AlphaPolis acquires 'Re:Zero' anime studio

Plus: OceanVeil service grows adult content scrutiny; Fewer Japanese readers pay for digital manga; Double-digit decline in Japan print light novel market; and more

This is your weekly Animenomics briefing, covering the business of anime and manga. Today is Wednesday, August 6, 2025.

In case you missed it: Disney Twisted-Wonderland: The Animation begins streaming on Disney+ on October 29 with an eight-episode run for the first of three seasons.

As previously reported by Animenomics, this adaptation of a manga series based on a Japanese mobile game is among the top anime properties that are expected to see the most cross-border merchandise purchases in 2025, package forwarding and proxy purchasing service provider Beenos said in March.

AlphaPolis enters anime business with White Fox buy

AlphaPolis has acquired all shares in anime studio White Fox from founder Gaku Iwasa in a deal that allows the digital manga and web novel publisher to diversify operations and transform itself into an IP production company.

Why it matters: As previously reported by Animenomics, AlphaPolis has been seeking potential mergers and acquisitions with anime companies as it prepares to invest in more anime productions.

White Fox, best known for animating Kadokawa’s flagship light novel title Re:Zero - Starting Life in Another World, can offer AlphaPolis with the know-how to create successful isekai anime productions based on AlphaPolis titles.

By the numbers: No acquisition price was disclosed, but Singapore-based investment management firm Hibiki Path Advisors, which invests in AlphaPolis, estimates that the deal was below ¥2 billion (US$13.5 million).

White Fox’s revenue has grown 50 percent in the last three fiscal years, but anime production costs have increased rapidly, putting pressure on operating income.

In the most recent fiscal year that ended in March, White Fox saw just ¥112,000 (US$760) in operating profit, down from ¥5.7 million (US$39,000) two years earlier.

What they’re saying: “There’s been a lot of speculation about White Fox becoming a subsidiary, but I don’t think things will change much going forward,” Iwasa wrote on X (formerly Twitter).

“I intend to stick with Re:Zero until the end unless I get fired by Kadokawa and [Re:Zero author Tappei] Nagatsuki,” he added.

OceanVeil grows amid scrutiny of digital adult content

OceanVeil has reached 8,500 registered users on its the English-language streaming platform for risqué and adult anime titles, its Tokyo-based parent company WWWave announced last week.

Why it matters: In the five months since launch, OceanVeil has added more than 200 titles to its catalog, many from sister company Suiseisha and a handful of non-adult titles from U.S. distributors like AnimEigo and MVD Entertainment.

Suiseisha entered the anime business through direct-to-video sales of its manga titles’ anime adaptations, but it has been licensing anime to streaming platforms in recent years in an effort to diversify from Japan’s stagnant home video market.

Between the lines: OceanVeil’s effort to carve out a niche in anime streaming comes amid payment processors’ growing scrutiny of digital platforms in Japan and abroad that serve adult and sexually themed content.

OceanVeil launched in March with PayPal as the only supported payment method and finally added Visa and Mastercard credit cards as additional payment options last month.

In June, a WWWave representative told users on OceanVeil’s Discord server that allowing card payments took more than six months because payment processors wanted to restrict the use of credit cards for purchasing adult content.

How it works: OceanVeil’s platform has two versions: one with non-adult titles and censored episodes, and one that includes adult titles with uncensored episodes.

WWWave didn’t disclose the split between paying subscribers who pay US$12.99 a month and free users who have access to 30-second previews of each episode.

What we’re watching: OceanVeil’s operator, WWWave of America, is registered in Texas, where a new child pornography law prompted concerns that it could be applied to anime and manga.

Clippings: AI manga localizer Orange gets new funding

AI manga localization startup Orange has received ¥2.5 billion (US$16.7 million) in loans from four Japanese banks to continue expanding its Emaqi digital manga platform in North America. (The Nikkei)

Orange’s latest fundraising round comes after the company launched a new version of the Emaqi app in May and conducted a recruiting blitz in June.

Taipei-based Gaea Books, the largest publisher of original Taiwanese comics, seeks a piece of Japan’s digital manga market and has begun selling six titles on 31 Japanese e-book platforms, including Comic C’moA and LINE Manga. (Central News Agency)

The intrigue: Gaea Books intends to increase that number to 20 titles published on Japanese e-book platforms by the end of the year. It’s also collaborating with Asahi Shimbun Publications and Kadokawa to serialize three titles in Japan.

Laid-Back Camp’s Shizuoka Prefecture tour collaboration brought the prefecture an estimated ¥498.1 million (US$3.37 million) in economic impact as 3,900 residents and 4,400 visitors traveled to sites featured in the anime series. (The Nikkei)

South Korea’s finance ministry plans to allow webtoon production studios to receive tax credits on a portion of their production costs—10 percent for large companies and 15 percent for small and mid-size companies. (The Chosun Biz)

Promos suppress paying digital manga readers in Japan

“Companies have implemented free promotional measures and sales promotion strategies under the belief that this will raise awareness of digital comics, increase the number of users, and ultimately lead to an increase in paying users. However, in reality, fierce competition has led to an increase in free users, and users who previously paid for comics are now reading them for free.”

— Mikio Amaya, e-book distributor Papyless founder and chairman

Context: Amaya warns in a column for the Japan Electronic Publishing Association that the country’s digital manga market is on the verge of collapse due to a declining share of readers who pay to read on digital manga platforms.

What he’s saying: “Online bookstores that emphasize sales promotion and promote the idea of everything being free offer approximately 50,000 free books to their readers, far more than pirate sites,” Amaya says. “It can be said that they are increasing the number of free readers more than pirate sites.”

