Anime industry fights Big Tech's AI control

Plus: Japanese government scrutinizes anime contracts; Chinese flock to see 'The Boy and the Heron'; Anime home video market declines again; and more

This is the weekly newsletter of Animenomics, covering the business of anime and manga. Today is Wednesday, April 24, 2024.

In case you missed it: Studio Ghibli will be awarded an Honorary Palme d’Or at the 77th Cannes Film Festival next month, the first time the award is given to a group rather than to an individual.

Group seeks new model of AI training in anime industry

Big Tech dominance in artificial intelligence poses a risk for studios as the anime industry seeks opportunities to use the technology to improve anime production’s most labor-intensive processes.

Why it matters: An overwhelming majority of anime industry workers polled by the Nippon Anime & Film Culture Association (NAFCA) last year believes Big Tech’s current practice of training AI on copyrighted data should be regulated.

What’s happening: “Big Tech is taking the approach of first making a large investment to create a standard, then offering it at a low fee to grab a large share of the market, and then tightening up,” Shuhei Mise, the CEO of blockchain consultancy Turingum, told Magmix.

“If this continues, we will be in a situation where there will be no other options in AI,” Mise contends.

Driving the story: Anime Chain, a consortium of Japanese AI and blockchain companies of which Turingum is a member, wants to create an “ethical” AI by training it using licensed data from anime copyright holders.

In exchange for supplying training data, copyright holders would receive payment from Anime Chain using blockchain technology for usage fees.

Reality check: Training AI requires vast amounts of data, as many as billions of pieces of data, which may be difficult to acquire under a licensing mechanism.

Mono Arai, chief technology officer of AiHUB, also an Anime Chain member, believes that is changing: “It’s now possible to create a high quality base AI with about 25 to 30 million [pieces of data]. Therefore, with permissions to about 300 anime titles, we should be able to gather that many pieces of data.”

What we’re watching: Anime director and NAFCA board member Naomichi Yamato told Magmix that his organization is also working with Anime Chain to explore using animation drafts to train the group’s AI model.

This approach would turn AI technology into an archival tool for anime studios and can help create an edge against Big Tech AI, which is only trained on finished anime works.

Japanese gov’t pledges investigation of anime contracts

Japan’s Fair Trade Commission will investigate entertainment industry contracts to ensure that workers have a sustainable working environment, Prime Minister Fumio Kishida announced last week.

Why it matters: Japan’s entertainment exports, now worth ¥4.7 trillion (US$30.4 billion), are comparable in value to its steel and semiconductor industries, the Cabinet Secretariat found.

A survey commissioned last year by the Keidanren, the Japan Business Federation lobbying group, also found that nearly 80 percent of overseas video licensing revenues come from anime.

What they’re saying: “We will conduct a fact-finding survey to ensure proper contracts, and in light of the results, we will aim to formulate guidelines to prevent the abuse of a superior bargaining position and show that any violation of the guidelines would potentially constitute a breach of the Antimonopoly Act,” Kishida said during a cabinet meeting last Wednesday.

In the anime industry, workers have for years sought to bring attention to the low wages and unfair business contracts that plague production studios.

Kishida also showed support for programs that provide financial assistance to production companies to expand their businesses overseas.

The other side: Anime director Osamu Yamazaki, a former executive director of the Japan Animation Creators Association (JAniCA), wants the government to go beyond providing subsidies.

“I would like to see consumption tax cuts, the abolition of invoices, and above all, measures to combat the weak yen,” he writes on X (formerly Twitter).

Clippings: Chinese viewers lift ‘The Boy and the Heron’

The Boy and the Heron surpassed CN¥700 million (US$96 million) in revenue last week in China, already the film’s biggest market globally, and is on track to beat Suzume’s CN¥807 million (US$111 million). (Sohu)

Producers of Dahlia in Bloom, a new anime series airing this July, are investigating reports that a North Korean animation studio may be involved in the project as a subcontractor without their knowledge. (Netlab)

Background: The North Korean studio’s role in the anime production was first reported by 38 North. North Korean animators have been involved in French animation productions in the past.

Toei Animation added an overseas institutional investor as a new shareholder as growth in its intellectual property business brings the anime production company attention from investors outside Japan. (Nikkei)

Spy × Family Code: White earned US$4.8 million over its opening weekend in the United States, with IMAX screens contributing 14 percent of the film’s box office revenue. (Deadline)

Tokyo District Court ordered the former operator of now-closed pirated manga website Manga-Mura to pay ¥1.7 billion (US$11 million) in damages to publishers Shogakukan, Kadokawa, and Shueisha. (Kyodo News)

