Anime studios seek more data from streamers

Plus: Hobby retail chain Suruga-ya targets U.S. expansion; Frontier Works acquires Yokohama anime studio; Japanese content market sets new record; and more

This is your weekly Animenomics briefing, covering the business of anime and manga. Today is Wednesday, September 10, 2025.

Situational awareness: Demon Slayer: Infinity Castle’s first anime film opens in two key film markets this weekend, the United States and India.

Box office ticket sales data compiled by Box Office Mojo show the film has earned more than US$272 million worldwide two months after releasing in Japan and one month after releasing in East Asian markets.

Indian media outlets report sold-out screenings in major cities after cinemas began ticket presales last week, and The New York Times Magazine predicts the film will break U.S. box-office records.

Studios seek to reclaim anime marketing from Netflix

TMS Entertainment senior vice president Kotaro Yoshikawa has urged Netflix to share detailed country-by-country reports of viewer demographics at an event celebrating ten years since Netflix’s entry into the Japanese market.

Why it matters: TMS Entertainment, which made the hit anime series Sakamoto Days, has been a Netflix partner for several years, but it still seeks more value out of the relationship.

The Japanese government’s New Cool Japan Strategy calls for better collection and use of data to accelerate growth in entertainment exports, but global entertainment platforms largely keep detailed marketing data to themselves.

Catch up quick: The Association of Japanese Animations, a trade association of anime producers, has also criticized Netflix in the past for not being more forthcoming with marketing data and revenue sharing.

“In many cases, sufficient marketing data, such as viewer demographics, are not disclosed.” the AJA wrote in a presentation to Japan’s Agency for Cultural Affairs last year.

Calls for more data transparency during strikes by the Writers Guild of America and the Screen Actors Guild–American Federation of Television and Radio Artists in 2023 led to Netflix to share total viewership figures.

The other side: “Netflix does not use personal information such as age or gender on our service, so we do not provide detailed data such as nationality or age group, as is often requested by partners,” Kazutaka Sakamoto, who heads Netflix Japan’s content acquisition business, explained in a panel discussion at AnimeJapan earlier this year.

“We analyze which episodes of an anime cause people to drop out and discuss the expected viewer reaction with the production side during script discussions,” Sakamoto expanded.

Zoom out: Auckland-based audience research firm Parrot Analytics is one company that is trying to provide Japanese producers with more data about their anime titles to inform future productions.

“Japan has reached a stage where it can dominate the market by intentionally utilizing data, rather than relying on chance success,” Parrot Analytics Asia market advisor Douglas Montgomery said in a recent seminar hosted by Branc.

Montgomery says anime IP owners can use data from third-party providers like Parrot Analytics to negotiate more effectively with Netflix and other streaming services.

The bottom line: After a decade of learning to work with global streaming services, Japan’s anime industry is seeking to reclaim control over some promotional efforts.

“If a work isn’t included in Netflix’s regional selection of flagship titles, the production studio should have the option to market it independently,” Justin Leach, who has worked on multiple anime productions with Netflix through his company Qubic Pictures, told the Toyo Keizai business magazine in a recent interview.

Secondhand hobby chain Suruga-ya targets U.S. market

Shizuoka-based Suruga-ya, a leading secondhand retailer of anime merchandise and hobby products, is kicking off an expansion that aims to take its retail operations to the United States within the next five to ten years.

Why it matters: Duty free sales now account for as much as 40 to 50 percent of sales volume at some Suruga-ya stores in major cities, indicating demand for secondhand hobby items among customers from abroad.

The company will open its second directly managed retail outlet and a franchise store in Taiwan later this year.

By the numbers: Annual sales on Suruga-ya’s international e-commerce website have now reached ¥3 billion (US$20.4 million) after launching in 2019, founder Tsunashige Sugiyama told the Toyo Keizai business magazine.

Domestically, Suruga-ya is the leader in online sales among Japanese outlets that sell secondhand items, with 10 million unique users and 200 million pageviews a month.

In the fiscal year that ended in August 2024, the company earned ¥44.33 billion (US$301 million) in revenue, up more than 13 percent from the previous year and up more than 74 percent since the August 2020 fiscal year.

What they’re saying: “Our greatest strength is our overwhelming product database,” Sugiyama said proudly. “There is no other database like this.”

Suruga-ya employs about 250 people responsible for registering all sorts of items into the company’s database, from magazine giveaways and crane game prizes to exclusive film pamphlets and concert merchandise.

“Our company motto is ‘creating the world’s largest archive of Japanese culture’,” Sugiyama declared.

What we’re watching: “We are aiming for sales of ¥100 billion [US$680 million] by 2030 and a combined ¥200 billion [US$1.36 billion] in Japan and the U.S. by 2035,” Sugiyama said. “If we can reach that level, we will have the confidence to go public.”

Clippings: Frontier Works buys Yokohama anime studio

Anime planning company Frontier Works acquired emerging anime studio Yokohama Animation Laboratory as a subsidiary in a bid to secure anime production lines for its own properties. (Animation Business Journal)

Between the lines: Yokohama Animation Laboratory saw a sharp downturn in the fiscal year ended in May 2024, reporting a ¥9.2 billion (US$62.4 million) net loss against ¥9.5 billion (US$64.4 million) in net sales due to skyrocketing labor costs.

Cloud Hearts, a Yokohama Animation Laboratory affiliate studio, was dissolved in April after bankruptcy proceedings began at Tokyo District Court in December, leading to work cancellations with last year’s Whisper Me a Love Song anime.

Software developer Celsys has built Webtoon Entertainment a corporate version of the popular digital illustration software Clip Studio Paint, which is popular with manga and webtoon artists, deepening a relationship that began in 2021. (Press release)

What they’re saying: “This initiative streamlines communication between creators and the production team, reducing the time needed to translate webcomics into multiple languages,” Celsys said in a media statement. “This allows for faster distribution of content to global audiences.”