By the numbers: A recent survey of 10,000 Japanese smartphone internet users found that the share of people who pay to read e-books has declined from a peak of 20.5 percent in 2021 to 17.8 percent this year.

The survey, published in a report on Japan’s e-book business that was released last month, also found that the share of people who read e-books for free has grown from 24.8 percent to 28.3 percent in the same period.

Rewind: E-book store DMM Books drew attention when it reported a ¥6 billion loss (US$40.7 million) in 2021 when more people than expected redeemed its 70 percent off coupon for first-time customers.

When customers pay a lower price using coupons and points, the burden of paying royalties to authors and publishers on the price difference falls on e-book stores, who then record those costs as promotional expenses.

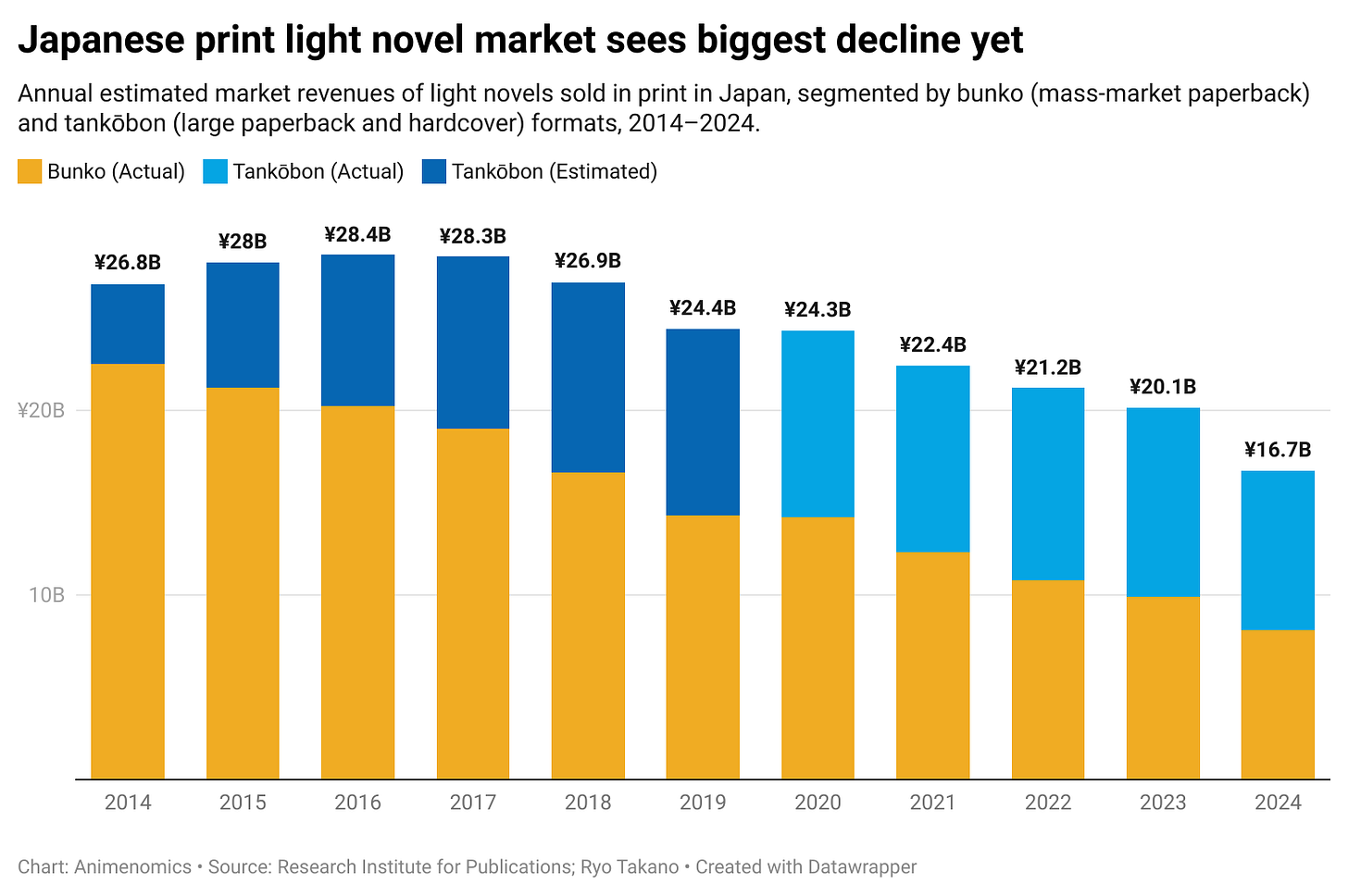

Japan print light novel market falls 17 percent in 2024

Japan’s print light novel market saw its first double-digit decline in five years last year, falling 17 percent year-over-year to ¥16.7 billion (US$113 million), the Research Institute for Publications revealed in its Annual Report on the Publication Market.

Why it matters: While the report doesn’t specify the size of the digital light novel market, its authors say that light novels are selling well as e-books and that a digital shift is continuing to happen.

An independent estimate by publishing industry journalist Ryo Takano released in December pegs the 2023 digital light novel market at ¥31 billion (US$210 million).

Zoom in: Titles adapted into anime like My Happy Marriage and The Apothecary Diaries continue to sell well, but there are also standouts among those without an anime adaptation.

Kadokawa’s Who Killed the Hero? reported 250,000 print and digital copies in circulation as of February, with the first print volume making up 100,000 copies.

Animenomics is an independently run and reader-supported publication. If you enjoyed this newsletter, consider sharing it with others.

I was interested in the data revealing the extent to which free samples are reducing revenue from paid content. Will more and more publishers go out of business as a result of this worrisome trend? Or will they pivot to something else?