Anime companies face language barrier in Middle East

Plus: Sony, Bandai invest in blockchain startup; Studio Ghibli's global rollout planned; Bilibili moves beyond streaming; Japanese firms bullish on anime; and more

This is your weekly Animenomics briefing, covering the business of anime and manga. Today is Wednesday, May 14, 2025.

In case you missed it: A temporary trade deal between China and the United States kept tariffs in place for U.S. imports of low-value goods made in China, where a large portion of anime merchandise is made.

Anime companies lag behind competitors in Middle East

Saudi Arabia leads the Middle East in new anime productions and collaborations with Japanese producers as part of an effort to pivot itself away from oil exports, but many Japanese companies still lack urgency in expanding into the region.

Why it matters: Middle East and North Africa is one of the fastest growing regions for anime, with size of the local market grow to US$42 billion by 2030, Weekly Toyo Keizai magazine reports.

Driving the story: Japanese companies lag behind competitors in South Korea, China, and the United States in overcoming language barriers in the Middle East.

“Last year, we had a conversation with a South Korean company that handles webtoons, and the Korean person in charge emailed us in Arabic,” Essam Bukhary, who leads Saudi IP production studio Manga Productions, recalls to Toyo Keizai.

As a result of the South Korean company’s initiative, a process that would have taken two or three years in Japan was completed in just two months.

Where things stand: Saudi children today watch more American cartoons than anime from Japan, according to data gathered by Manga Productions.

Bukhary wants to reverse the trend, but Japan is producing fewer children’s anime today than more mature titles airing in late-night television programming blocks.

“Of course, that’s not to say that late-night anime is bad, but we shouldn’t forget to take a long-term perspective toward the children of the world who will become the anime fans of the future,” he argues.

What’s next: Bukhary told Toyo Keizai that he wants to see more Japanese properties represented at Riyadh Season, an entertainment festival held annually in the Saudi capital from October to April.

Earlier this year, Manga Productions announced a partnership with Saudi Anime Expo organizer Sela to help bring more Japanese companies to Riyadh Season.

In the 2022 edition, the companies collaborated to create a Japan-themed exhibit that included a life-size statue of the Grendizer robot from UFO Robot Grendizer.

The bottom line: Bukhary wants Japanese firms need to be proactive in developing content directly with Saudi partners, and he’s setting up Manga Productions to be that local partner.

Sony, Bandai Namco invest in blockchain startup Gaudiy

Sony and Bandai Namco are investing ¥10 billion (US$68 million) in blockchain startup Gaudiy, the companies announced last week, forming a three-way partnership that aims to combine each company’s fan data to personalize entertainment experiences.

Why it matters: As previously reported by Animenomics, Gaudiy’s recent acquisition of anime and manga fan community website MyAnimeList gives the startup access to a wealth of data on the anime and manga fandom.

The details: The agreement will result in closer collaboration among Sony’s streaming service Crunchyroll, Gaudiy’s MyAnimeList, and Bandai Namco to promote IPs.

Sony’s portion of the investment is ¥7 billion (US$48 million), and Bandai Namco’s is ¥3 billion (US$20 million), the Nikkei financial newspaper reports.

Gaudiy will apply its work on digital tokens to Sony’s Soneium public blockchain, allowing fans to support creators through digital asset auctions.

Bandai Namco is working with Gaudiy to further develop an app that generates dioramas of Gundam robot plastic models using artificial intelligence.

Between the lines: Gaudiy has become the sole owner of MyAnimeList after buying out Media Do’s stake last month and now all shares from the remaining shareholders.

Some previous MyAnimeList shareholders like Coamix, Kodansha, Shogakukan, Shueisha, Akatsuki, The Anime Times Company, and Bushiroad are now shareholders of Gaudiy through a stock swap.

Clippings: Nippon TV plans Studio Ghibli global rollout

Broadcaster Nippon TV is establishing a new team dedicated to providing business support for Studio Ghibli’s overseas business development, growing the value of the studio’s films, and running spin-off events. (Nikkan Sports)

Nippon TV’s new three-year plan unveiled last week outlines plans for screenings of Studio Ghibli anime films in China, Taiwan, Vietnam and exhibitions in South Korea and France.

Anime studio consolidation is urgently needed to streamline back-office operations that include non-production roles such as accounting, says Kadokawa chief executive officer Takeshi Natsuno. (The Worldfolio)

Anime distributor REMOW announced plans to distribute on YouTube more than 370 episodes of KochiKame, adapted from the long-running manga published by Shueisha, with English-language subtitles for the first time. (Anime News Network)

Mobile developer DeNA saw profit in its gaming business grow tenfold in the most recent fiscal year as Pokémon Trading Card Game Pocket, which launched in October, hit 100 million downloads and 51 million monthly active users. (Gamebiz)

When asked about earnings forecasts for the current fiscal year, the company told analysts, “Since [Pokémon Trading Card Game Pocket] is a title of unprecedented scale for us, we need more time to make reasonable forecasts.”

IG Port and Sega each opened a retail store in Shanghai over the weeklong May Day holiday, with both stores generating combined sales of several million yuan (hundreds of thousands of U.S. dollars) in their first two days of operation. (Yicai)

The two stores, located in Bailian ZX Creative Center, a shopping mall dedicated to anime and video game merchandise, are operated by a merchandising unit of Beijing-based anime film distributor Road Pictures.

