Anime market outside Japan up 26% in 2024

Plus: Toei Animation looks abroad to form new studios; Kodansha forms Hollywood studio; Disney bets on 'Twisted-Wonderland' to draw anime fans; and more

This is your weekly Animenomics briefing, covering the business of anime and manga. Today is Wednesday, November 5, 2025.

In case you missed it: Japanese booksellers will get access to new book and manga charts from Billboard Japan on Thursday, The Yomiuri Shimbun reports, with the data being made available to the general public for a fee starting next month.

As previously reported by Animenomics, they will be Japan’s first book charts to measure digital readership, data that has been missing despite digital manga’s growing importance in the country’s e-book and broader publishing market.

General manager Seiji Isozaki also told The Bunka News in August that Billboard Japan plans to release rankings showing Japanese book and manga titles that are popular abroad starting in 2026.

Anime revenues abroad jump as domestic sales stagnate

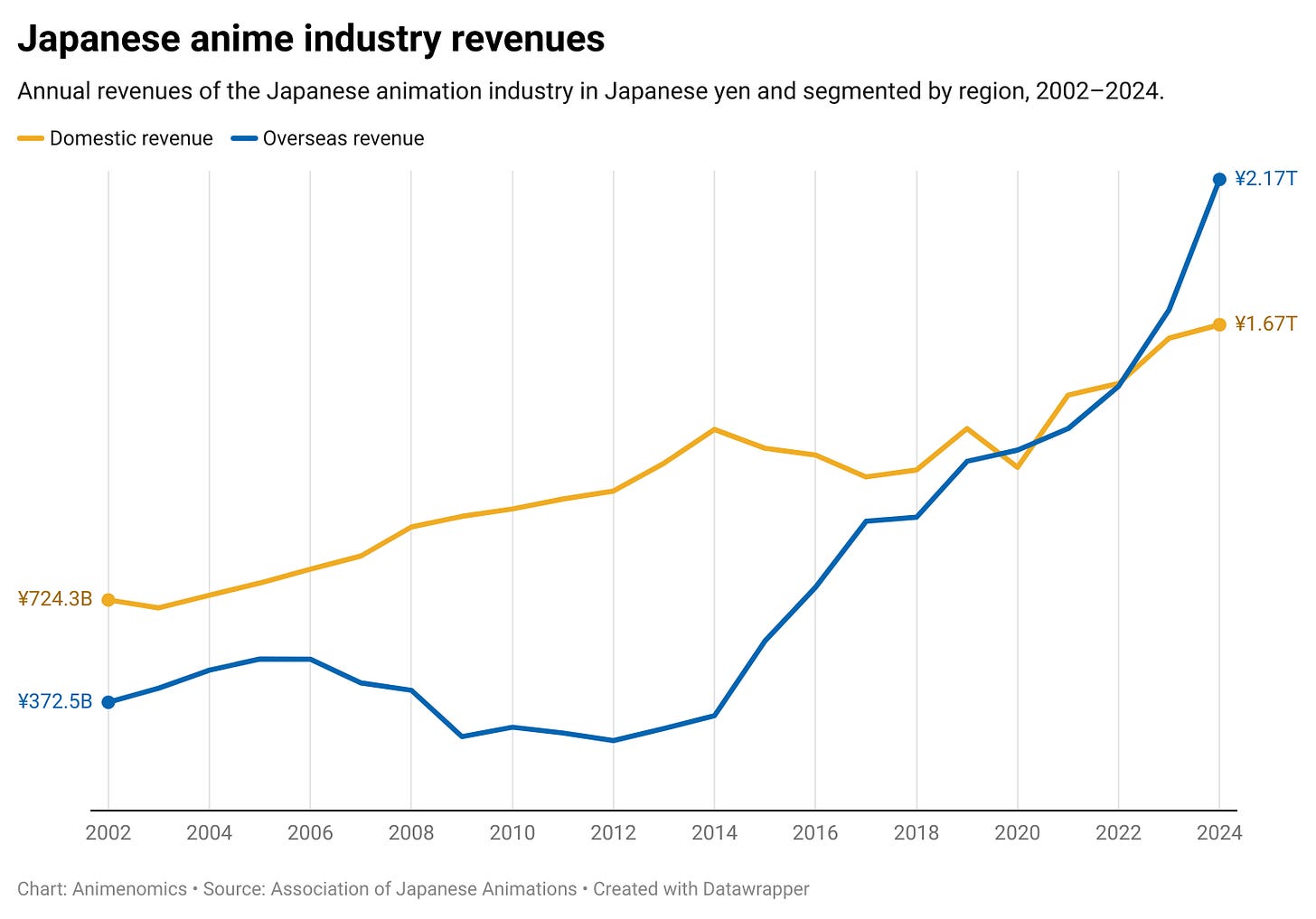

Growth in overseas revenues of Japan’s anime industry accelerated in 2024 compared to the previous year, climbing 26 percent, the third consecutive year of double-digit growth, according to an annual analysis by the Association of Japanese Animations.

Why it matters: Anime’s global market expanded 14.8 percent at the second fastest annual growth rate since 2019, when it grew 15.3 percent.

A global surge since the COVID-19 pandemic has resulted in a 75 percent jump in overseas revenues since 2020, while domestic revenues grew 41 percent.

By the numbers: Overseas spending on licensed anime content and products stood at ¥2.17 trillion (US$14.1 billion) in 2024.

