Anime trading card makers see rising demand

Plus: Fuji TV seeks anime expansion in reform; Publishers turn international books into manga; Webtoon distribution retreats from emerging markets; and more

This is your weekly Animenomics briefing, covering the business of anime and manga. Today is Wednesday, June 11, 2025.

Programming note: This weekly news briefing is going on a break and will return on July 16. I will be publishing several special reports to fill the gap until that date.

What’s happening: I am traveling over the next few weeks and will also be attending Anime Expo, so I won’t be able to keep up the regular writing schedule that’s needed to compile these briefings.

Bushiroad raises earnings forecast on strong TCG sales

Bushiroad has increased its year-end operating profit expectation by 38.3 percent on better-than-expected sales revenue, especially in its flagship anime trading card game unit, signaling continued growth in this business segment.

Why it matters: Trading cards have become the top-selling toy category in Japan by retail value, Nikkei Asia reports.

Trading cards and card games accounted for 27 percent of Japan’s toy market in 2023, or about ¥277 billion (US$1.9 billion), according to data from the Japan Toy Association.

By the numbers: Bushiroad reported ¥18.7 billion (US$130 million) in trading card game sales through the third quarter ending in March, up 27 percent from last year.

English-language and Chinese-language edition cards and overseas shipments of Japanese-language cards accounted for 38.6 percent of total card game sales.

What’s next: Takaaki Kidani, Bushiroad’s president and chief executive officer, told the Nikkei financial newspaper that the company is aiming for ¥60 billion (US$415 million) in net sales next fiscal year, 12 percent higher than this year’s forecast, and ¥5 billion (US$35 million) in operating profit, up 20 percent.

Yes, but: Kidani also told the Nikkei that he expects the trading card game business to slow down after years of rapid growth, allowing Bushiroad to develop new properties.

The bigger picture: Printing facilities in Japan are also experiencing a surge in demand for trading card orders.

Artpresto, a unit of Bandai Namco, will consolidate three trading card production facilities into a 20,000 square-meter factory next month, boosting production capacity by 50 percent.

Commercial printing giant Dai Nippon Printing is also converting idle publication printing facilities into trading card production, Nikkei Asia reports.

Fuji TV to expand anime production in corporate reform

Fuji Television’s parent company Fuji Media plans to expand production of anime and film titles as it embarks on a major reform that aims to transform the broadcaster into a content-focused company, according to plans announced last month.

Why it matters: Fuji Media’s reforms are part of an effort by the company to restore investor confidence after public condemnation of its handling of a sexual misconduct scandal involving Masahiro Nakai, a singer and Fuji TV program host.

The scandal led a sharp decline in advertising revenue as advertisers suspended their contracts with Fuji TV and forced out the company’s top executives.

Driving the story: In January, Fuji Media named Kenji Shimizu, a past producer who oversaw anime productions at Fuji TV, as its new president and chief executive officer.

As previously reported by Animenomics, Shimizu was the network’s producer for popular anime properties in its catalog like Chibi Maruko-chan, Dragon Ball, and One Piece.

He also helped create in 2005 the noitaminA late-night programming block for anime programs that target audiences outside the young male demographic.

What he’s saying: “Fuji TV has traditionally been a broadcasting-driven company, and content was positioned as an accessory to fill the 24-hour timetable,” Shimizu told the Nikkei financial newspaper last week.

“If we had invested in anime and movies with ambitious goals, we might have been able to expand our business more,” he said, reflecting on the network’s past relationship with anime, films, and the character business.

Between the lines: Shimizu showed interest in licensing Fuji TV’s properties to global streaming providers like Netflix but acknowledged that more IP development work is needed.

“To expand overseas, it would be better to narrow down the genre to anime, Japanese horror, or reality shows,” he said.

What we’re watching: Shareholders will vote on June 25 for a new slate of directors to approve the new direction of the company, even as activist investors seek to push Fuji Media to make more drastic changes.