Blu-ray sales slow declines in anime home video market

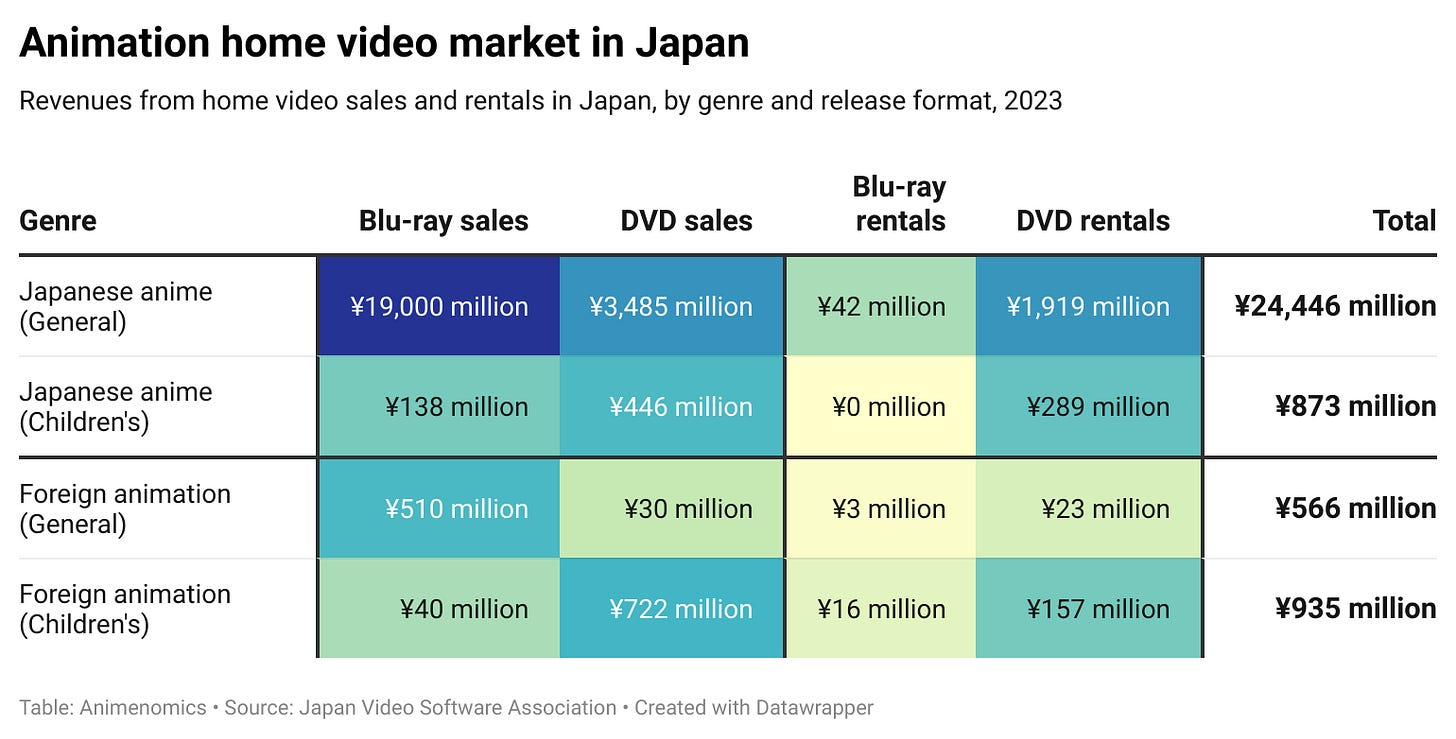

Japan’s animation home video market fell an average 8.3 percent across all genres and media formats last year, driven by large declines in the broader rental market, according to new data published by the Japan Video Software Association.

Why it matters: Home video sales, historically used as a metric for the success of anime productions, continue to decline as producers diversify into other sources of revenue.

By the numbers: Blu-ray and DVD sales of non-children anime titles, which make up 84 percent of the animation home video market, fell 4.5 percent to ¥22.5 billion (US$145 million).

Sales of children’s anime home videos fell 23 percent to ¥584 million (US$3.8 million), and non-Japanese animation home video sales fell 33 percent to ¥1.3 billion (US$8.4 million).

Rentals now make up about one-tenth of the animation home video market, just half of its market share 10 years ago.

Zoom in: “The animation home video market is increasingly being supported by general purchase by adults, who have many core fans,” Tadashi Sudo writes in the Animation Business Journal.

Blu-ray’s share of home video sales for Japanese anime has also grown to 83 percent, versus 78 percent in 2018.

Animenomics is an independently-run and reader-supported publication. If you enjoyed this newsletter, consider sharing it with others.

I recently read an interesting essay by Hayao Miyazaki that his theory behind the manga/anime boom in Japan was the possibly a result of the immense stress Japanese adults were feeling under the strain of rapid industrialisation, and therefore needing more escapism and fantasia than ever before. I wonder if you think we are seeing a similar phenomenon in China, given they are steadily forecast to outpace North America as a global consumer of animation?