With international licensing deals being transacted in United States dollars, the anime industry also benefits heavily from recent depreciation of the Japanese yen.

Between 2020 and 2024, the yen depreciated about 30 percent against the dollar, allowing international buyers to increase product offerings for a surging fandom.

Yes, but: At home, there is concern that anime’s domestic market is stagnating after showing just a 2.8 percent annual revenue growth to ¥1.67 trillion (US$10.8 billion).

Taking into account Japan’s average headline inflation rate of 2.7 percent in 2024—inflation in culture and recreation was even higher at 5.4 percent—it’s likely that the domestic anime market was flat or even shrank.

“One reason is that program sales to television stations, which have sustained the market until now, have plateaued,” anime journalist Atsushi Matsumoto wrote in a column this week.

“Furthermore […] while new content acquisitions remain robust on domestic and international platforms, the procurement of older catalog titles appears to have largely run its course,” he added.

Between the lines: Studios and production companies that make anime saw total revenue growth of 9.1 percent, slower than the broader market that includes product sales.

As previously reported by Animenomics, an analysis by credit reporting agency Teikoku Databank done earlier this year showed that studios’ revenue growth is increasingly concentrated in larger establishments.

“The domestic anime production scene faces a chronic shortage of personnel, and domestic production capacity is already nearing its limits,” Matsumoto explained.

Toei Animation plans new anime studios outside Japan

Toei Animation will establish additional animation studios in Southeast Asia by 2030, the company said last week as it laid out an ambitious plan for doubling revenue and operating profit in the next five years.

Why it matters: The formation of two or three new studios in the region is expected to increase the number of Toei Animation’s anime production lines by 50 percent over today’s level.

The bigger picture: As previously reported by Animenomics, Southeast Asia has seen a surge of investment in recent years, allowing the region to exert influence on global anime productions.

Toei Animation has had a presence in Southeast Asia since 1992, when it entered into an animation joint venture with a Philippine company.

The Manila studio, in which Toei Animation took full ownership in 1999, already handles about 70 percent of the company’s animation production workload today.

Zoom in: Toei Animation plans to spend an estimated ¥24 billion (US$156 million) in the next five years to establish the new studios, staff them, and invest in digital work processes.

Earlier this year, the company established a new studio in Osaka to diversify its domestic workforce away from the flagship studio in Oizumi, Tokyo.

It will also invest an estimated ¥70 billion (US$455 million) in IP production and ¥39 billion (US$254 million) international licensing and distribution.

The intrigue: Toei Animation has also set a long-term goal of achieving ¥500 billion (US$3.25 billion) in revenue beyond 2030, more than the estimated combined revenue of all Japanese anime production companies in 2024 just announced by the AJA.

“If the mid-term management plan targets and long-term goals are achieved, the landscape of Japan’s anime business is set to change dramatically,” anime journalist Tadashi Sudo writes in the Animation Business Journal.

Clippings: Kodansha forms Hollywood live-action studio

Publishing giant Kodansha established a Hollywood live-action film and television studio named Kodansha Studios that will adapt the publisher’s manga and novel titles with the help of Academy Award-winning filmmaker Chloé Zhao. (Nikkan Sports)

Anime and manga publishers are warning Silicon Valley technology firm OpenAI that they are prepared to challenge it in court for any unauthorized use of characters by the Sora 2 text-to-video generative artificial intelligence model. (The Asahi Shimbun)

Anime studio CloverWorks has established a new division named Flint Base as a gateway to recruit and train graduating students as in-between animators for up to two years before they continue in their careers. (Press release)

Changsha-based Yoousi, a Chinese animation technology startup that implements artificial intelligence in animation production processes, is setting its sights on the Japanese market following a multimillion-dollar angel funding round. (KrASIA)

Russia’s media watchdog has blocked access to Gaudiy-owned anime and manga community platform MyAnimeList in the country, part of an ongoing effort by the government to restrict the availability of LGBTQ content. (The Moscow Times)

Mitsui Fudosan’s LaLaport shopping center in Kuala Lumpur, Malaysia, has emerged from the COVID-19 pandemic as a retail hub for Japanese anime and games, triggered initially by last year’s opening of a pop-up store by anime retailer Animate. (Gamebiz)

Disney bets on ‘Twisted-Wonderland’ to pull anime fans

“[Disney Twisted-Wonderland: The Animation] will reach markets where the [Disney Twisted-Wonderland] game is already active, such as the United States, Australia, and Singapore. We expect it to also serve as a catalyst for expanding the Disney fan base by attracting new fans in Europe, where anime enjoys high popularity.”

— Gaku Narita, The Walt Disney Company Japan executive director of original content

Context: Narita, in an interview in Nikkei Entertainment! magazine’s December issue, said that Japanese anime is an important part of the Disney+ streaming service’s core strategy and that it’s focusing on local content development.

Disney Twisted-Wonderland: The Animation, based on the successful mobile game collaboration by Disney Japan and anime production planning company Aniplex, debuted on Disney+ and Hulu streaming services last week.

What’s next: Disney Japan games director Nana Gadd also told the magazine that the company planned from the beginning to develop Disney Twisted-Wonderland beyond games and into merchandise and other media.

“We hope that more people engaging with [the world of] Twisted-Wonderland will create a cycle where they then try the game,” she explained.

Animenomics is an independently run and reader-supported publication. If you enjoyed this newsletter, consider sharing it with others.