Bilibili builds offline presence in Chinese anime market

“Bilibili is recognized by publishers as a streaming platform, and its importance remains unchanged, but after the COVID-19 pandemic, there was discussion that streaming alone was not enough. Over the past two to three years, we have been focusing on strengthening the long-tail business capabilities of IP. […] Since China is a large country, promotion has been mainly online up until now. It’s common to expand anime IP through SNS and online influencers, and offline advertising hasn’t been as important in China as it is in Japan.”

— Kang Yue, Bilibili senior business director

Context: Kang, who oversees animation licensing at Bilibili, told Real Sound that the streaming platform operator has increased spending on physical retail collaborations, live events, and billboard advertisements as part of a 360-degree IP strategy.

Last year, the company organized street-level advertisements for anime such as Kaiju No. 8 and Delicious in Dungeon.

One big thing: Bilibili has invested in production committees in the past to learn the Japanese anime business model, but Kang says the company now actively invests in new anime to bring to the Chinese market.

One example is Aharen-san wa Hakarenai, a slice-of-life anime in which Bilibili is the sole investor and whose second season began airing last month.

“Slice-of-life serialized stories are popular in China,” Kang said. “It’s been popular for a long time, but nowadays, most anime fans are between 15 and 35 years old, so I think it’s something that resonates with that generation.”

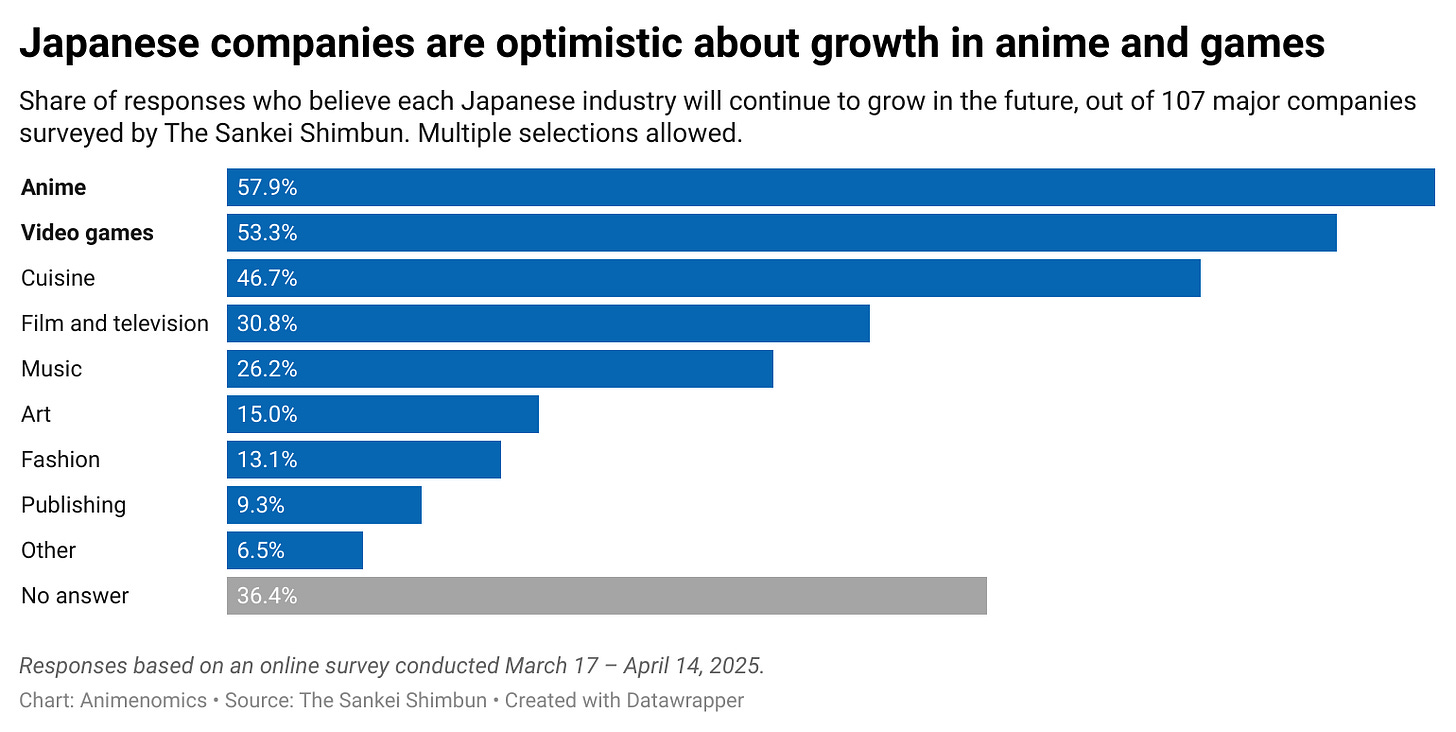

Japanese firms display optimism for anime and games

Two out of three major Japanese companies are optimistic that the country’s cultural industries, especially anime and video games, will continue to grow in the near future, according to findings from a survey conducted by The Sankei Shimbun.

Why it matters: Growing demand for Japanese entertainment properties abroad has already driven up the price of Japanese entertainment stocks.

Zoom in: About 20 percent of the companies surveyed say they are already investing or have active plans to invest in a cultural industry.

On the other hand, half of respondents say they no plans to invest or are still in the early stages of participating in the culture business.

Animenomics is an independently run and reader-supported publication. If you enjoyed this newsletter, consider sharing it with others.