Children’s manga magazine CoroCoro Comic has surpassed 3 million subscribers on its YouTube channel despite the magazine having a target market of just 1.5 million boys in grades 3 to 5. (ITmedia Business)

Saudi Arabia’s Manga Productions has entered into a partnership with Chinese video streaming service Bilibili to distribute each other’s animated titles in China and the Middle East, respectively. (Saudi Press Agency)

Japanese webtoon studio No. 9 will launch a boys’ love production label targeting the ¥18 billion (US$122 million) market for content aimed at women that depict romantic relationships between men. (Press release)

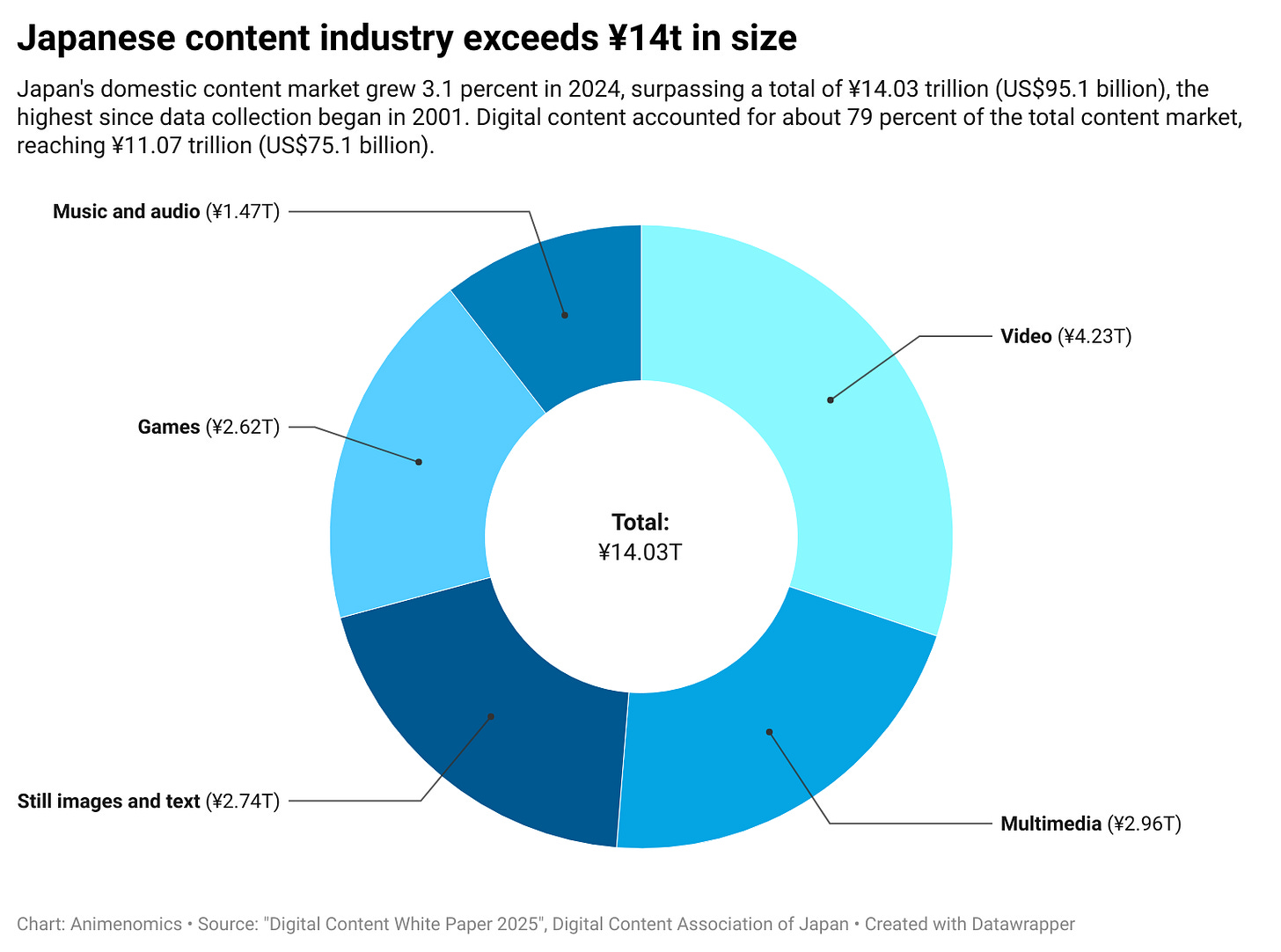

1 chart to go: Japan’s content industry sets new record

Japan’s domestic content market grew 3.1 percent last year and exceeded ¥14 trillion (US$95 billion) in size, the highest amount since the Digital Content Association of Japan began surveying the content industry in 2001.

Zoom in: Digital content accounted for 78.9 percent of Japan’s total content market, exceeding ¥11 trillion (US$75 billion).

Digital content grew 4.6 percent year-over-year, driven by rapid growth in content distributed over the Internet, which climbed 9.1 percent.

Animenomics is an independently run and reader-supported publication. If you enjoyed this newsletter, consider sharing it with others.

What do you think the likelihood of Netflix offering more data to Japanese producers? I think it is highly unlikely.

I’m curious. What’s TMS’s point of comparison. How forthcoming is Crunchyroll or HiDive with sharing their dashboard with Japanese anime licensors?

"Yokohama Animation Laboratory saw a sharp downturn in the fiscal year ended in May 2024, reporting a ¥9.2 billion (US$62.4 million) net loss against ¥9.5 billion (US$64.4 million) in net sales due to skyrocketing labor costs."

Big OUCH right there...