Clippings: International books get manga treatments

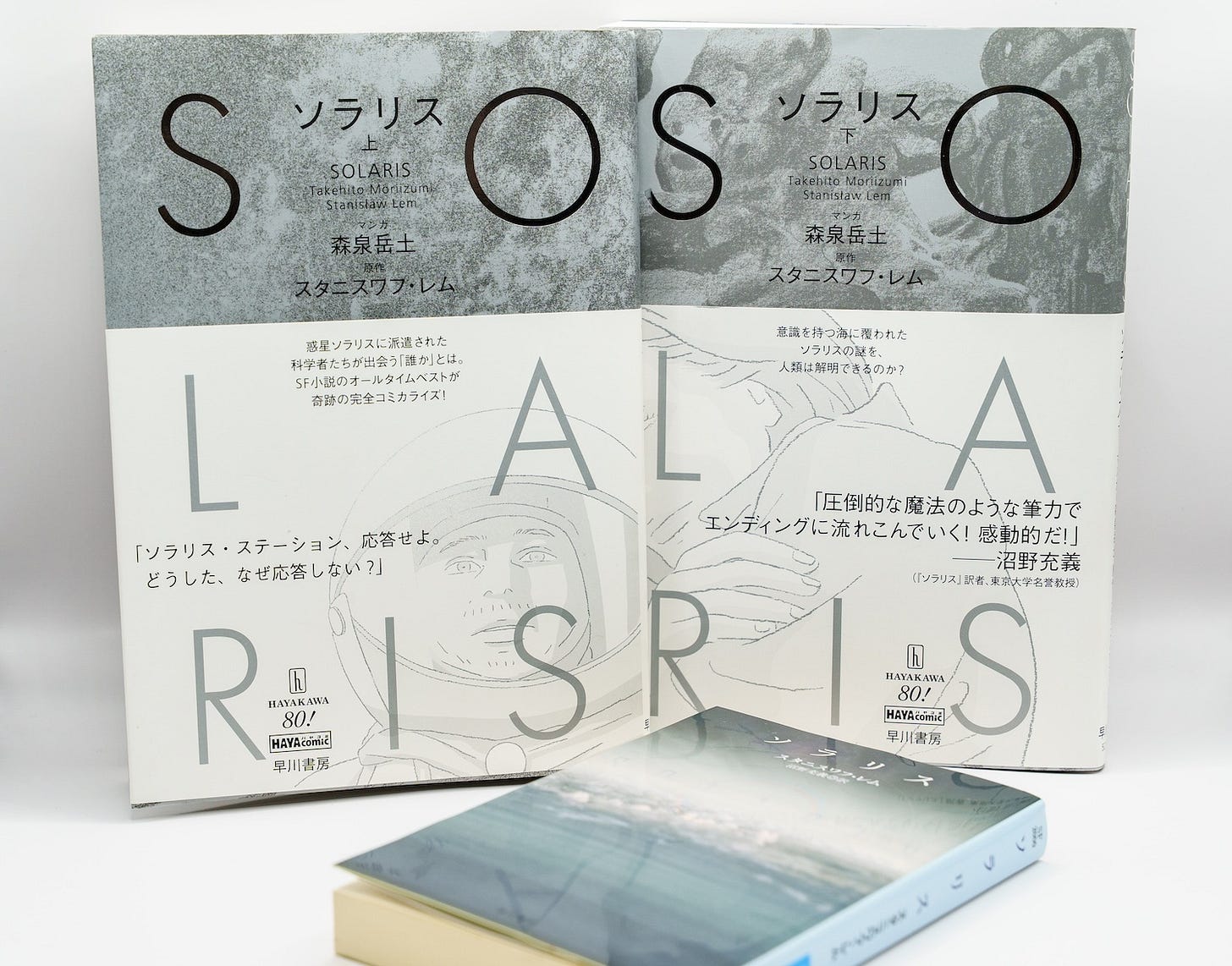

Japanese manga publishers are adapting more and more popular international fiction and non-fiction titles like Paulo Coelho’s The Alchemist and Stanisław Lem’s Solaris into manga. (The Chunichi Shimbun)

Inflation and yen depreciation haven’t affected fandom spending, says a majority of Japanese men and women in a survey about oshikatsu activities conducted by Tokyo-based marketing research firm Intage. (The Nikkei)

Anime featuring girls’ rock bands like BanG Dream! It's MyGO!!!!!, BanG Dream! Ave Mujica, and Girls Band Cry have found popularity in China, with fan videos on social media receiving millions of views and concerts selling out. (Gamebiz)

Japanese YouTuber Hajime Syacho began streaming both anime seasons of Kyoto Animation’s Miss Kobayashi’s Dragon Maid over the weekend, the first known instance of a YouTuber receiving permission to broadcast an anime series. (Nikkan Sports)

Zoom out: A new Miss Kobayashi’s Dragon Maid anime film will be distributed in theaters in Japan by Shochiku later this month.

China’s character merchandise companies that rely on IP licenses from Japan are increasingly going public on the Hong Kong Stock Exchange, though license costs are also putting downward pressure on the companies’ profits. (The Nikkei)

South Korea’s NHN is considering suspending its Pocket Comics webtoon platform in France, Europe’s largest comic book market, just three years after it first launched due to slowing growth in the country’s webtoon market. (Maeil Business Newspaper)

The bigger picture: As previously reported by Animenomics, Kakao Piccoma’s pullout from France last year sent shockwaves in the webtoon industry, resulting in other service providers also reevaluating their businesses in the country.

Webtoon distribution retreats into established markets

“Instead of focusing on emerging markets, [webtoon] platforms and publishers will be focusing on high-revenue markets and languages. That means we should expect the competition in the English and Japanese markets to increase over the next year while everyone’s still licking their wounds from the Southeast Asian markets.”

— Michael Song, webtoon industry translation and licensing professional

Context: Song summarizes the webtoon industry’s current developments in Webtoon-ish, a newsletter on the webtoon industry that he launched last month.

“With SEA essentially being closed down, that leaves western markets of which we’ve already seen significant pullbacks in Europe. Basically, that leaves English[-speaking markets],” Song writes.

Zoom in: In Southeast Asia, Song believes webtoon companies will focus on building content production pipelines rather than distribution channels.

As recently reported by Animenomics, Indonesia is among the Southeast Asian countries that is drawing the attention of webtoon producers.

Japan seeks to replicate EU digital cultural archive effort

Japan is seeking to create a digital archive of cultural content such as manga, anime, and video games by 2035 that is comparable to the European Union’s cultural assets platform Europeana.

Driving the story: The Prime Minister’s Office released last month a five-year digital archive strategy that will be implemented starting in 2026 to further disseminate Japan’s soft power.

Why it matters: Digital archiving makes it possible to preserve cultural works and prevent them from deteriorating. It also makes it easier for the public to search and use cultural assets.

What we’re watching: The strategy document lists manga, anime, and video games as priority areas in the development of a digital archive, and it specifically calls out potential collaboration with the private sector efforts like the Association of Japanese Animations’ Anime Taizen database.

As previously reported by Animenomics, the AJA launched Anime Taizen in 2022 in an effort to preserve anime production data.

Animenomics is an independently run and reader-supported publication. If you enjoyed this newsletter, consider sharing it with others.