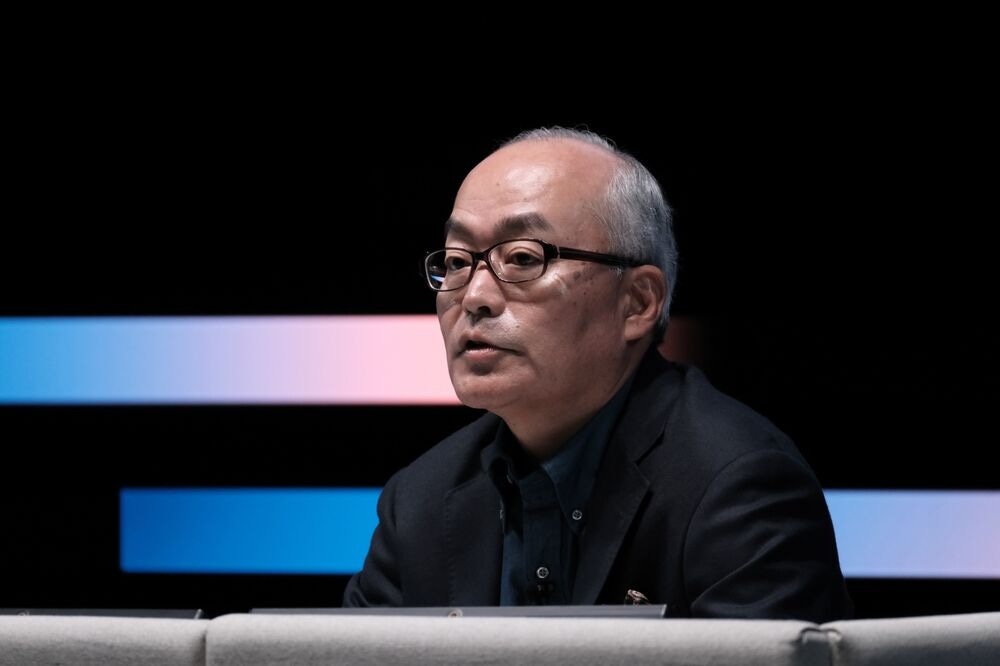

What they’re saying: “We welcome information from anyone working in the field of film and animation production regarding problems such as the absence of a contract or purchase order, unilateral imposition of extremely low compensation by the client, cancellation of an order without reason, or requests for unreasonable rework without compensation,” JFTC secretary-general Tetsuya Fujimoto told local media.

When asked whether the JFTC would pursue enforcement action based on the information submitted, Fujimoto responded, “At this time, we are only conducting a limited fact-finding survey, so the information gathered at this time will not necessarily lead directly to a formal complaint.”

Between the lines: Anime workers have for years sought to bring attention to the low wages and unfair business contracts that plague production studios.

More recently, a United Nations human rights report that warns of poor working conditions in the anime industry triggered a spat between an animator advocacy group and a producers’ association.

The JFTC last published a fact-finding report on the anime industry in 2009, but that investigation largely focused on the relationship between anime studios and production committees.

What's next: The JFTC will assess the collected information and identify practices that likely violate laws and regulations like the Antimonopoly Act, the Subcontract Act, and the recently-enacted Freelance Act.

A final report is expected to be published by the end of the year.

Clippings: Sony picks new group chief executive officer

Sony Group named Hiroki Totoki the technology and entertainment conglomerate’s next chief executive officer, effective April 1, replacing Kenichiro Yoshida, who remains as chairman of the group. (Nikkei Asia)

Totoki has been Yoshida’s right-hand man since 2018 and spearheaded Sony’s growth-focused pivot into entertainment content like anime.

Secondhand anime retailer Mandarake reported ¥1.4 billion (US$9 million) in sales in December, its highest ever monthly sales figure. This number is also up 16 percent year-over-year. (Gamebiz)

Kadokawa’s Book Walker e-book store operations will be consolidated under the corporate structure of Dwango, the digital services subsidiary known as the operator of the Niconico video sharing website. (Anime News Network)

Young Chinese immigrants seeking work in anime and video games and drawn by Japan’s relaxation of permanent residency requirements in 2017, now make up 70 percent of international students at Japanese art universities. (Nikkei)

Vietnamese migrant workers who returned home from Japan are thought to have contributed to a growing number of Vietnamese-language anime and manga pirate websites, a publishing industry group told Japanese lawmakers. (Comic Natalie)

Convicted Kyoto Animation arsonist Shinji Aoba has withdrawn an appeal of his death penalty sentence that was handed down last year. (Kyodo News)

Data must accompany New Cool Japan initiative efforts

“By leveraging advanced data analytics, the anime industry can go beyond typical ‘hearing base’ data. Advanced analytics can identify microtrends, anticipate audience shifts and inform creative strategies to ensure longevity in a competitive market. This represents a more systematic and intentional approach to overseas business, with the ability to more quickly capitalize on opportunity.”

— Douglas Montgomery, Global Connects Media chief executive officer

Context: Montgomery, writing in an opinion for Nikkei Asia, highlights the need for real-time data to track and predict anime franchises that are most likely to succeed on the global market.

As previously reported by Animenomics, the need for better data in the anime industry isn’t limited to measuring economic outcomes, but also identifying labor patterns to ensure a sustainable work environment in the sector.

Japan box office continues reliance on animated films

Six out of the top ten highest-grossing films in Japan’s domestic box office last year were animated films, according to annual box office ticket sales data compiled by the Motion Picture Producers Association of Japan.

Why it matters: Japan’s largest film distributors have grown to rely on animated films for box office revenue in recent years, the Nikkei financial newspaper reports, and last year was no exception.

By the numbers: Anime films earning at least ¥1 billion (US$6.5 million) within 2024 brought in a cumulative ¥61 billion (US$400 million) in box office revenue, 39 percent of all box office revenue from domestically-produced films.

Japan produced 14 anime films that earned at least ¥1 billion—the threshold for a commercially successful film—two more than in 2023.

Detective Conan: The Million-Dollar Pentagram and Haikyu!! The Dumpster Battle were the country’s two top-earning films last year.

Between the lines: Japanese movie theaters continue to feel the aftereffects of the Hollywood writers’ and actors’ strikes two years ago.

Box office revenue from foreign films fell 30 percent year-over-year. No foreign live-action film made last year’s top ten box office rankings.

American animated films Inside Out 2 and Despicable Me 4 placed seventh and tenth, respectively, in the overall rankings.

Animenomics is an independently-run and reader-supported publication. If you enjoyed this newsletter, consider sharing it with others.